In a move that caters to the growing interest among consumers, Costco has broadened its selection of precious metals, introducing an array of new coins and bars to cater to the growing interest in tangible assets. The addition includes a variety of gold and silver coins and bars from renowned mints around the world, making it easier for members to diversify their investment portfolios.

The new lineup features investment-grade bullion coins such as the American Gold Eagle, Canadian Maple Leaf, along with various sizes of gold bars from PAMP Suisse and the RAND Refinery. These offerings are tailored to both seasoned investors and those new to precious metals, providing competitive pricing that aligns with Costco’s commitment to value.

Costco is able to leverage its membership model to offer competitive pricing on precious metals, while providing members with Cash Back rewards that can be accrued alongside credit card rewards. This combination is helping to undercut traditional coin dealers or precious metals retailers.

The coin offerings have included both gold and silver coins from the US Mint and the Royal Canadian Mint. This move by Costco follows a broader trend that reflects a mainstream acceptance and interest in precious metals as both an investment and long term store of value.

US Mint

The US Mint began minting bullion coins for investors in 1986 after the passage of the Liberty Coin Act. Along with the Gold Bullion Coin Act of 1985, these two laws require the U.S. Mint to produce and sell the American Gold Eagle and the American Silver Eagle in both bullion and proof finishes in sufficient quantities to meet demand from investors and collectors.

The coins are issued as a vehicle to provide consumers with a trusted tangible asset. At the time of the introduction, the economy was in recovery from a recession that was triggered by increases in oil prices by OPEC starting around 1979 and dragged on until 1982. In the first two years of minting, more than 16,835,340 Silver Eagle coins were sold.

US Mint Gold Coins

The most popular gold coins from the U.S. Mint are the American Gold Eagle and the American Gold Buffalo. These coins are significant to investors for their gold content, legal tender status, historical and aesthetic appeal. Both coins are backed by the U.S. government, ensuring their gold content and purity.

They are both highly recognized and traded worldwide, providing liquidity to investors looking for a tangible asset.

