On August 30, A-Mark announced that their JM Bullion subsidiary had entered into an agreement to buy online bullion dealer BGASC for $4.5 million in cash.

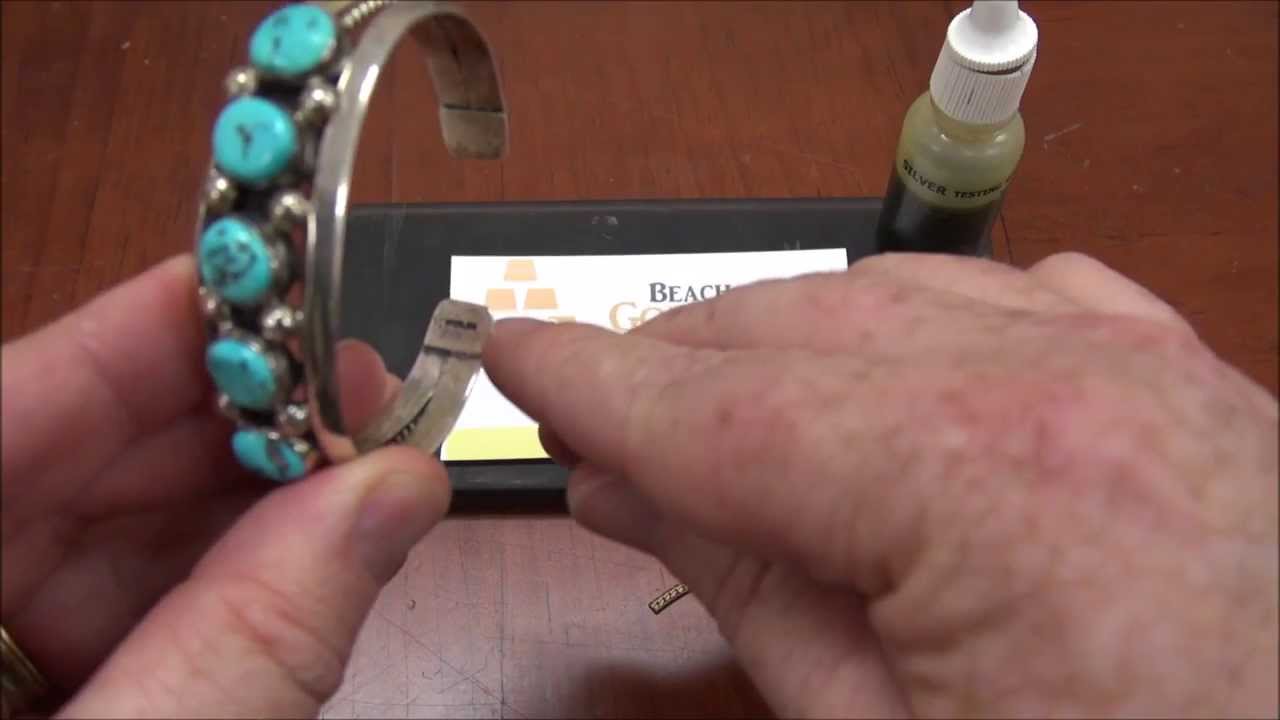

BGASC was founded in 2012 in California and has reported more than 70,000 customers and $200 million in annual revenue. BGASC is an abbreviation for Buy Silver and Gold Coins.

Over the last few years, A-Mark has been leading an effort to consolidate and control many aspects of the bullion industry.

The Silver Heist channel on YouTube recently posted a video discussing the potential for long term impacts to consumers resulting from A-Mark’s ongoing acquisition-streak in the retail bullion industry that began with JM Bullion in 2021.

As pointed out in the video, A-Mark has been acquiring stakes in many companies across all segments of the precious metals industry. The acquisitions have included refineries, smelters, wholesalers, distributors and retailers.

A-Mark now has control of an entire vertical segment from raw material to finished investment and industrial products. They have a stake in companies throughout all facets of the supply chain. Starting with the refineries, which is close to the point of extraction from mines.

At the refiner level of the supply chain the company has access to raw material from miners, recyclers and others through the ownership of Sunshine Minting and Silvertowne Mint.

Sunshine Minting was established in 1979 in Coeur d’Alene, Idaho. In 2007, the company was acquired by Tom and Patricia Power.

In 2020, A-Mark acquired a 31.1% stake in Sunshine Minting, which included a joint-venture in Shanghai, China.

Sunshine Minting plays an important role in the minting and distribution of American Silver Eagle coins.

The US Mint sources blank silver planchets from private mints and Sunshine Minting is a primary supplier of the raw blanks that are pressed into Silver Eagle coins.

A-Mark is also one of the “Authorized Purchasers” of wholesale products that are produced by the US Mint.

As an approved wholesalers, A-Mark is able to purchase products from the mint at a fixed markup.

According to business guidelines published by the US Mint in the spring of 2022, the current wholesale premium from the US Mint for American Silver Eagle coins is $2.35 per coin.

A-Mark and American Silver Eagle Retail Distribution

As of this morning, the lowest current online retail premiums from A-Mark affiliated bullion dealers is $14.41 per coin from BGASC, earning A-Mark affiliated investments a gross premium of $12.06 per coin over the combined spot price and $2.35 manufacturing cost of the US Mint.

Other A-Mark affiliated online retailers that are listed on FindBullionPrices.com offer this exact same product at even higher price points and premiums.

In a way, A-Mark is able to strategic leverage their position in the industry to outsource the manufacturing of Silver Eagles to the US Mint at a fixed cost that they then sell at various price points through retail channels that they have influence over through investments or full ownership control.