Gold

Buy Gold Bullion Bars and Coins

Physical gold investing comes in various forms, such as coins, bars and rounds.

Gold Quick Facts

Gold bullion symbolizes stability and enduring value, offering a sanctuary in the tumultuous seas of economic uncertainty. Its allure transcends mere aesthetics, representing a pragmatic choice for those seeking to safeguard wealth and prepare for financial contingencies.

Especially in an era marked by economic concerns, global political unrest, and other uncertainty, the multifaceted nature of gold bullion as an investment, whether in the form of coins and bars, or rounds, underscores its role in providing security against inflation as a long-term store of wealth.

Gold Bars

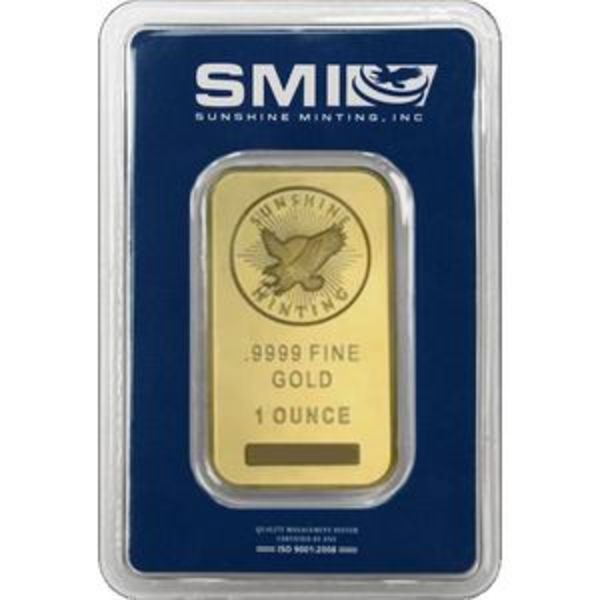

Gold bars epitomize the concept of gold as a store of value and are at the top of my mind when considering bullion. Available in various sizes, from small gold gram bars to larger kilo bars, they offer a straightforward, unembellished form of gold investment. Serious investors find larger sizes appealing ways to preserve significant wealth against the erosive effects of inflation.

In an economic landscape where inflation continues to loom as a threat, gold bars can serve as a stable foundation for a mixed-asset portfolio.

Their sheer weight in gold content offers a sense of security, acting as a bulwark against the devaluation of paper currencies. Moreover, the storability and scalability of gold bars make them practical for comprehensive wealth preservation strategies.

The one-troy-ounce gold bar is by far the most popular size and can be bought with a low premium over the spot price. They are readily available from virtually all bullion dealers. With few exceptions, 1 oz gold bars are minted by private mints.

Gold Coins

For centuries, gold coins have been a cornerstone of wealth preservation. Minted by various government mints, they carry legal tender status, imbuing them with trust and authority.

Renowned mints like the U.S. Mint, Royal Canadian Mint, and Perth Mint produce gold coins that are celebrated not just for their intrinsic value but also for their artistic merit.

The American Gold Eagle, Canadian Gold Maple Leaf, and Australian Gold Kangaroo exemplify this blend of purity, artistry, and governmental backing.

In times of financial instability, where fiat currency shows signs of strain, gold coins stand as bulwarks of reliability. Their worldwide acceptance provides liquidity, ensuring they are not just stores of wealth but also mediums of exchange in times of need.

Gold Rounds

Gold rounds offer an accessible alternative to coins, particularly appealing to those looking to invest in gold at a lower price point.

While rounds lack the legal tender status of coins, they compensate with lower premiums. Produced by private mints, they are often available at a cheaper price than coins. This affordability does not compromise quality, as rounds are usually minted with the same purity of gold as their coin counterparts.

Gold Rounds are a quintessential item for those who buy gold. Gold rounds are often called generic or just 1 oz gold rounds. Several private manufacturers mint them, such as the Sunshine Minting, Golden State Mint, Valcambi, and others.

When you buy gold rounds from online bullion dealers, they will often come loose in 2x2 coin flips to protect them during shipping. When ordering larger quantities, typically 20 or more, the rounds should be delivered in a sealed tube or roll directly from the mint unless otherwise noted in the product listing.

Gold Bullion Investing

In its various forms, gold represents a multifaceted approach to investment and wealth protection. Whether in the form of bars, coins, or rounds, it offers an indispensable tool for those preparing for financial emergencies and seeking stability in an increasingly unpredictable economic environment.

Gold's ability to hedge against inflation and act as a reliable store of value is particularly poignant in an era marked by concerns over de-dollarization and the potential for hyperinflation. As history has repeatedly shown, gold's luster lies in its physical beauty and its enduring ability to safeguard wealth and offer peace of mind in times of financial uncertainty.

The FindBullionPrices.com comparison engine searches dozens of trusted and reputable online bullion dealers to help you find the best prices when you're ready to buy gold.

Where to find the cheapest Gold

FindBullionPrices.com compares prices from trusted and reputable online precious metals dealers to help you find the lowest premiums when shopping for Gold. The prices on our site are updated hourly and adjusted for gold spot price, providing a tool that helps investors compare gold prices.

We help find the cheapest Gold when you're ready to buy.

You can find a large assortment of gold bars at FindBullionPrices.com. If we don't list prices for something you're looking for Contact Us and let us know so we can add it.

Compare Gold prices

FindBullionPrices.com compares Gold prices from top-rated and trusted bullion dealers. Our product listings compare the online prices to help you buy the cheapest Gold.