When you buy silver and gold bullion from online dealers the pricing displayed on their websites can be confusing. It can sometimes be hard to tell if you’re getting a good deal or not.

All bullion dealers, whether online or a local coins shop, price their bullion relative to the spot price of the precious metals. The price the dealer charges over spot price is called the dealer premium.

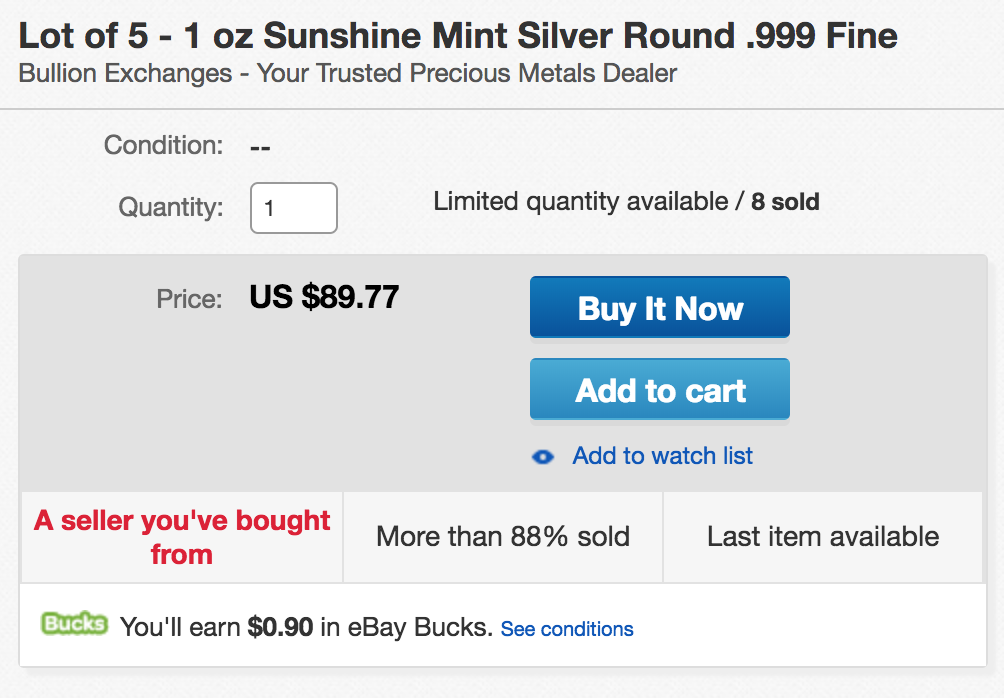

The only way to know whether or not you’re getting the best price when you buy precious metals online is to compare the dealer premiums over spot price.

Comparing dealer premiums for a particular item, whether it’s the latest American Silver Eagle coins, 10 oz silver bars, or Pre-1933 gold coins, can be a tedious and time consuming job. Looking for the same item across multiple dealer websites takes time.

FindBullionPrices.com provides tools to help simplify the process for buying silver and gold bullion from online dealers. We pull the latest prices from many trusted and reputable bullion dealer websites for over 300 unique products.

Each product listing is designed to make it easier to decide which dealer has the best deal when you buy bullion online. The product listings display the current spot price, including the melt value for each item. The current price the dealer is selling an item for is displayed, along with the calculated dealer premium over the melt value.

For each product we try to show as many dealers as possible that are selling a particular gold or silver coin. Dealer inventories can change quickly so we may not always show every dealer that is selling a particular item, though we try to do the best we can.

Shipping Charges and the Myth of Free Shipping

Many online bullion dealers offer free shipping when you place an order over a certain dollar amount. For a lot of bullion dealers, the free shipping threshold is that orders over $99 ship for free. The cost of the shipping is generally included in the dealer premiums.

Several online bullion dealers offer free shipping for all orders regardless of the dollar value of the order. These dealers typically have much higher premiums per item to cover the shipping costs.

Still, there are other dealers that are more transparent in their pricing and cost structure. They may not offer free shipping at all, or have a higher minimum order dollar value threshold for offer free shipping.

As silver and gold bullion are commodities, market conditions dictate the price trend which affects the price you pay. As with any business, each dealer has different levels of overhead, operating costs and desired profit margins.

Some online bullion dealers prefer high volume with lower margins while others may charge a heavy premium, especially when purchasing lower quantities or lower order values.

The top trusted and reputable online bullion dealers willing to compete on both service and price, who are interested in establishing long-term stacker customers that will continue to buy from them on an ongoing basis, are the dealers will to compete on price and provide the best customer service.

Payment Methods and Types

Our dealer listings section has a page that shows the payment methods accepted by dealer accepts and displays information regarding the shipping policies, minimum order value thresholds for free shipping and more.

Virtually all online bullion dealers accept credit cards, checks and wire transfers for payment. Dealers that accept credit cards and PayPal as payment methods typically incur a fee for each transaction. The fee that credit card companies and PayPal charges the dealer are typically 3% to 4% of the dollar value of the order. These fees are included in the cost.

Online bullion dealers often display on their product pages two or three different prices. Dealers will usually display the Cash Price and the Credit Card/PayPal price, and some dealers may display a third category that have begun accepting BitCoin and other cryptocurrencies for payment.

Paying the Cash Price for Silver & Gold Bullion

The lowest price is the Cash Price. The Cash Price when you buy gold or silver from an online dealer represents the equivalent to walking into the store and paying cash. This is obviously not possible when making an online transaction, so this price also often represents the price if you were to mail a check to the dealer, use an e-check option or perform a wire transfer.

Some credit card companies and payment processors have requirements that forbid merchants from charging a fee for accepting credit cards as a payment method. Online bullion dealers get around this by offering the items for sale at a Credit Card/PayPal price that is typically 3% to 4% higher than the Cash Price. While the Cash Price is often referred to as a discounted price for using Cash, Check, e-Check or wire transfer as a payment method.