Bullion has been cherished, worshipped, valued, exchanged and recognized as the oldest, most natural and pure form of money for thousands of years.

Historians and archaeologists have unearthed and documented many examples of coins struck from precious metals from ancient civilizations and cultures that date back thousands of years in China, India and Ancient Greece.

Gold Coins have been a mainstay in the global economy and international trade since colonial times when the 20 Francs Gold Coin and British Gold Sovereign spread around the world.

Many other European countries joined the Latin Monetary Union during the mid-19th century, with many colonial expeditions returning large quantities of gold to Belgium, Portugal, Spain, France and Great Britain.

During the late 19th and early 20th centuries, the United States was on a gold-based economy. Both gold coins and silver coins were in circulation and in everyday daily use.

Liberty Gold Eagle Coins, the Famous Gold Indian, and the St-Gauden’s Gold $20 Double Eagle coins are notable examples of some of the beautifully designed coins that were mass produced and in everyday use before gold was removed by Roosevelt in 1933.

Most of these coins were confiscated from private citizens in exchange for fiat paper reserve notes during the Great Depression.

Federal Reserve bankers and politicians in the 1930s believed that the private ownership of gold was a contributing factor in stalling the recovery of the economy following the Great Depression.

Today, investment coins from the US Mint represent a trusted, government backed gold bullion product that is respected and recognized worldwide.

The American Gold Eagle Series was established by Congress with the Liberty Coin Act of 1985 (Public Law 99-185). This bullion coin series is widely recognized and respected worldwide for its authenticity and purity.

The number of coins manufactured each year varies on demand from investors. The coins are minted based on sales. This helps the US Mint to implement a business model that allows for flexibility in scaling capacity.

This year, it has been widely reported that the US Mint has been unable to keep up with investor demand for the first time in the 36 year history of minting bullion coins.

This has led to consumers experiencing significant increase premiums of products from the US Mint, with some speculating that recent consolidation amongst mint suppliers, wholesalers and retail distribution channels by A-Mark being one of the contributing factors.

Additionally, issues with delivery of blank planchet from private industry refiners have been amplified by pandemic related supply-chain problems has also been a factor in Mint officials deciding to cancel both the 2022 Morgan and Peace Silver Dollar Coins.

In the American Gold Eagle series, the US Mint produces 4 distinct denominations of size, weight and face value gold coins that are suitable for gold investors.

The blank planchets that are minted into bullion coins are sourced from select private mints which use documented refineries that source raw materials as described by law.

Many stackers are searching to buy alternatives to gold eagle coins to save on premiums.

For new precious metals investors, the process of learning about all of the available options, researching and shopping for gold coins can be an intimidating task.

Even for experienced and seasoned investors, the process at times at be daunting and confusing.

Gold Coin Categories

One simple way to think about gold coins for investment and a store of value or wealth is look at the options available in the market for both Historic Gold Coins and Modern Gold Coins.

Historic Gold Coins

Throughout history, many countries around the world have based their international trade with other countries based upon agreed upon standards of various amounts of gold and silver as established by treaties.

Some of the most commonly available gold bullion coins were minted by European countries beginning in the mid-19th century.

The large scale minting of gold bullion coins in Europe coincided with much of the colonial expansion and development of the New World.

Gold coins were minted and in regular circulation in many countries up through the mid-20th century. For today’s stackers, historic European gold bullion coins are one of the lowest premium fractional gold investments available.

Investors can typically buy some of the most popular historic gold coins, such as the 20 francs and British Gold Sovereigns at premiums that are significantly lower than current year government bullion coins.

20 Francs Gold Coins

The Latin Monetary Union was formed by European monarchs and political leaders to create a new standard based around the French Franc.

The specifications for the gold franc is was defined in the LMU treaty.

The 20 Francs Gold Coin was minted by numerous countries, including France, Belgium and Austria, with some being minted at colonial mints.

Many countries abandoned the LMU treaty as a result of World War I and it was officially disbanded in 1927.

Some countries continued to mint coins to the LMU standards following the ending of the trade agreement. Most notably, Switzerland with the 20 Francs Helvetia or Vrenelli (goldvreneli) being officially minted until 1936.

All 20 Francs gold coins from Switzerland with dates beyond 1936 are considered restrikes. One of the most common and popular gold bullion restrike coins for stacking that is available from online bullion dealers continues to be the Swiss 20 Francs Helvetia Gold Coin.

Regardless of the country of origin, each 20 francs gold coin is minted with .1867 troy ounces of pure gold.

During the late 1800s, the United States had considered joining the LMU. In 1879 and 1880, several “pattern coins” were designed by notable sculptors Charles Barber and George Morgan that were proposed as part of the consideration.

The most famous example is the Gold Stella coin. In 1880, the US Mint produced 425 “Stella” gold coin to specifications that were similar to the LMU requirements, with a face value of $4 USD.

