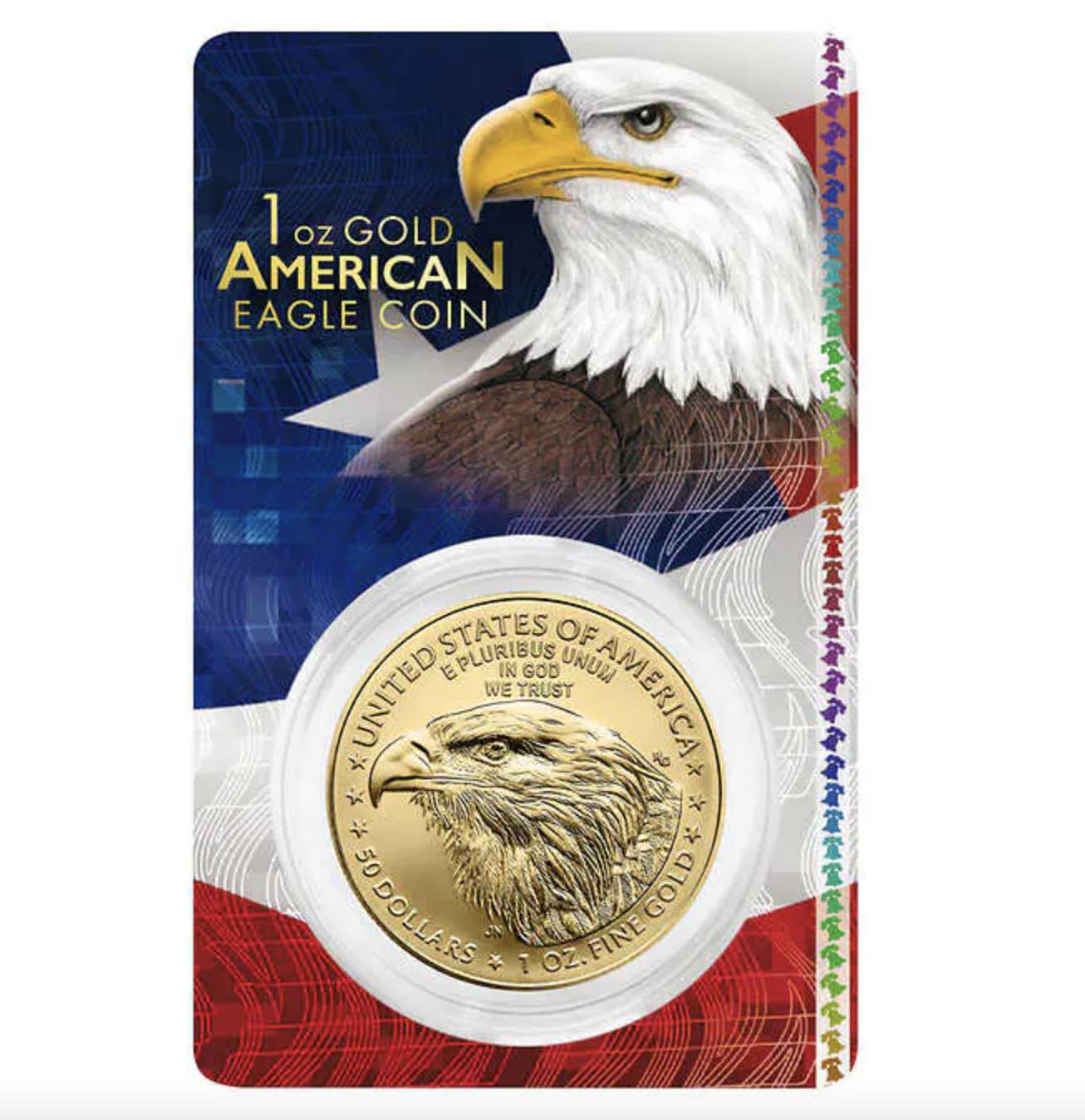

Connecticut and Florida Eliminating State Sales Tax on Bullion

Connecticut and Florida have just ended state sales tax on gold and silver bullion, a move that lowers costs for buyers and signals a major shift in how precious metals are treated across the U.S. This change isn’t just about saving money at the register—it’s part of a bigger trend recognizing bullion as real money and a hedge against inflation. As more states follow suit and central banks continue to stockpile gold, Americans now have more incentive—and fewer barriers—to protect their wealth with physical gold and silver.