1 oz Gold Bars

1 oz gold bars are available from a wide assortment of manufacturers including both government and private mints.

Learn More About 1 oz Gold Bars

The compact size of 1 oz Gold Bars makes them convenient to store in a home safe or a safety deposit box. They are also easy to conceal while traveling, making these bars more affordable compared to larger sizes.

Why Buy 1 oz Gold Bars?

Through regular buying of 1 oz gold bars, investors can gradually build up their holdings over time. Owning gold bars allows individuals to maintain a portion of their wealth outside of the traditional financial system. Physical gold can be bought with more privacy, minimal paperwork, and no government reporting.

Many financial planners recommend that their clients buy 1 oz bars as a safe haven since they are tangible assets without counter-party risk. Holding a portion of your cash savings in gold provides a hedge against inflation and a stable foundation for other, more volatile investments.

American 1 oz Gold Bars

- ecious metal products, Scottsdale Mint 1 oz gold bars are highly liquid. Headquartered in Scottsdale, Arizona, the Scottsdale Mint has evolved into a leading force in the precious metals industry since its founding in 2009.

- Sunshine Minting - For affordable precious metals products which are recognized for their MintMark SI anti-counterfeiting feature, many investors turn to Sunshine Mint 1 oz Gold bars. These bars allow for instant authenticity with the decoder lens. Based in Idaho, the company is known for its high-quality gold bars and is a trusted supplier of gold blank planchets to the US Mint.

- Asahi 1 oz gold bars - Following the acquisition of Johnson Matthey, Asahi Refining has become the leading refiner of gold bullion in America. Asahi 1 oz gold bars are also LBMA certified.

- American Reserve 1 oz Gold Bar by Asahi Refining utilizes gold mined exclusively in the United States, contributing to the country's legacy in minerals and mining.

- And the cheapest 1 oz gold bars prices...

Swiss 1 oz Gold Bars

Along with being the world's banking capital, Switzerland is also known as the world's leader in gold refining.

Swiss refineries and mints are renowned for their precision.

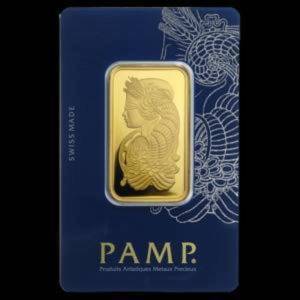

- PAMP Suisse—Since the 1970s, investors have trusted PAMP Suisse for the 1 oz Lady Fortuna gold bar, the same that Costco sells. PAMP Suisse's gold bars are minted with .9999 fine gold, and the design is one of the most iconic worldwide.

- Valcambi Suisse—Based in Switzerland, Valcambi is among the world's most trusted mints. Its product line includes a variety of unique investment products, such as the 1 oz Gold CombiBar series of minted bars.

- Argor-Heraeus—Another prominent Swiss refiner, Argor-Heraeus, is known for its high-quality gold bars and innovative approach to precious metals refining, such as the 1 oz gold kind bar.

Government 1 oz Gold Bars

- Royal Canadian Mint - RCM 1 oz gold bars are a long-time favorite of investors. The Royal Canadian Mint produces a variety of Canadian 1 oz gold bars that are available at a cheaper premium than most 24k coins.

- The Royal Mint—Britannia 1 oz gold bars, featuring Jody Clark's interpretive design, are a favorite of investors looking to have pure 24k gold bars in their portfolio.

- The Perth Mint - Based in Australia, the Perth Mint offers various options suitable for investors looking for a trusted store of value and wealth. While Perth Mint 1 oz gold bars are serialized and sealed in an assay card during manufacturing, Cast 1 oz Gold Bars show the natural texture created by the cooling metal. Additionally, the Perth Mint issues the Lunar Series, which features a design that reflects the current year's lunar celebration, such as the Year of the Dragon 1 oz Gold Bar.

- Austria Mint - As one of Europe's oldest continually operating mints, the Austrian Mint has earned a reputation for refining and manufacturing excellence. Austrian 1 oz gold bars are stamped with the "Münze Österreich" on the obverse with a blank, mirror-like finish on the reverse.

1 oz Gold Bar Prices

1oz Gold Bar prices vary by brand and dealer and are based on the spot price plus an additional premium.

In addition to the spot price, 1 oz gold bars carry a premium, which is the additional cost that a dealer charges to cover production, distribution, and profit.

Different dealers have varying markups, which can affect the final price. Online dealers offer lower prices due to lower overhead costs, while local coin stores and major retailers like Costco and Walmart have higher markups.

Some dealers offer a discount on the premium for payments made via bank transfers or wire payments, while credit card, PayPal and crypto purchases may carry an extra fee.

Well-known brands like PAMP Suisse, Credit Suisse, and Perth Mint may carry higher premiums due to their reputation. Investment grade 1 oz gold bars are .9999 fine (24k).

Bars with more intricate designs or special editions may have higher premiums. During economic uncertainty or high demand, premiums may increase due to supply shortages.

Newly Minted vs Secondary Market

Newly minted bars will include an assay card that provides the purity, weight, and other pertinent details, with most gold bars arriving sealed inside a tamper-proof plastic sleeve. The plastic assay cover is designed to protect both the bar and the card encapsulated inside.

The assay card not only provides protection, it also contains detailed information about the gold bar's provenance and includes the name and/or signature of the assayer responsible for the gold analysis. The card often includes a unique serial number that matches the number engraved or etched onto the bar.

Secondary market 1oz gold bars have been previously owned and then resold on the open market. Unlike newly minted bars, secondary market bars can vary in condition, including being lightly scratched or tarnished, though they still maintain their intrinsic gold value.

One of the main advantages of buying secondary market gold bars is the lower premiums compared to newly minted bars, making them an attractive option for cost-conscious investors. Since they are pre-owned, dealers sell them at a slightly reduced premium over the spot price.

Reputable dealers test each secondary market gold bars to ensure that they are 24k gold and contain the appropriate amount of gold. Many dealers offer buyback programs for these bars as well.

FindBullionPrices.com helps to find the lowest dealer premiums for 1 oz gold bars when you are ready to buy.

-10.11.2024.jpg)

CombiBar.jpg)