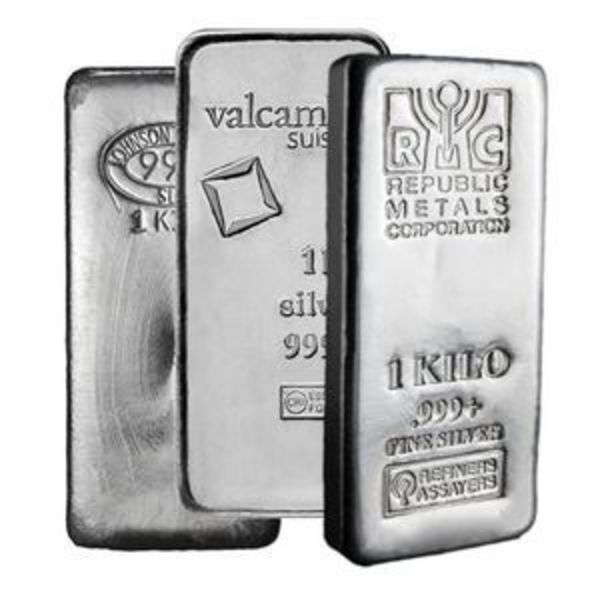

Generic Silver Bullion

Silver Bullion Rounds and Bars

Learn More About Generic Silver Bullion

Generic Silver bullion is a practical and cost-effective way to buy physical silver to diversify portfolios or hedge against economic uncertainty.

Unlike government-minted coins, generic silver bullion comes from private mints or refineries and is available in various forms, sizes, and designs.

With lower premiums over spot price, generic silver bullion provides an accessible entry point for those looking to buy tangible assets.

What Is Generic Silver Bullion?

Generic silver bullion refers to silver products manufactured by private mints or lesser-known refineries. These products are not legal tender but hold intrinsic value based on silver content. Popular forms of silver bullion include:

- Silver Bars: They are available in a range of weights, from 1 oz to 100 oz, offering flexibility for both small and large investments.

- Silver Rounds: Coin-like in appearance but not issued as legal tender, silver rounds often feature creative designs.

- Unique Shapes: Some private mints produce bullion in distinctive shapes or with intricate designs that appeal to collectors and investors alike.

These products have stampings with essential details like weight, purity, and the mint’s logo.

Benefits of Buying Generic Silver Bullion

- Lower Premiums: Generic silver bullion usually carries smaller premiums over the spot price, making it more cost-effective per ounce than government-issued coins.

- Variety: With options ranging from simple minted bars to intricately designed silver rounds, it is easy to find products that align with your preferences and budgets.

- Liquidity: While generic bullion may lack the instant recognition of government-minted coins, it's marked weight and purity make it easily tradable.

Leading Brands in Silver Bullion

Several private mints and refineries are well-regarded for producing high-quality generic silver bullion. These brands offer reliability, consistent quality, and a variety of product options:

Sunshine Minting

A prominent U.S.-based producer, Sunshine Minting is known for its secure and high-quality silver bars and rounds. Their anti-counterfeit features, such as MintMark SI, add to the appeal of their products.

Engelhard Silver Bars and Rounds

Although Engelhard no longer manufactures bullion, its bars, and rounds are still actively traded in the secondary market. Renowned for their craftsmanship, Engelhard products remain a staple in the silver investment community.

Johnson Matthey

Another historic name in precious metal refining, Johnson Matthey silver bars, and rounds are widely sought after in the secondary market despite the company exiting the bullion business.

Silvertowne Silver Bars and Rounds

This U.S.-based mint offers diverse silver bars and rounds, often featuring custom designs. Silvertowne products are a reliable and affordable choice for investors.

APMEX (American Precious Metals Exchange)

APMEX-branded silver bullion combines quality with affordability. As a leading precious metals dealer, their products are highly regarded.

Golden State Mint

Known for its creative designs, Golden State Mint produces various silver bars and rounds, catering to investors and collectors.

How Generic Silver Bullion Differs from Government-Issued Coins

While government-minted silver coins like the American Silver Eagle or Canadian Maple Leaf enjoy global recognition and liquidity, they come with higher premiums due to their legal tender status and government backing. In contrast:

- Generic silver bullion lacks legal tender status but offers a lower-cost way to acquire silver.

- It provides greater variety in designs and sizes, appealing to investors who prioritize affordability and flexibility.

Popular Weight Options in Silver Bullion

Silver bullion is available in a range of standard weights, making it suitable for investors with varying budgets and goals:

- 1 oz: The most common and widely traded size, ideal for new investors.

- 5 oz and 10 oz: Popular among those looking to accumulate silver efficiently without significant premiums.

- 100 oz: A cost-effective option for large-scale investors.

Things to Consider When Buying Silver Bullion

When purchasing silver bullion, investors should evaluate several factors to ensure they make an informed decision:

- Purity: Most generic silver bullion is .999 fine silver, but always confirm the purity before buying.

- Mint Reputation: Buying from trusted private mints or established dealers ensures authenticity and quality.

- Market Conditions: Monitor silver spot prices to time purchases for maximum value.

Why Choose Silver Bullion?

Generic silver bullion is an excellent option for investors focused on maximizing their silver holdings while minimizing costs. Its affordability, variety, and intrinsic value as a tangible asset make it a practical choice for new and seasoned investors.

.png)