For thousands of years, people have cherished, worshipped, valued, exchanged, and recognized bullion as the oldest, most natural, and pure form of money. Government-issued gold coins have been a mainstay in the global economy and international trade since colonial times when the 20 Francs Gold Coin and British Gold Sovereign spread worldwide.

Historians and archaeologists have uncovered numerous examples of coins struck from precious metals, revealing the practices of ancient civilizations and cultures in China, India, and Ancient Greece that date back thousands of years.

Many other European countries joined the Latin Monetary Union during the mid-19th century, and colonial expeditions returned large quantities of gold to Belgium, Portugal, Spain, France, and Great Britain.

During the late 19th and early 20th centuries, the United States operated on a gold-based economy. People used gold and silver coins in daily transactions.

Mass-produced, beautifully designed coins, such as Liberty Gold Eagle Coins, Gold Indians, and the Saint-Gauden’s Gold $20 Double Eagle, made them standard in everyday use. Gold was used in everyday transactions until President Roosevelt removed it from circulation in 1933.

Federal Reserve bankers and politicians in the 1930s believed that private ownership of gold contributed to the stalling of the economy’s recovery following the Great Depression.

As a result, most of these coins were confiscated from private citizens in exchange for fiat paper reserve notes.

Criminalization of Gold Ownership

In 1933, President Roosevelt signed Executive Order 6102, which ordered the government to confiscate gold from citizens as part of the recovery efforts from the economic struggles of the Great Depression.

The US Treasury was expected to repatriate the gold coins and melt them back into gold bars for deep storage. US Government Reserves include almost 261,500,000 troy ounces of gold.

Many defiant citizens refused to exchange their gold coins for worthless paper and stashed the coins away for their intrinsic value.

However, 40 years after the gold confiscation, citizens still faced arrest and criminal prosecution for owning more than five troy ounces of gold until President Ford signed Public Law 93-373 in August 1974.

Several months later, Ford issued Executive Order 11825, which repealed Roosevelt’s criminal categorization of gold ownership.

Today, many online bullion dealers offer these Pre-1933 US Gold Coins in various circulated conditions. Stacking these coins is a great way to store wealth.

Today’s Bullion Market

Congress established the American Gold Eagle Series with the Liberty Coin Act of 1985 (Public Law 99-185). This bullion coin series is widely recognized and respected worldwide for its authenticity and purity.

Today, gold coins from the US Mint represent a trusted, government-backed gold bullion product that is respected and recognized worldwide.

The number of coins manufactured each year varies depending on investor demand. The coins are minted based on sales, which helps the US Mint implement a business model that allows for flexibility in scaling capacity.

In recent years, the media has widely reported that the US Mint has struggled to keep up with investor demand for the first time in its history of minting bullion coins.

This has led to consumers experiencing a significant increase in premiums for products from the US Mint, with some speculating that recent consolidation amongst mint suppliers, wholesalers, and retail distribution channels by A-Mark is one contributing factor.

Additionally, issues with the delivery of blank planchet from private industry refiners have been amplified by pandemic-related supply-chain problems, which was also a factor in Mint officials deciding to cancel both the 2022 Morgan and Peace Silver Dollar Coins.

In the American Gold Eagle series, the US Mint produces four distinct denominations of gold coins in size, weight, and face value suitable for gold investors.

Many stackers are searching for alternative gold eagle coins to save on premiums.

For new precious metals investors, learning about all of the available options, researching, and shopping for gold coins can be intimidating.

Even for experienced and seasoned investors, the process may be daunting and confusing.

Historic Gold Coins

One simple way to consider gold coins as an investment and a store of value or wealth is to look at the options available in the market for both Historic and Modern Gold Coins.

Throughout history, many countries around the world have based their international trade with other countries on agreed-upon standards of various amounts of gold and silver established by treaties.

Some of the most commonly available government gold bullion coins were minted by European countries beginning in the mid-19th century.

The large-scale minting of gold bullion coins in Europe coincided with much of the colonial expansion and development of the New World.

Gold coins were minted and regularly circulated in many countries until the mid-20th century. For today’s stackers, historic European gold bullion coins are among the lowest premium fractional gold investments available.