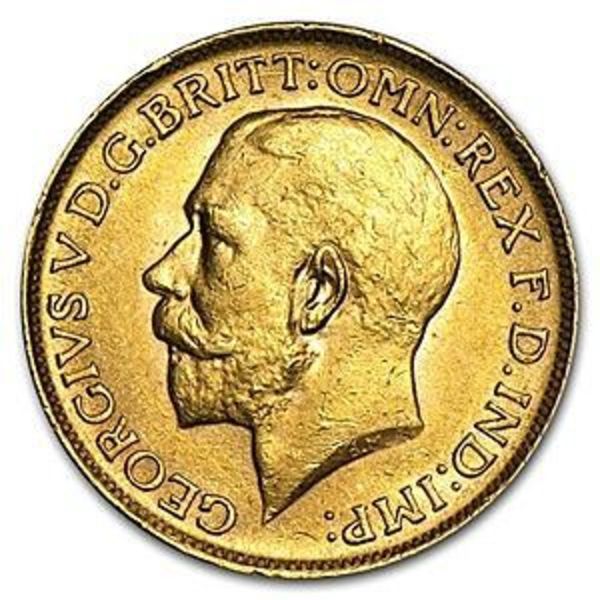

British Gold Sovereign

The British Gold Sovereign coin entered circulation in 1817. The coin was minted with an alloy mixed of .917 gold, .083 copper or other metals.

From the mid-1850s until 1932, gold sovereigns were also minted worldwide at mints that were part of the British Colonial Empire. These include coins with mint marks from Australia and later in Canada, South Africa and India.This provides some additional interest for stackers with a passion for history or numismatics.

Each gold sovereign coin has an overall mass of 7.98805 grams with .2354 troy ounces of pure gold.British Gold Sovereign coins are an excellent low-premium alternative to the quarter ounce gold eagle.

Pre-1933 Gold Coins from the US Mint

The US Constitution helps to define some aspects of the US economy and its early reliance on a Gold Standard, as much of the rest of the world.

In Article I, Section 10, Clause 1 of the US Constitution that helps to define the powers of the States, constrains each state to the issuance of only coins made from gold or silver.

Gold Coins were an essential part of the economy following the American Revolution. For the first 157 years of US history, gold coins were circulated instead of paper fiat reserve notes.

Courts have ruled that this Constitutional definition only applies to States and not to the Federal Reserve, which is a privately controlled central bank responsible for issuance of paper fiat currency backed by gold in Fort Knox and other vault locations.

Criminalization of Gold Ownership

In 1933, President Roosevelt signed Executive Order 6102, which ordered the government to confiscate gold from citizens as part of the recovery efforts from the economic struggles of the Great Depression.

It was expected that the gold coins would be repatriated by the US Treasury and melted back into gold bars for deep storage. US Government Reserves include almost 261,500,000 troy ounces of gold.

Many defiant citizens refused to exchange their gold coins for worthless paper and stashed the coins away for their intrinsic value.

Today, many online bullion dealers offer these Pre-1933 US Gold Coins in various circulated conditions. Stacking these coins is a great way to store wealth.

Modern Gold Coins

Secondary Market American Gold Eagles

Premiums on the 2022 Gold Eagle coin series are the highest they have ever been and investor demand has never been higher.

For investors and stackers who insist on only buying fractional gold eagles, the lowest premium and most popular choice is to buy secondary market or random year gold eagles.

Throughout the normal course of business, dealers regularly buy, sell and trade gold coins from private investors.

Many of these coins are backdated gold eagles that had been originally sold in the year in which they were minted.

In some cases, these coins will be delivered in brilliant uncirculated (BU) condition. It is most common that these coins will exhibit some type of minor imperfections. Such as slight fingerprints or maybe some tiny scratches from being handled.

This does not have any impact on the monetary value or intrinsic value of the gold. Buying secondary market fractional gold eagles is one of the ways serious gold stackers save on premiums.

These will be Gold Eagles that were minted and released by the US Mint in previous years.

After dealers buy these coins from investors who are selling, the coins are then resold, often with a significant discount when compared to current year coins.

Canadian Gold Maple Leaf Coins

Gold Maple Leaf coins are minted by the Royal Canadian Mint annually.

The coin series was introduced in 1979 with a design that has received several enhancements throughout the years.

From 1979 until 1982, gold maple leaf coins were minted from .999 fine gold. Near the end of 1982, the RCM upgraded their refining process and increased the purity of the maple leaf coins to .9999 fine gold.

The high level of 24k gold purity in Maple Leaf Gold coins has long been one of the defining characteristics that has set it apart from other government issued bullion coins available in the marketplace.

Premiums on Gold Maples are most often available at a significant discount when compared to gold eagles.

South African Gold Krugerrand

The South African government was the first to issue a gold bullion coin exclusively as a vehicle for investors in 1967 with the iconic Gold Krugerrand.

However, in the United States, citizens still faced arrest and criminal prosecution for owning more than 5 troy ounces of gold until Public Law 93-373 was signed by President Ford in August 1974.

Several months later Ford issued Executive Order 11825, which repealed Roosevelts criminal categorization of gold ownership.

In 1974 and 1975 more than 8 million Krugerrand 1 oz gold coins were minted.

In the decade that followed, 31 million more coins were minted until prohibitions and sanctions against the South African government were put in place in response the ongoing policies related to Apartheid.

Random Year Gold Krugerrand Coins are available in fractional and 1 troy ounce denominations.