Today, the Federal Reserve announced their decision to cut interest rates by 50 basis points (0.5%) marking a significant shift in the central bank’s monetary policy.

This is the first such cut since the early days of the COVID-19 pandemic, which will reduce the federal funds rate to a range of 4.75%-5%.

While the decision aims to combat a slowing labor market and maintain economic growth, its implications are far-reaching, affecting everything from mortgage rates to precious metals prices.

While this is generally good for consumers in the short term, the long term implications could lead to higher inflation and other economic problems down the road.

Effect on Precious Metals Prices

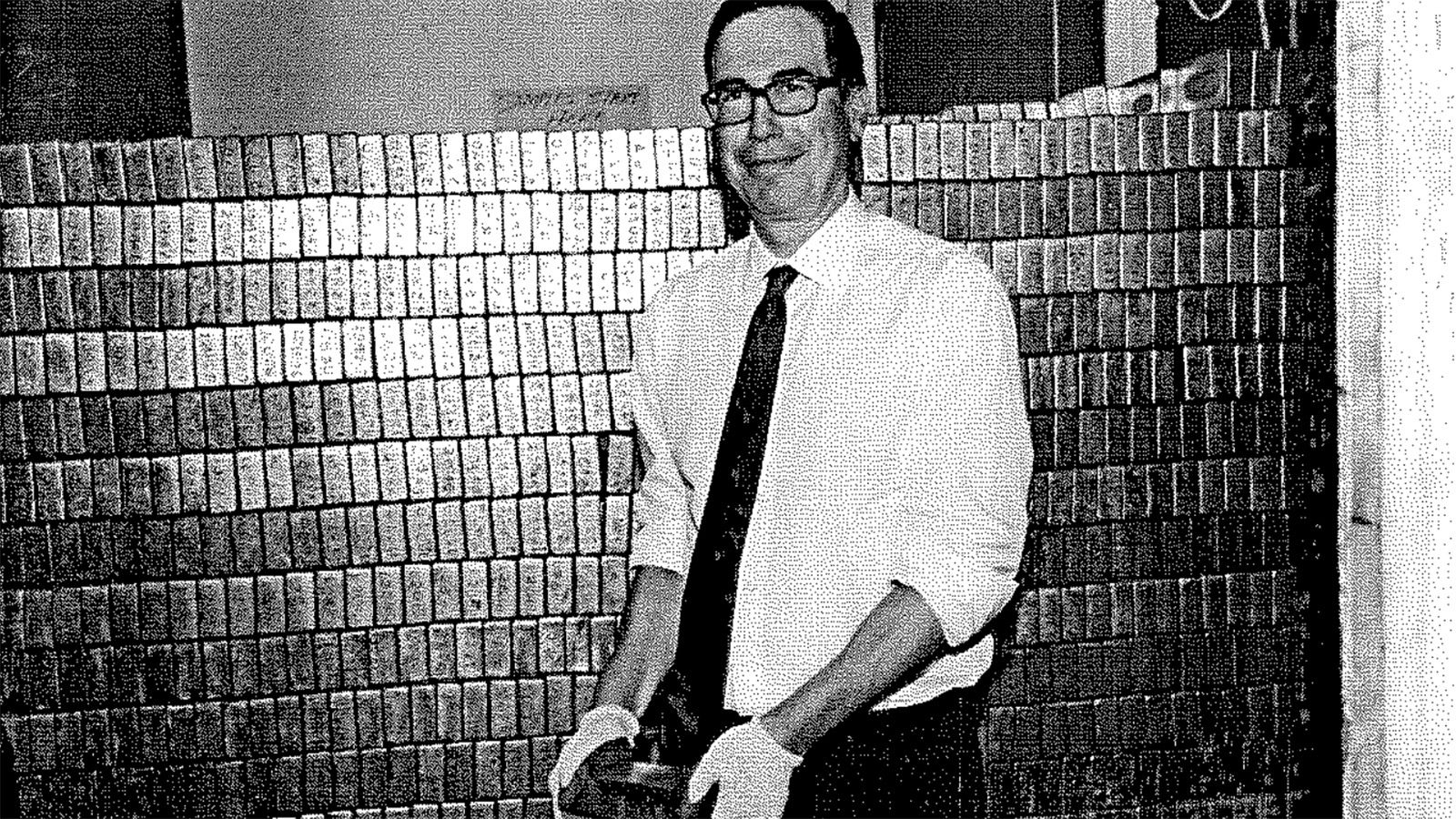

Precious metals, particularly gold, often benefit from lower interest rates. When interest rates are cut, the yield on bonds and other interest-bearing assets falls, making non-yielding assets like gold more attractive.

Investors flock to gold as a store of value, especially during times of economic uncertainty or when inflation is a concern. In the short term, the Fed’s decision to cut rates will likely continue to push gold prices higher to new records, as lower rates will weaken the U.S. dollar and boost demand for safe-haven assets.

If inflation starts to pick up again, gold prices are likely to continue to climb. Historically, gold has performed well in low-interest-rate environments, particularly when real yields turn negative. Silver, which often follows gold’s price trends, may also see a boost in demand and price as a result of the Fed’s actions.

The Fed’s 50 basis points rate cut is a double-edged sword. While it provides immediate relief in the form of lower borrowing costs, it also signals concerns about the health of the economy and the Fed’s ability to manage future risks.

Everyday consumers will feel the effects in their mortgages, car loans, credit cards, and savings accounts, while investors will need to weigh the impact on stocks and precious metals carefully as the Fed navigates an uncertain economic landscape.