In an age where digital transactions and cryptocurrencies are the norms, the concept of precious metals as a form of currency might need to be updated to many. However, there’s a compelling case for silver investing, not just as a relic of the past but as a relevant and wise choice for long-term wealth preservation and financial security.

The Lost History of Silver as Money

For centuries, silver and gold have been the cornerstones of global trade and currency. Our grandparents carried silver coins in their pockets. In fact, most coins in circulation prior to 1965 were minted from 90% pure silver.

Today, silver continues to be an important asset in investment portfolios and various forms of commemorative and investment-grade coins. The historical significance of precious metals as a medium of exchange and store of value remains an integral part of the global monetary systems.

The Case For Silver Investing Today

In the world of digital finance, silver stands out because it is a tangible asset. It’s an object you can own and keep as a store of value, like a physical savings account. Unlike digital currencies or stocks, silver is something you can hold.

Precious metals like silver often retain their value when fiat currencies like the dollar lose value due to inflation. There have been many historical examples where their value appreciates because these commodities frequently have an inverse relationship with other investments.

Beyond its role as an investment, silver’s industrial uses are expanding in the tech and medical industries, which will likely continue to be a driver of demand and value.

For environmentally conscious investors, silver offers a sustainable investment. It’s crucial in various green technologies, including solar panels, electric vehicles, batteries and other climate initiatives.

Compared to gold, silver is much more affordable, making it an accessible investment option for young investors who are starting to build their portfolios.

Diversifying your investment portfolio is a fundamental principle of sound financial planning. Including silver can provide balance and stability, especially during high inflation and economic uncertainty.

Silver Investing Books and Resources

Start by learning about the history of silver as a currency and its current role in the economy by exploring various educational resources and platforms.

An excellent place to begin is with books focused on the history of precious metals as money and currency. Most of these well-regarded books are available in Kindle and other eReaders, paperback and hardcover:

- Guide To Investing in Gold & Silver: Protect Your Financial Future by Michael Maloney. Maloney is a leading expert on monetary history, economics, investing, and precious metals. He is CEO and founder of one of the world’s largest gold and silver bullion dealers, and host of the wildly popular video series The Hidden Secrets of Money. He has served as an adviser on Robert Kiyosaki’s Rich Dad team.

- The Case for Gold by Ron Paul and Lewis Lehrman. Ron Paul, an eleven-term congressman from Texas, is the leading advocate of freedom in our nation’s capital. He has devoted his political career to defending individual liberty, sound money, and a non-interventionist foreign policy. This book outlines the roles the Federal Reserve and banking industry mismanagement play in creating economic inflation and was part of a report of the U.S. Gold Commission in the Congressional Record, Government Printing Office, Washington D. C., 1982.

- The Story of Silver: How the White Metal Shaped America and the Modern World by William L. Silber Silber is the former Marcus Nadler Professor of Finance and Economics at NYU’s Stern School of Business and member of the New York Mercantile Exchange, where he traded options and futures contracts, managed an investment portfolio for Odyssey Partners and Lehman Brothers.

- One Nation Under Gold: How One Precious Metal Has Dominated the American Imagination for Four Centuries by James Ledbetter. Ledbetter is the former editor of Inc. magazine and Inc.com and has worked at TIME, Reuters, The Village Voice, and many other publications, some of which still exist.

- Aftermath: Seven Secrets of Wealth Preservation in the Coming Chaos by James Rickards

- The Death of Money: The Coming Collapse of the International Monetary System by James Rickards. In these two books, NY Times best-selling financial expert James Rickards explains why and how global financial markets are being manipulated and artificially inflated and what investors can do to protect their assets.

Online Tools, Forums and Social Media

Follow financial news platforms and blogs that specialize in precious metals to stay updated on silver’s current role in the economy.

Websites such as Kitco, The Silver Institute, and Find Bullion Prices offer news, analysis, market prices and other data on silver markets.

Various online learning platforms offer courses in economics and history, some of which specifically provide courses that cover the use of precious metals as currency.

The CME Group, which runs and operates various commodities markets and exchanges, including COMEX, offers a free self-guided Introduction to Precious Metals online class that provides an overview of various precious metals, how they are consumed by industry, and why they are important investments.

YouTube also offers numerous educational channels where experts and influencers discuss the history and economics of silver. Documentaries and TV programs that focus on economic history or the history of money often cover the role of silver.

Social Platforms such as Reddit, Facebook, LinkedIn, and other specialized online forums have communities devoted to precious metals, such as /r/Silverbugs and /r/Gold. These online communities can be valuable for discussions, resource sharing, and advice from experienced investors and enthusiasts.

Silver ETFs and Digital Silver

Silver can be purchased physically (as bars or coins) or through silver Exchange-Traded Funds (ETFs). An ETF purchases and holds silver or silver-related assets in a trust. The value of an ETF share tracks the price of silver minus fund expenses and fees.

Investors can buy and sell shares of a silver ETF on a stock exchange, providing a simple way to invest in the silver market without dealing with the challenges of physical silver storage and security while aiming to track the spot price of silver. The ETF’s share price moves in tandem with silver prices in the global market.

Digital Silver

Additionally, digital platforms like OneGold.com and Vaulted.com provide investors with a mobile application that enables quick and easy buying of vaulted physical silver, gold, and platinum allocations. These stored allocations are easily redeemed anytime for secure delivery.

OneGold.com specializes in digital precious metals, allowing customers to buy, sell, and hold digital gold and silver without physical storage. The company is a partnership between APMEX and Sprott Metals. Founded in 2000, APMEX is a leading online retailer of precious metals.

Sprott Money is known for providing valuable insights into the precious metals market with articles, reports, and analyses that can help investors make informed decisions.

