Today's Gold Spot Price

View the live spot gold price per ounce, gram, and kilogram. This is the current price at which a troy ounce of gold is traded in the commodities markets. The spot price fluctuates due to global trading, making it important to stay informed on market conditions, current events and other metrics, as they affect both selling and buying of gold. Dealer premiums apply when trading gold bullion.

| Gold Price | Today | Change |

|---|---|---|

| Price Per Ounce (1 oz) | $5171.5 | $80.69 |

| Price Per Kilo (32.15 oz) | $166263.73 | $2509.74 |

| Price Per Gram (0.03215 oz) | $166.27 | $2.59 |

Live Gold Spot Price Charts

The default chart shows the gold spot price for the last 28 days. Use the buttons above and below to adjust the chart and update in real-time.

Live Gold Coin Prices & Dealer Premiums

| Product | Lowest Price | Lowest Dealer Premium | Vendor | Link |

|---|---|---|---|---|

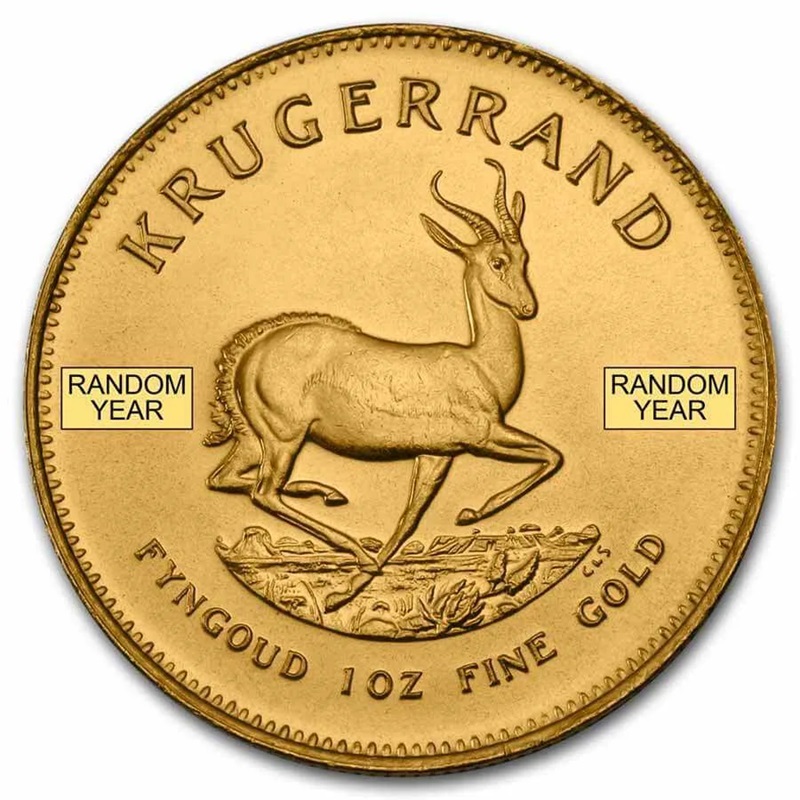

1 oz Krugerrand Gold Coin - Random Year |

$5206.29 | $34.79 (0.67%) | Bullion Exchanges | Compare Prices |

Maple Leaf 1 oz Gold Coin (Random Year) |

$5239.12 | $67.62 (1.31%) | Safe Haven Metal | Compare Prices |

Britannia 1 oz Gold Coin (Random Year) |

$5274.09 | $102.59 (1.98%) | Safe Haven Metal | Compare Prices |

1 oz American Gold Eagle (Random Year) |

$5282.69 | $111.19 (2.15%) | Safe Haven Metal | Compare Prices |

1 oz Gold Buffalo Coin (Random Year) |

$5344.26 | $172.76 (3.34%) | Safe Haven Metal | Compare Prices |

Lowest Premium Gold Bullion Search

Use the search form below to find the lowest premiums on popular investment grade gold bullion products and collectible gold coins from top online dealers

Live Gold Melt Value by Purity and Weight

The current live gold spot price is 5171.5 per troy ounce. The table below features common karat alloys typical of gold coins and jewelry with the current melt value displayed in various denominations including 1 gram, 1/10 oz, 1/4 oz, 1/2 and 1 oz. You can use the melt value below to determine the worth of your item based on the live gold price.