Investors can typically buy some of the most famous historic gold coins, such as the 20 francs and British Gold Sovereigns, at premiums significantly lower than those of current-year government bullion coins.

20 Francs Gold Coins

European monarchs and political leaders formed the Latin Monetary Union to create a new standard based on the French Franc.

The specifications for the gold Franc are as defined in the LMU treaty.

Numerous countries minted the 20 Francs Gold Coin, including France, Belgium, and Austria, with some being minted at colonial mints.

Many countries abandoned the LMU treaty due to World War I, and it was officially disbanded in 1927.

Some countries continued to mint coins according to the LMU standards following the end of the trade agreement. Most notably, Switzerland had the 20 Francs Helvetia or Vrenelli officially minted until 1936.

All 20 Francs gold coins from Switzerland with dates beyond 1936 are considered restrikes. One of the most common and popular gold bullion restrike coins for stacking, available from online bullion dealers, continues to be the Swiss 20 Francs Helvetia Gold Coin.

Regardless of the country of origin, each 20 franc gold coin is minted with .1867 troy ounces of pure gold.

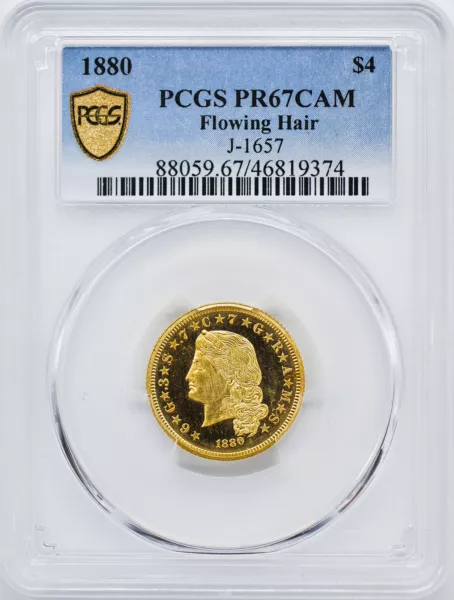

In the late 1800s, the United States considered joining the LMU. In 1879 and 1880, notable sculptors Charles Barber and George Morgan designed several “pattern coins” that were proposed as part of the consideration.

The most famous example is the Gold Stella coin. In 1880, the US Mint produced 425 “Stella” gold coins to specifications similar to the LMU requirements, with a face value of $4 USD.

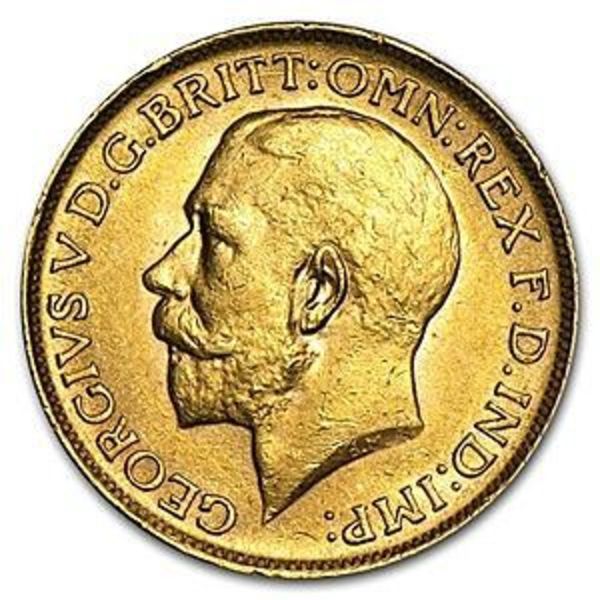

British Gold Sovereign

The British Gold Sovereign coin entered circulation in 1817. It was minted with an alloy of .917 gold, .083 copper, and other metals.

From the mid-1850s until 1932, gold sovereigns were also minted worldwide at mints that were part of the British Colonial Empire. These include coins with mint marks from Australia and later in Canada, South Africa, and India. This provides some additional interest for stackers with a passion for history or numismatics.