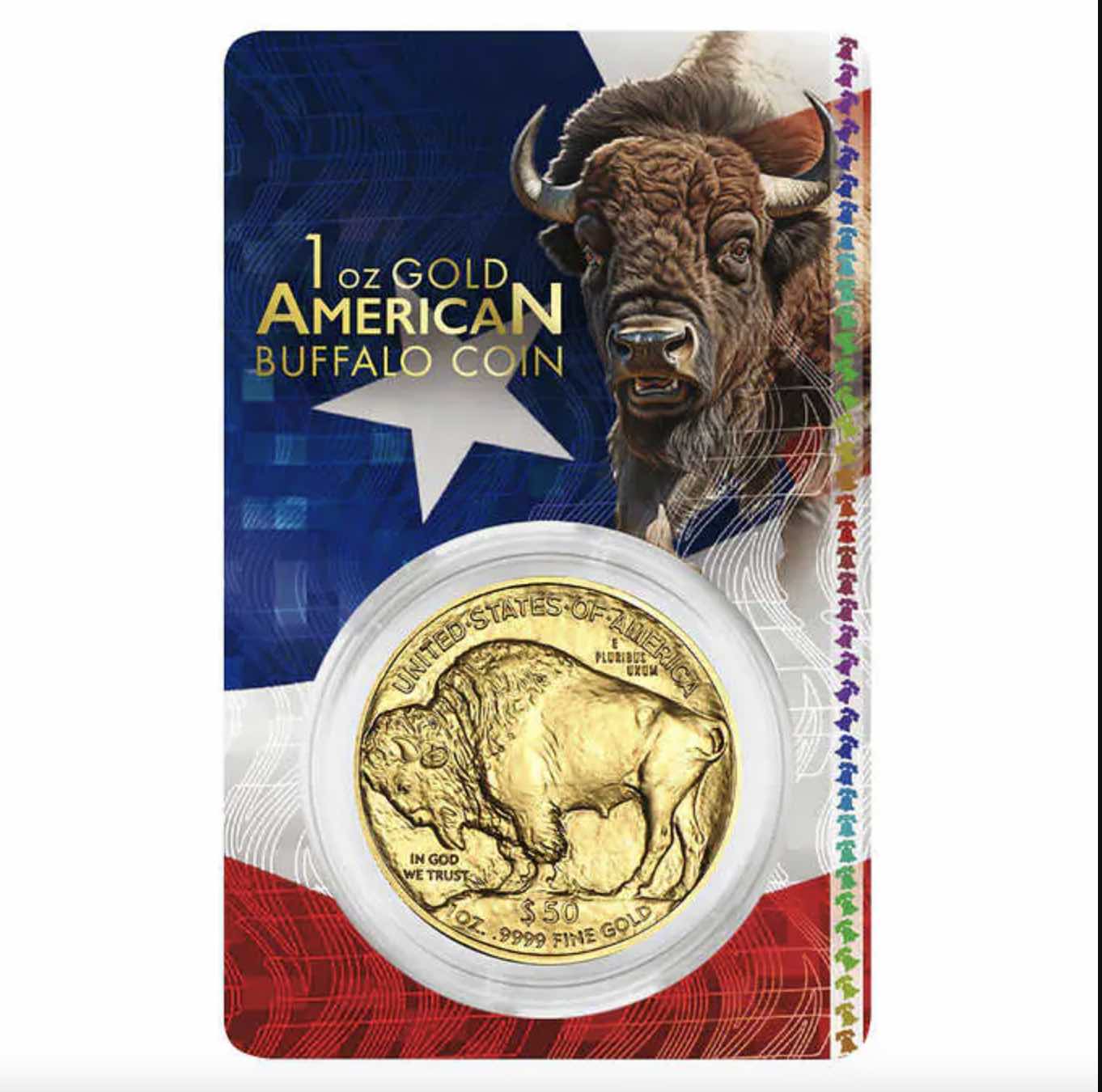

2024 1 oz American Buffalo Gold Coin

The American Gold Buffalo was first issued in 2006 as the U.S. Mint’s answer to pure gold bullion coins like the Canadian Gold Maple Leaf. It is the first 24-karat gold coin from the U.S. Mint.

It features the classic design of the Indian Head nickel or Buffalo nickel, with an image of a Native American on the obverse and an American buffalo on the reverse, both designed by James Earle Fraser.

The Gold Buffalo is 99.99% gold (24 karats), and has a face value of $50 and is also recognized as U.S. legal tender.

One of the most recent times that the Gold Buffalo was in stock, it was priced at $2099.99. At the time, the gold spot price was trading around $2049, indicating only a $50 markup or roughly 2.5% dealer premium. Normal dealer premiums typically range from around 4% to 10% above the spot gold price. While the Costco price beats out the national bullion dealers, the gold coins have typically sold out within an hour or two as experienced investors pounce on these deals.

