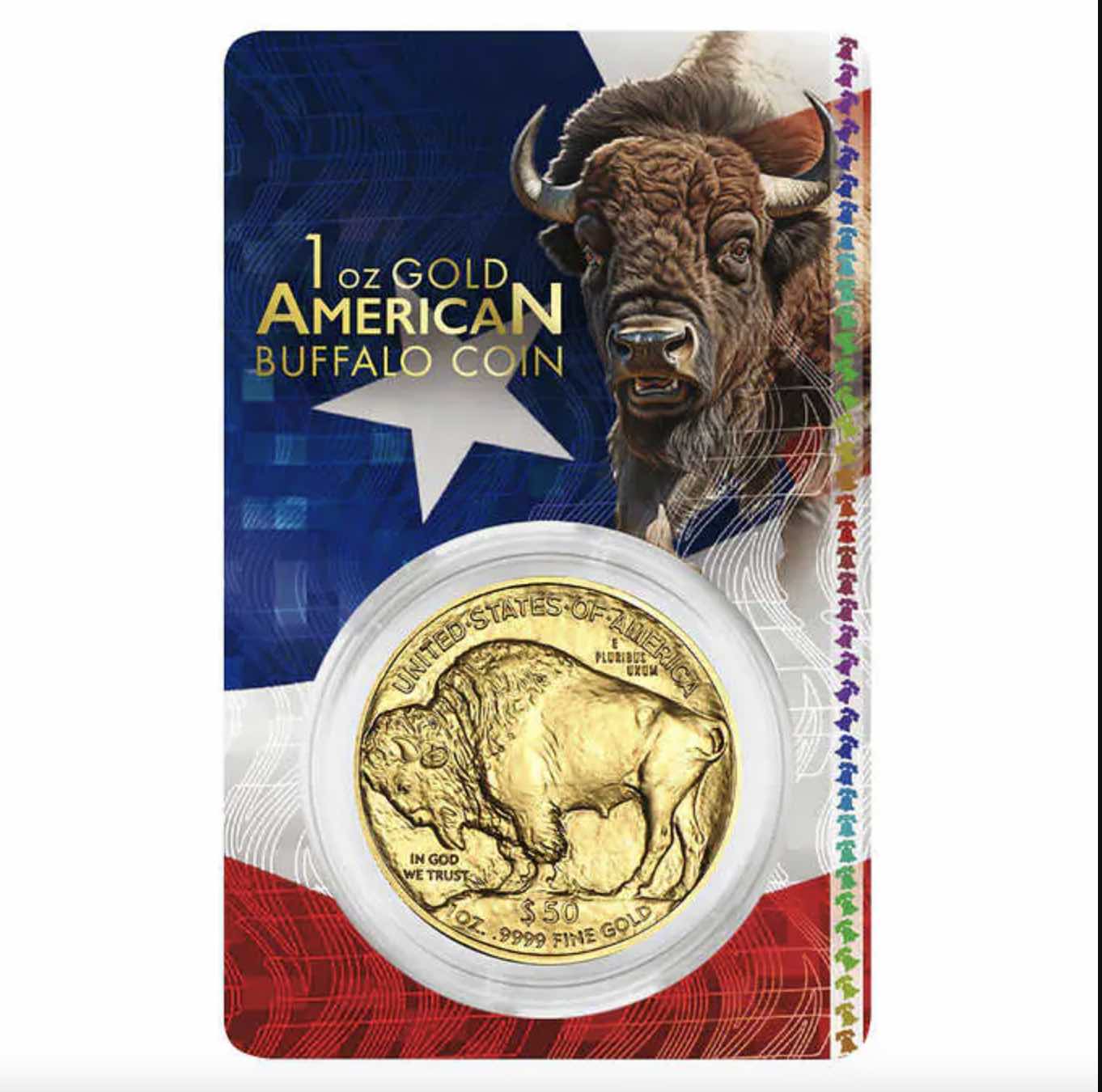

Flipping Costco Gold Coins for Profit

Some investors are buying gold coins from Costco below melt value when factoring in the rewards. The premium on Costco’s gold coins appears to average around 2.5%. Once receiving them, they bring them to their local coin stores to sell back. If your local coin store will pay 3% above melt, then without factoring in other rewards, its possible to make a quick .5% profit.

However, there are ways to use other rewards to increase profits. Flipping gold coins for profits has been a side hustle that many collectors and numismatists have been using for a long time to increase their collections and investments in tangible assets.