Each gold sovereign coin weighs 7.98805 grams and contains .2354 troy ounces of pure gold. British Gold Sovereign coins are an excellent low-premium alternative to the quarter-ounce gold eagle.

Pre-1933 Gold Coins from the US Mint

The US Constitution helps to define some aspects of the US economy and its early reliance on a Gold Standard, as much of the rest of the world.

Article I, Section 10, Clause 1 of the US Constitution, which helps to define the powers of the States, constrains each state to the issuance of only coins made from gold or silver.

Gold Coins were an essential part of the economy following the American Revolution. For the first 157 years of US history, gold coins were circulated instead of paper fiat reserve notes.

Courts have ruled that this Constitutional definition only applies to States and not to the Federal Reserve, a privately controlled central bank responsible for issuing paper fiat currency backed by gold in Fort Knox and other vault locations.

Modern Gold Coins

Secondary Market American Gold Eagles

Premiums on the Gold Eagle coin series are the highest they have ever been, and investor demand is the highest it has ever been.

For investors and stackers who insist on only buying fractional gold eagles, the lowest premium and most popular choice is to buy a secondary market or random-year gold eagles.

Throughout the industry, dealers regularly buy, sell, and trade gold coins from private investors.

Many of these coins are backdated gold eagles that were originally sold in the year they were minted.

Sometimes, these coins are delivered in brilliant uncirculated (BU) condition. However, they most commonly exhibit minor imperfections, such as slight fingerprints or tiny scratches from handling.

This does not impact the monetary or intrinsic value of gold. Buying secondary market fractional gold eagle coins is one-way serious stackers save on premiums.

These will be coins minted and released in previous years that dealers back from investors. The coins are then resold at a discount compared to current-year coins.

Canadian Gold Maple Leaf Coins

Gold Maple Leaf coins are minted by the Royal Canadian Mint annually. The coin series was introduced in 1979 with a design that has received several enhancements.

From 1979 until 1982, maple leaf coins were minted from .999-fine gold. Near the end of 1982, the RCM upgraded its refining process and increased the purity of the maple leaf coins to .9999 fine gold.

The high level 24k gold purity in Maple Leaf Gold coins is one of the defining characteristics that sets them apart from other government gold coins available in the marketplace.

Lower premiums on Gold Maples often make them cheaper than Gold Eagles.

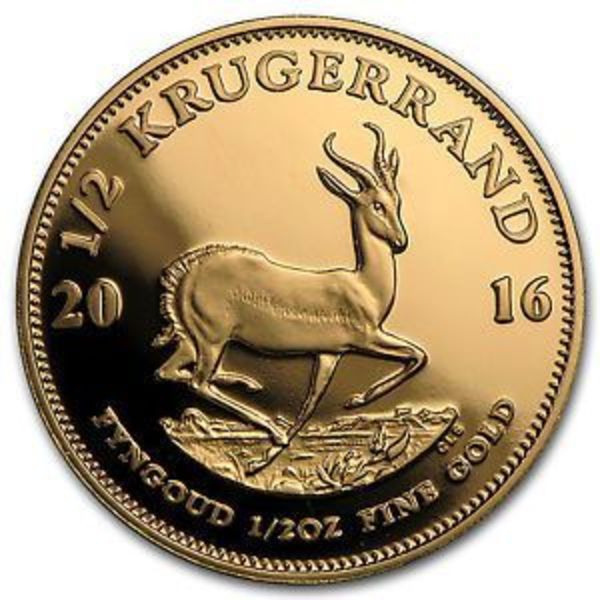

South African Gold Krugerrand

The South African government was the first to issue a gold bullion coin exclusively as a vehicle for investors in 1967 with the iconic Gold Krugerrand.

In 1974 and 1975, more than 8 million Krugerrand 1 oz gold coins were minted.

In the decade that followed, 31 million more coins were minted until prohibitions and sanctions against the South African government were put in place in response to the ongoing policies related to Apartheid.

Random Year Gold Krugerrand Coins are minted in 1/10 oz, 1/4 oz, and 1/2 oz and 1 troy-ounce denominations.