Where to Sell Gold: How to Maximize Your Return

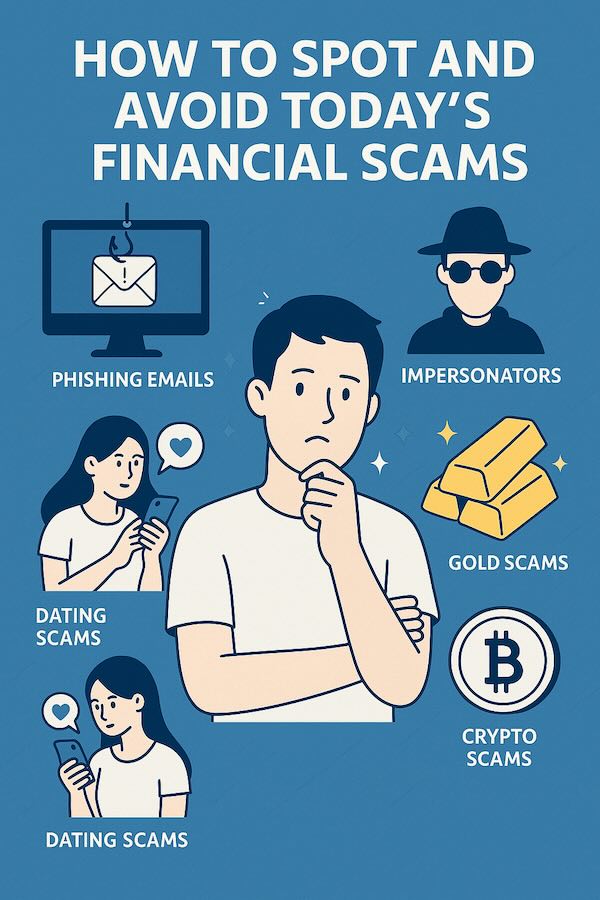

Whether you’re cashing in during a market high or rebalancing your investments, selling gold requires smart strategy. This guide breaks down the pros and cons of selling to local dealers, online platforms, and private buyers—plus tips on pricing, taxes, and avoiding scams. Know where to sell your gold for the best return.