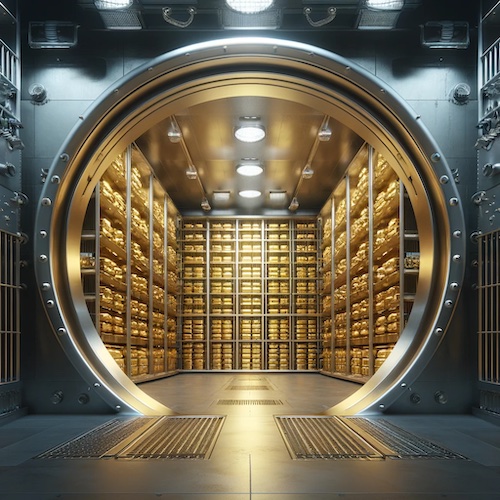

Beginner’s Guide: Why, How, and Where to Buy Gold

Buying gold doesn’t have to be overwhelming. Whether you’re comparing local coin shops or browsing top online dealers, this beginner’s guide walks you through where to buy gold, what types of coins and bars to consider, and how to make smart, secure decisions that align with your investment goals.