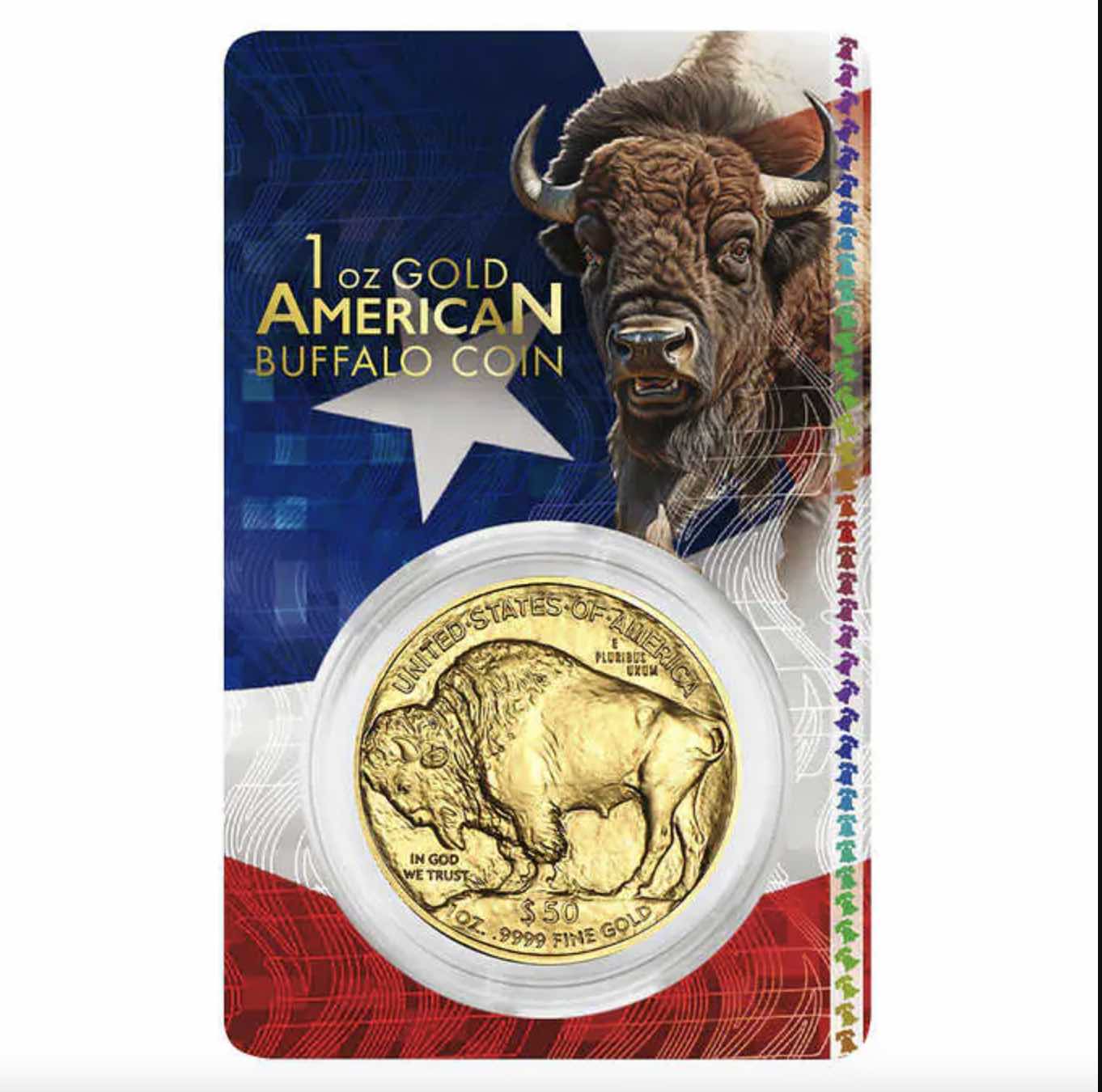

Costco Adds Platinum Bullion Amidst Double-Digit Gold Sales

According to a report from Kitco, the Costco’s gold bullion sales have become a significant driver of its online sales, with reports of double-digit increases in gold sales over the past three months.