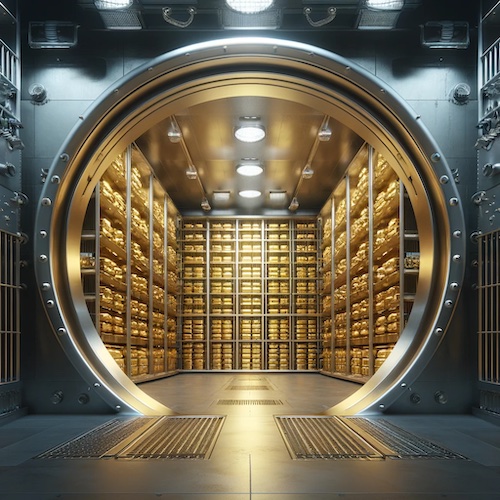

New Idaho Bullion Depository Opens Its Doors

This new depository not only enhances the security options available for precious metals storage in the Western United States but also brings additional employment opportunities to the Treasure Valley area. The opening of this depository reflects the growing demand for physical precious metals, driven by concerns over currency debasement and economic uncertainty.