Platinum Coin Prices

Compare dealer prices of popular investment platinum coins.

Compare prices from trusted and reputable online precious metals dealers to find the lowest premiums on popular investment-grade platinum coins from the US Mint, Royal Canadian Mint and Royal Mint. The cheapest prices for each product are highlight in green.

Spot Platinum Price: $2144.83 |

1 oz Platinum Eagle |

1 oz Platinum Maple |

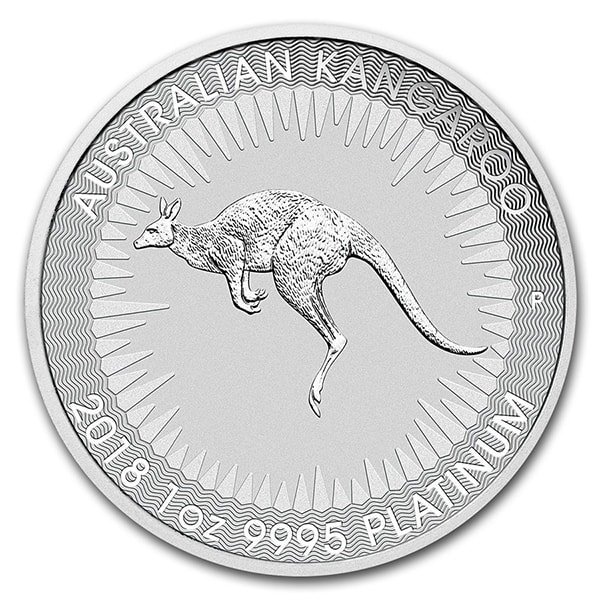

Platinum Kangaroo |

Random Platinum |

Britannia 1 oz Platinum |

Platinum Philharmonic |

|---|---|---|---|---|---|---|

| SD Bullion | $2465.29 | $2355.29 | $2335.29 | |||

| eBay | $2250.00 | $2380.14 | $2364.86 | $2364.00 | $2364.00 | |

| Silver Gold Bull | ||||||

| APMEX | $2319.69 | $2354.69 | ||||

| Monument Metals | $2471.23 | $2333.75 | ||||

| Bullion Exchanges | ||||||

| BGASC | $2461.29 | |||||

| Money Metals Exchange | $2482.20 | $2337.20 | $2332.20 | $2330.20 | ||

| Provident Metals | ||||||

| JM Bullion | $2286.87 | |||||

| Hero Bullion | $2428.97 | |||||

Modern Investment Platinum Coins

Modern investment platinum coins are platinum coins minted by government or private mints that are specifically designed for investment purposes. These coins typically contain high purity platinum, are widely recognizable, highly liquid and are traded globally in the precious metals market.

After the prohibition on platinum ownership ended in the 1970s a variety of government mints began issuing bullion coins to provide investors with a trusted store of value and wealth. These modern platinum coins are issued in various denominations, with each having a legal tender denomination. Investment-grade platinum bullion coins are typically .999 fine platinum or higher.

There's a significant global market for investment-grade bullion. As legal-tender, these platinum coins carry a guarantee for their weight and purity by their respective governments, which gives investors confidence in the product and makes them highly liquid anywhere in the world.

platinum Coin Prices are driven by commodities trading in futures markets happening around the clock. With constant fluctuations in price against the dollar, it has become important to find the cheapest platinum coin prices when you're ready to buy.

US Mint Eagle platinum Coins

platinum Eagle coins are the most logical and practical choice for most investors. These platinum coins are issued by the US Mint and are legal tender in the United States. The face values of the coins are significantly less than the intrinsic value of the platinum. Four denominations are available including 1 troy ounce, 1/2 oz, 1/4 and 1/10 oz.

American Eagle platinum coins are minted with 22 karat platinum. Easily compare online dealer prices to find the cheapest platinum eagles.

Royal Canadian Mint Maple Leaf platinum Coins

The Maple Leaf platinum coin was the first investment-grade bullion coin minted to .9999 purity standards. The series from the Royal Canadian Mint includes more denominations than any other which offers options that are budget friendly at all price points. Perfect for bullion investors.

Investors are drawn to platinum maples for their purity and reputation, but find that the lower dealer premiums that are available online can help lower the dollar-cost average of their investment.

Royal Mint Britannia platinum Coins

The Britannia platinum coin is minted with .9999 fine platinum and includes the four standard weight denominations most common amongst sovereign mints.

The new 2023 Britannia platinum coins feature a portrait of King Charles III. Some current year coins were released early in the year with Queen Elizabeth II.

platinum Coin Prices

Many dealers trade platinum coins with a different prices for bid price and ask price. The bid is the price at which the dealer is selling the particular coin, while the ask is the price that the dealer is willing to pay when they buy platinum coins from investors.

When shopping for platinum coins to add to your investment portfolio, an important step is to compare bid prices from a variety of trusted dealers, both locally and online. Prices for the same platinum coins can vary based on the premium, or markup, that each dealer is charging above the current spot platinum price. The premium is just one of the factors that helps determine the intrinsic value of each platinum coin.

Bullion coins are typically sold very close to the current spot price of platinum with a moderate premium based on supply and demand. Coins like the American platinum Eagle, Canadian platinum Maple Leaf, or South African Krugerrand are examples of widely recognized bullion coins. Buying these coins may offer a lower premium over the spot price compared to numismatic or collectible coins.

Buying pre-owned platinum coins from the secondary market is often more cost-effective than purchasing newly minted ones. Secondary market or random year 1 oz platinum coins often have the lowest premiums and will be the cheapest platinum coins. Secondary market platinum coins from random years may contain signs of handling such as fingerprints, smudges or minor scratches. However, this does not have any impact on the intrinsic value of the platinum.

The value of platinum bullion coins is based entirely upon the weight and purity of the platinum. Secondary market coins are essentially circulated platinum coins which were minted in previous years and were initial bought by investors in the year they were minted. At some point since, those coins were sold back to a dealer by the investor. These coins are bought, sold and traded often and are one of the cheapest and most liquid investment choices. Random year 1 oz platinum coins and fractional platinum coins have the same intrinsic value as current year coins but with a lower premium.

More 1 oz platinum Coins

Comparing prices helps you understand the current market value of modern investment-grade platinum coins. Price transparency is helpful way to ensure that you are not overpaying when buying or receiving less than the fair value when selling. By comparing prices, you can identify the best deals and potentially save money. Different dealers and sellers offer the same platinum coin at varying prices due to factors like premium, fees, or discounts. Comparing allows you to find the most cost-effective option.

- American platinum Buffalo - 1 oz .9999 fine platinum (24k) from the US Mint.

- Australian platinum Lunar Series - 1 oz .9999 fine platinum from the Perth Mint.

- Mexican platinum Libertad - highly desired .999 fine platinum coin from Mexico.

- Australian platinum Kangaroo - official platinum bullion coin from Australia.

- South African platinum Krugerrand - minted continuously since 1967 from 22k platinum.

- Austrian platinum Philharmonic - meticulously crafted in Vienna, Austria.