| Karat (Purity) | 1 oz | 1/2 oz | 1/4 oz | 1/10 oz | Per Gram |

|---|---|---|---|---|---|

| 24k (.9999) | $5170.98 | $2585.49 | $1292.75 | $517.10 | $166.25 |

| 22k (.916) | $4737.09 | $2368.55 | $1184.27 | $473.71 | $152.30 |

| 21.6k (.900) | $4654.35 | $2327.18 | $1163.59 | $465.44 | $149.64 |

| 21kt (.875) | $4525.06 | $2262.53 | $1131.27 | $452.51 | $145.48 |

| 18k (.750) | $3878.62 | $1939.31 | $969.66 | $387.86 | $124.70 |

| 14k (.585) | $3025.33 | $1512.66 | $756.33 | $302.53 | $97.27 |

| 10k (.417) | $2156.52 | $1078.26 | $539.13 | $215.65 | $69.33 |

| 9k (.375) | $1939.31 | $969.66 | $484.83 | $193.93 | $62.35 |

* Spot price is updated every minute

What “Gold Spot Price” Really Means

Gold Spot Price is the real-time benchmark for unfabricated gold traded on global markets. It reflects the price for prompt settlement (typically T+2) of wholesale bars that meet institutional standards (e.g., London Good Delivery, ≥ .995 fine), and it is quoted per troy ounce (ozt). Dealers, mints, and refiners worldwide reference this price to quote products and manage risk.

Gold Price vs. Gold Spot Price (and Futures)

- Gold Spot Price: Live market price for immediate settlement of wholesale bullion, quoted per troy ounce.

- Gold Futures Price: Exchange-traded contracts (e.g., COMEX) for future delivery. Futures embed carrying costs (financing, storage) and expectations—so they may trade above or below spot.

- Relationship: Continuous trading in London OTC, COMEX futures, and other venues collectively drives price discovery. Retail bullion pricing takes spot as the base input.

Bid / Ask & “Gold Price Per Ounce”

- Bid: What the market (or a dealer) will pay per troy ounce right now.

- Ask: What the market (or a dealer) will sell for per troy ounce right now.

- Spread: Ask − Bid; compensates liquidity providers for risk and execution.

Gold Price Per Ounce on this page reflects live market data; retail bullion prices are then derived from spot.

Market prices are volatile and can change rapidly. Quotes may differ by venue and include latency. All prices shown are informational and not a solicitation to buy or sell. This content is educational and not financial advice. Consider your objectives, time horizon, storage, and taxes when purchasing precious metals.How many grams per ounce of gold?

There are 31.1035 grams in one troy ounce of gold. This measurement is specific to precious metals and is different from the standard avoirdupois ounce used in most other applications, which equals 28.35 grams. While the troy ounce is the standard unit of measurement used in the precious metals industry, some countries track gold price by gram.

What is a troy ounce?

The troy ounce originates from the Roman monetary system that was used throughout the Middle Ages in Europe. The term "troy" is believed to be derived from the city of Troyes in France, a major trading hub in the 9th and 10th centuries where merchants from around the world traded goods.

You can learn more about the history of the troy ounce and how it differs from the ounce we use everyday (avoirdupois) in our blog: What is a Troy Ounce?.

The troy pound is divided into 12 troy ounces, reflecting the old Roman libra. Compared to the avoirdupois system, which is divided into 16 ounces per pound.

Quick Troy oz Conversions

- 1 troy oz is equal to 31.1034768 grams, compared with an avoirdupois ounce, which is 28.3495 grams.The troy ounce is roughly 10% heavier than the avoirdupois ounce.

- 1 troy pound is equal to 12 troy ounces (373.2416016 grams).

- The troy ounce is often abbreviated as "t oz", "oz t" or "ozt".

- Precious metal prices are almost always quoted in troy ounces.

The troy weight system is used exclusively in the precious metals industry. When you buy an ounce of gold or silver, it's a troy ounce. Similarly, when precious metals are mined, they're weighed using the troy system.