In a letter to investors, an analyst from Wells Fargo estimates that Costco may be selling up to $200 million in gold each month.

Based on recent spot price averages, that would mean the brick & mortar retailer may be shipping up to 85,000 troy ounces of gold each month, the equivalent to around 2,400 kilos of gold.

Earlier in the year, Costco stated that gold sales contributed around $100 million in revenue in the final quarter of last year when they first began the offerings.

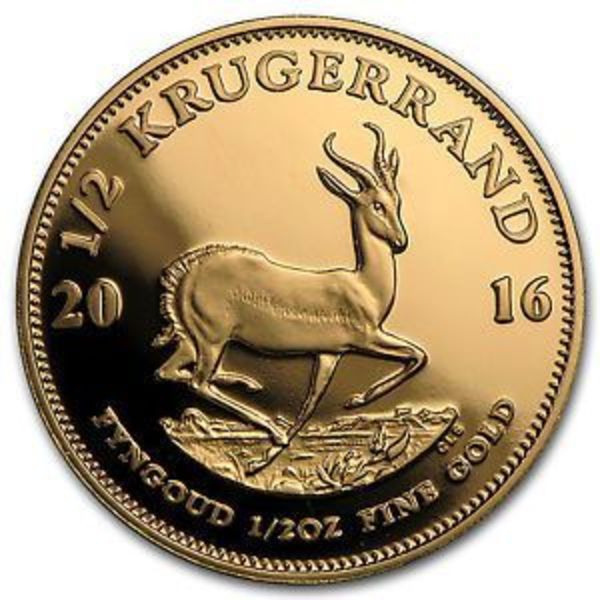

Since then, Costco has been making regular offerings of gold coins from both the US Mint and Royal Canadian Mint, such as the 1 oz Gold Buffalo and 1 oz Gold Maple Leaf coins.

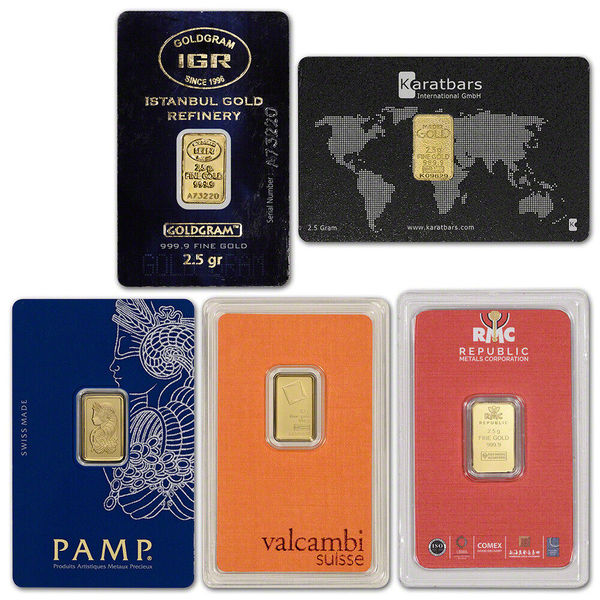

The offerings have also included various denominations of gold bars from PAMP Suisse and RAND Refinery. In addition to the 1 oz Lady Fortuna gold bars, there have been sales of the PAMP Multigram+25 gold bars as well as larger sizes such as 50 gram and 100 gram gold bars.

The premiums that Costco charges seem to be roughly 2-3% over spot, which is a great deal for current year coins. From online bullion dealers, the premiums for current year gold coins are typically around 4.5% at the low end, while secondary market coins will usually be in the 2-3% range.

Costco offers their Executive members a 2% reward, which allows these members to buy gold coins below spot price. When shopping online for these deals, the best practice is to use a credit card that offers additional rewards in the form of cash back. The industry average credit card rewards adds an additional 2%, which some offer more.

The spot gold prices have been hitting record all time highs in recent weeks, overall gold is up around 13% YTD. Industry analysts suggest that the mass buying by the central banks of BRICS countries, along with persistently high inflation in the US, and record high government debt are major contributing causes to the surge.