Costco Product Page: Item #1799474

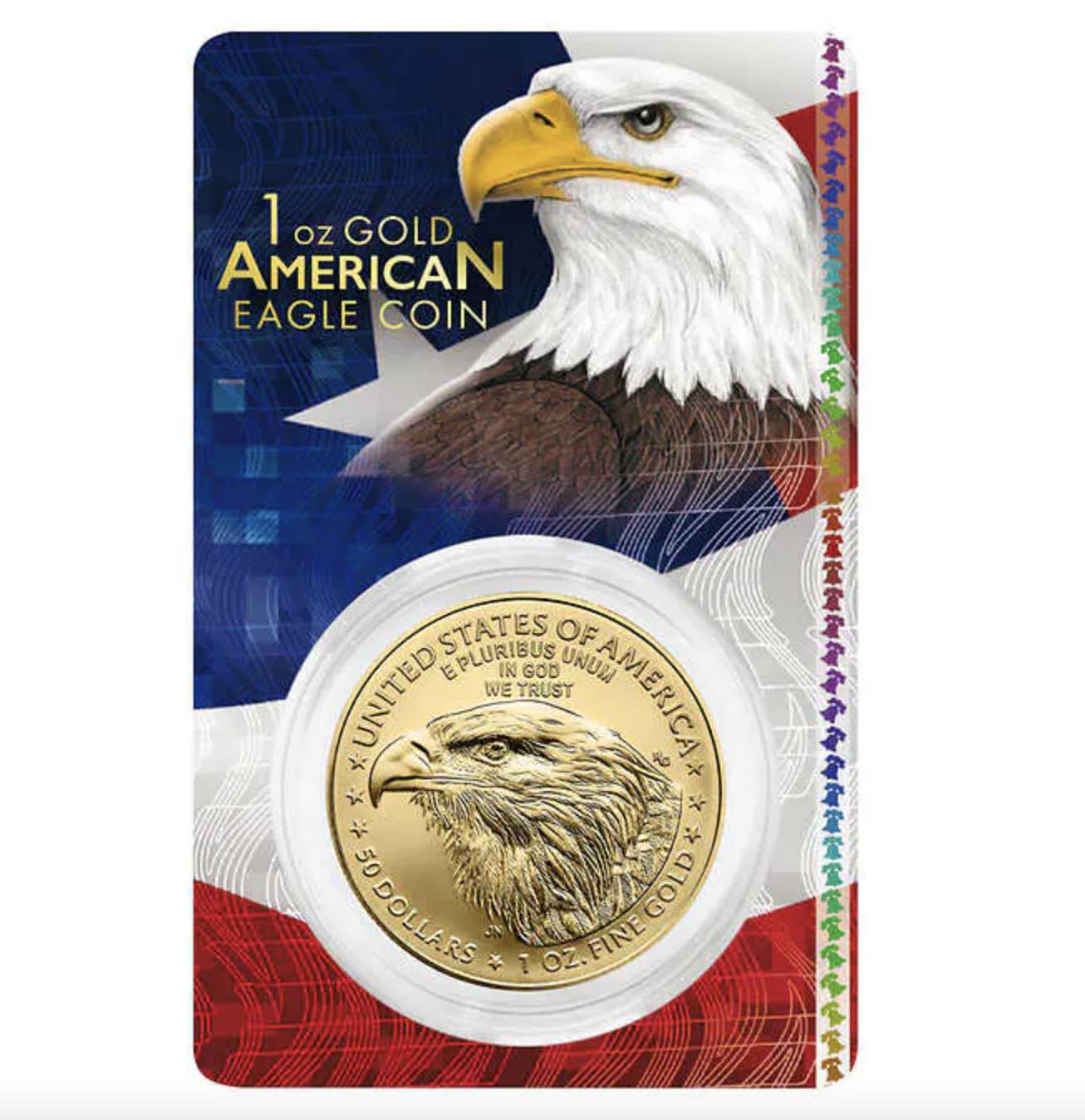

2024 1 oz American Gold Eagle Coin

Introduced in 1986, the American Gold Eagle is available from bullion dealers in four sizes: 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz. However, only the 1 oz Gold Eagle is available from Costco, making this offer limited to investors with a larger budget.

The US Mint provides investors with fractional gold coins that allow for investors having more modest budgets to invest in a long-term store of value and wealth. This variety allows investors to choose based on their budget and investment strategy.

Costco offered the 1 oz Gold Eagle in late February with a price of $2,089.99 with each member limited to just two coins. That day, the spot gold price closed at $2,036.00 per ounce, a dealer premium of $53.99 per ounce or slightly higher than 2.5%.

Typical dealer premiums on current year gold eagles range from as low as 3.5% to around 8%. When Costco Gold Eagles are available for purchase, they are typically sold out within an hour or two. The addition of the Membership Rewards for their Executive Members offers an additional 2% cash back that can later be used on future Costco purchases, including precious metals.

Costco Product Page: Item #1804545

US Mint American Eagle Silver Coins

2024 1 oz American Silver Eagle Tube of 20 Coins

The American Silver Eagle is a one-ounce silver bullion coin issued annually by the United States Mint since 1986. A standard mint tube of Silver Eagle coins usually contains 20 coins. Each coin is one troy ounce of .999 fine silver. The coins are packed tightly in a tube to prevent movement and reduce the risk of scratching or damage during shipping.

