Platinum Bars

Learn More About Platinum Bars

Private mint platinum bars have several distinctive attributes that make them appealing to investors. These bars are produced with platinum of .9995 fine platinum or higher, the same that are consumed by industries utilizing the metal for the manufacturing of various products.

Like other precious metals, platinum can act as a hedge against inflation and currency devaluation, preserving purchasing power over time. Investing in platinum bars is a way to diversify an investment portfolio, spreading risk across different types of assets. Private mints offer a wide range of bar sizes giving investors more flexibility in terms of investment scale and budget.

Platinum is one of the most rare of all precious metals. Mines located in South Africa, Russia and Zimbabwe provide roughly 93% of all of the platinum ore that is available in world markets. In Western markets, the vast majority of the ore is refined in Switzerland. With sanctions on most Russian goods, any geopolitical uncertainty can lead to volatility with platinum prices.

While no investment is without risk, platinum bars from reputable private mints are considered secure due to their tangible value and the stable demand for platinum in various industries, including automotive, jewelry, and investment.

Platinum bars from recognized private mints are easily traded in the global precious metals market, ensuring liquidity for investors. Some of the well-known private mints that refine and issue platinum bars include:

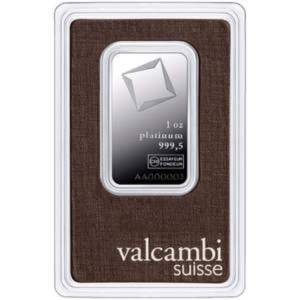

- Valcambi Suisse - Based in Balerna, Switzerland, they are one of the most reputable refineries in Europe, with a history that goes back to 1961.In addition to traditional 1 oz platinum bars, Valcambi manufacturers fractional platinum bars in a variety of industry standard gram denominated weights up to 100 grams. They also issue larger 10 oz platinum and 1 kg platinum bars. The Valcambi 50 gram Platinum Combibar provides options for investors looking to be prepared for any situation.

- PAMP Suisse - Based in Ticino, Switzerland, PAMP has been accredited in the London Platinum and Palladium Market since 2003 and the Tokyo Commodities Exchange since 2007. PAMP Suisse bars are renowned for their artistic and intricate designs, particularly the famous Lady Fortuna, which is a symbol of wealth and prosperity. For investors looking for the most liquidity, the PAMP Multigram25+1 Platinum Bar includes twenty-five 1 gram bars sealed inside individual assay packaging. If you want to sell just a portion, the bars are easy to separate from the overall assay card.

- Engelhard Corporation - Engelhard bars are esteemed not just for their intrinsic value but also for their historical and collectible significance. The company's long-standing history contributes to the desirability of its platinum bars. Engelhard played a pivotal role in developing the catalytic converter, which significantly reduces the harmful emission internal combustion engines.

- Argor-Heraeus - With a history of excellence in precious metals refining in 1951, Argor-Heraeus platinum bars are a tangible asset with intrinsic value and considered a stable store of value, especially in times of economic uncertainty.

.jpg)