The spot price of gold rocketed past $2,400 per ounce in Asia this morning, topping out at $2,429.70 before the tamp down by the Wall Street after the New York opening bell. By afternoon, the price had settled down to around $2,342, $87 lower.

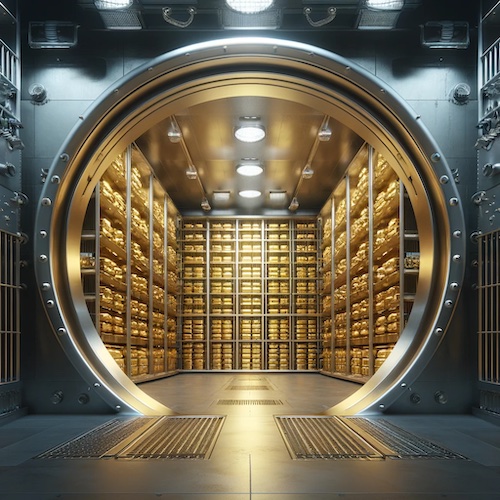

While consumers in China have been buying up small gold beans, the People’s Bank of China (PBOC), the country’s central bank, has been buying vast quantities of gold over the last couple of years while simultaneously dumping US Treasury Bonds and dollars.

Even though gold prices continue to trend upwards, consumers demand for gold in the United States keeps getting stronger.

An analyst from Wells Fargo estimates that Costco is likely selling between $100 to $200 million worth of gold each month. Based on the typical premiums that Costco prices their gold products, that’s somewhere in the range of 43,500 to 86,000 troy ounces per month.

By comparison, APMEX, one of the largest online bullion dealers has annual sales of around $2.4 billion, which is also around $200 million per month. A-Mark, one of the largest precious metals wholesalers, which owns JM Bullion, Provident Metals, BGASC and others, reported $9.3 billion in sales in its 2023 annual report.

Some industry analysts have speculated that China has taken over control of the gold price since the middle of 2022. In 2023, the PBOC bought roughly 735 tonnes of gold, a 23% increase over the record breaking buying of 597 tonnes in 2022.

Additionally, the Chinese government has created strong consumer demand for gold, particularly for younger generations that view gold as safe haven amid ongoing economic uncertainty.

Costco has limited their precious metals products to mostly 1 troy ounce coins and bars. With prices continuing to test record highs almost weekly, a more affordable investment option that many investors turn to is fractional gold bars and coins.

The US Mint issues the American Eagle Gold coin in three fractional denominations of 1/2 oz, 1/4 oz and 1/10 oz. Each of these fractional Gold Eagles shares the same design, purity, recognition and trust as the 1 oz coin, but are minted in smaller denominations that are more accessible to a wider range of investors.

These coins are minted in mass quantities by the Mint and are extremely liquid with an expansive amount of bullion dealers and others paying cash for gold.

Fractional gold bars are available in many different increments. With available sizes as small as 1/2 gram. However, the premiums for the smallest sizes can be relatively high. While denominations containing 5 grams or 10 grams of gold per bar can offer significantly lower premiums.