FindBullionPrices Displaying Collect Pure Marketplace Bid and Ask Prices

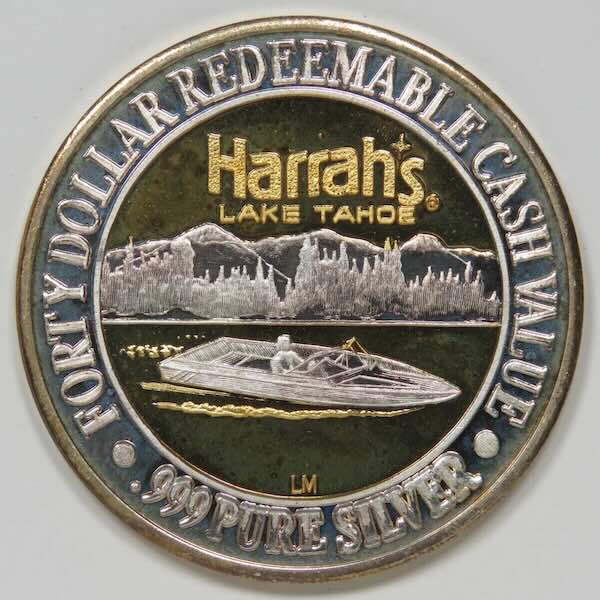

The Collect Pure Marketplace provides a platform for trusted peer to peer transactions of authentic bullion coins, bars, and numismatics from brands like the U.S. Mint, Royal Canadian Mint, and Perth Mint. Many sellers list rare coins, fractional gold, and vintage silver pieces.