Tubes of Silver Eagle coins are made available for sale periodically. The availability of Silver Eagle coins from Costco is limited and the pricing is typically similar to other online bullion dealers. It’s important to compare prices of Tubes of Silver Eagle Coins before making a purchase.

Costco Product Page: Item #1789494

2023 1 oz American Silver Eagle Tube of 20 Coins

Costco Product Page: Item #1799373

Royal Canadian Mint

Founded in 1908, the Royal Canadian Mint has established a global reputation for its innovative coin designs, high-quality craftsmanship, and advanced security features

The RCM is a prestigious institution, producing high-quality, pure gold and silver coins, with the Canadian Gold and Silver Maple Leafs being their flagship products. These coins are widely recognized in international markets and are considered to be a highly liquid investment.

Canadian Maple Leaf Silver Coins

2024 1 oz Canadian Maple Leaf Silver Coin Tube of 25 Coins

Maple Leaf silver coins are our Northern neighbors’ equivalent to the Silver Eagle and are suitable as an investment or store of value. The key advantages that Maple Leaf silver coins have over the Silver Eagle are:

- .9999 Purity – The Silver Maple Leaf boasts a .9999 fine silver purity. While some investors prefer the four-nines purity, the extra nine does not add any extra value in today’s market.

- Design and Recognition – The 2024 issue carries the King Charles’ profile on the obverse, while the iconic sugar maple leaf design is featured on the reverse. This classic reverse design has been minted annually since 1988 and is recognized and respected worldwide, ensuring the coin’s liquidity and marketability.

- Anti-Counterfeiting and Security Measures – The Royal Canadian Mint began incorporating advanced security measures into the design of the coins in 2014, providing visual ways for investors to distinguish between fake and genuine coins.

The Maple Leaf coins were in stock on Costco’s website for a few hours recently at the price of $609.99. That puts each coin in a tube of 25 at around 24.40, with the spot price of silver that day closing at $22.08 per ounce. Typical dealer premiums are slightly higher at around $2.50 per coin.

Costco Product Page: Item #1814000

Canadian Maple Leaf 1 oz Gold Coins

The Maple Leaf 1 oz Gold Coin is the flagship bullion investment coin from the Royal Canadian Mint. It has been a mainstay with global investors since 1979. Its .9999 fine gold content makes it one of the purest investment grade gold coins available, which can be important for some investors.

Costco’s first offering of Maple Leaf gold coins including the Queen Elizabeth Memorial obverse design from last year.

A few weeks ago, the current year issue featuring the official portrait of King Charles was made available at the price of $2,219. On the same day gold spot price closed at $2,161.71 per ounce, a premium of $57.29, which is slightly higher than the lowest available price from national bullion dealers. The average premium for the Costco sale had some investors buying, with availability lasting around 17 hours.

Although the 1 oz coin is the standard, the Maple Leaf series is available in various sizes (1 gram, 1/20 oz, 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz) from a variety of trusted and reputable online bullion dealers, offering flexibility for different investment budgets and strategies.

2024 1 oz Canada Maple Leaf Gold Coin (King Charles Design)

Costco Product Page: Item #1814006

Costco’s expansion into the precious metals market by adding more coins and bars to its lineup demonstrates the company’s response to increased consumer demand for tangible investments as a store of value and wealth. This expansion not only broadens the investment options for Costco members but also signifies the growing trend of retail investment in precious metals.

Moreover, Costco’s foray into precious metals is complemented by its robust online platform and in-store services, ensuring secure and convenient purchases. With this expansion, Costco aims to solidify its position in the precious metals market, among industry veterans like APMEX, JM Bullion, Bullion Exchanges and SD Bullion, offering an accessible path for its members to invest in physical gold, silver, platinum, and palladium.

Precious metals coins are government backed with a guarantee for their purity and weight. They are purposely minted as a long term store of value and wealth that have historically been an effective hedge against inflation and currency devaluation.