Ordering Physical Silver from Online Dealers

Buying silver online offers numerous advantages, including convenience, variety, and competitive pricing.

Online dealers offer a wide range of silver products, from coins and bars to specialty and numismatic items, providing more options than what might be available in your local coin stores.

Most offer products from various international mints that are unavailable locally. With lower overhead costs compared to brick-and-mortar stores, online dealers can offer lower premiums over the spot price of silver.

Several dealers also offer silver at spot price deals explicitly catered to new investors that provide a low-risk way to start.

Buying online allows for broader product offerings, easy price comparisons across multiple dealers, privacy, discrete delivery.

Most trusted and reputable dealers have customer reviews and ratings on third-party websites, helping you make an informed decision based on other buyers’ experiences.

Online transactions offer various payment options, including credit cards, e-check and bank transfers, and even a large assortment of cryptocurrencies through platforms like Bitpay. With purchases being delivered discreetly and securely to your doorstep, this level of privacy, discretion, and convenience is impossible with in-person transactions.

FindBullionPrices.com provides comprehensive price comparisons for various physical silver coins, bars, and rounds from a wide range of online dealers and enables investors to find the best available prices quickly. By aggregating prices from dozens of reputable online bullion dealers, FindBullionPrices.com gives investors access to a broad market landscape from a single platform that saves time and effort that you would otherwise spend visiting multiple websites.

Our product listings cover a wide array of silver coins, bars, rounds, and even collectible and numismatic items. In addition, we provide access to a wide range of educational materials, analysis, and detailed guides on investing in precious metals. These resources help buyers understand market dynamics, investment strategies, and other factors affecting precious metals prices.

Silver Coins, Bars and Rounds

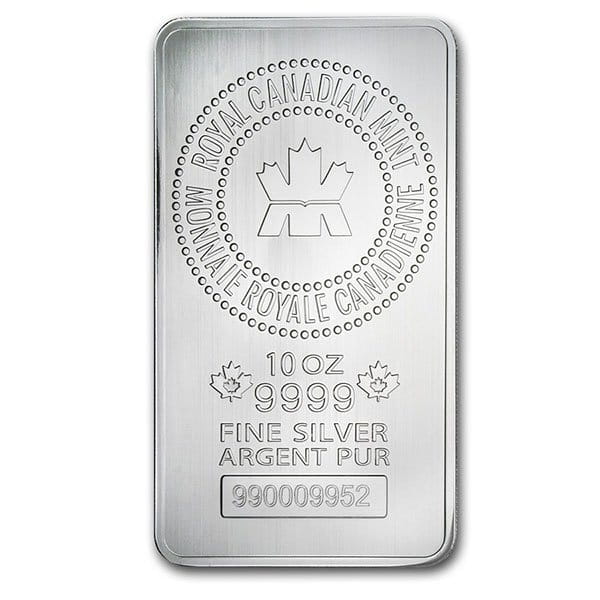

The most popular coins and bars for silver investing include top-selling 1 oz coins like the American Eagle, the Canadian Maple Leaf, and the Krugerrand. These are a mainstay for those who prefer government backing or a specific need, such as a Silver IRA.

Private mint silver bars offer a combination of low premiums, high liquidity, bulk discounts, and unique varieties suitable for both long-term holding and short-term trading.

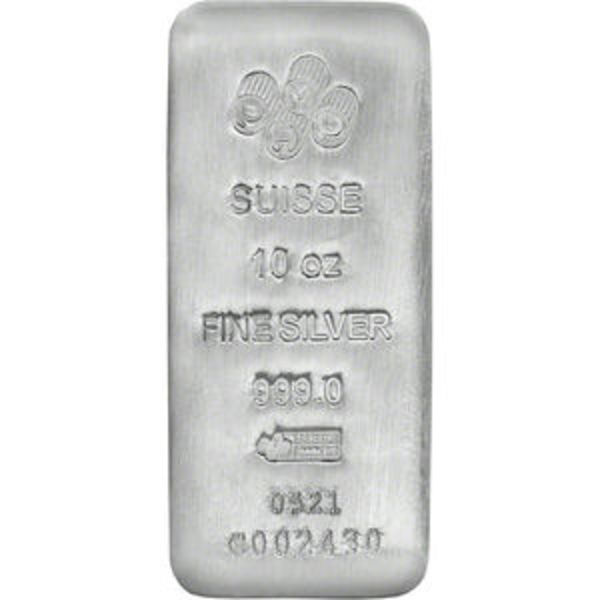

Compared to smaller denominations like 1 oz coins or bars, 10 oz, kilo and 100 oz silver bars have lower premiums over the spot price of silver, allowing you to acquire more physical silver for the same money.

Selling Silver

Silver has a high market demand and is recognized globally, which makes buying and selling easy. Its value is universally recognized, and prices are updated daily based on global markets.

Unlike owning real estate or land, you can buy, sell, or trade silver in smaller units, making transactions more straightforward and quicker. This liquidity makes silver and other assets like gold and stocks a preferred choice for beginning investors seeking liquid tangible assets.

Long Term Silver Investing

Like any investment, the spot price of silver constantly fluctuates. Keeping an eye on the market can help you make informed decisions.

The “spot price” of commodities like silver and gold refers to the real-time market price at which they can be bought or sold for immediate delivery.

Various factors influence silver’s spot price, including supply and demand dynamics, geopolitical events, market speculation, and currency fluctuations. The spot price quotes for precious metals like silver, gold, and platinum are per troy ounce.

For beginning investors, especially Millennials and Gen Z, rethinking silver as a currency and store of value offers a bridge between the past and the future. It’s a way to preserve wealth in a tangible form that has stood the test of time while aligning with modern sustainability and diversification values. In an ever-changing financial landscape, the enduring value of silver can provide both stability and peace of mind.