With the rise of trading through social media and other online marketplaces, it’s important to note the prevalence of fake coins and bars on the market and testing can help protect you from scams. Testing can help ensure that the silver item you have is indeed made of genuine silver and not a counterfeit or an alloy.

Silver bullion is a popular investment choice for portfolio diversity, as a hedge against inflation and high interest rates or simply using it like a savings account or store of value.

As with other investments, verifying that you have genuine silver is a normal part of the due-diligence. Most of the methods described here can be performed at home with simple and inexpensive tools you may already own. They allow one to quickly and easily verify silver for purity and determine if any suspicious items in your stack are not genuine.

Ice Melt Test

The ice silver testing technique involves placing a piece of ice on the surface of the silver bullion. The ice should melt quickly and evenly across the surface. If the ice melts unevenly or leaves spots or blemishes on the surface, it may indicate that the bullion is not pure silver.

Pure silver has a high thermal conductivity, which means it can transfer heat quickly and evenly across its surface. When you place ice on refined silver, the heat from the silver rapidly melts the ice, creating a thin layer of water across the surface. If the silver is not pure, it may have a lower thermal conductivity, which can cause the ice to melt unevenly or leave spots on the surface.

While the ice test can be a helpful way to verify the authenticity of your silver bullion, it’s important to note that it is not entirely foolproof. Other metals have a high thermal conductivity and could pass the ice test even if they are not pure silver. Additionally, some counterfeiters have figured out ways to thicken the silver-plating on some fake bullion coins that can pass the ice test.

It’s a good recommendation to use multiple methods to test silver bullion beyond checking for hallmarks or engravings, such as accurately measuring its weight and dimensions or performing a magnet test.

In case of doubts about the authenticity of your bullion, another option is to befriend your local coin shop to have it examined by a professional before making any investment decisions.

Magnet Test

Verifying silver can be made much simpler with the use of neodymium magnets.

Neodymium magnets are among the most powerful permanent magnets, capable of producing a high magnetic field. When placed close to a piece of silver bullion, they can provide an effective means of verifying its authenticity.

Silver is non-ferrous, which means that it is not magnetic. If the silver is genuine, the magnet will not stick to it, but at angle will slide down the piece showing some slight resistance. However, if the magnet sticks to the bullion, it is likely to be counterfeit metal alloy or plated material.

This is because most metals used to fake silver bullion, such as copper, brass, or nickel, are magnetic and will therefore be attracted to the magnet.

Note that this method should be used with other forms of testing silver bullion, such as weight and visual inspection. However, using neodymium magnets can provide more confidence when investing in silver bullion.

A set of tiny, inexpensive neodymium magnets can be bought from Amazon for under $10.

Measuring with a Precision Scale

A high-quality precision scale for precious metals that is accurate to at least 0.01 grams and also measures in troy ounces is a very affordable accessory.

A scale allows you to weigh the bullion accurately and determine its weight in grams or troy ounces. Once you have an accurate weight, you can then compare it to the manufacturer’s stated weight to and note any variances. When measuring in fractions of a gram there is likely to be some variances in weight, even between silver rounds of the same manufacturer and design.

In addition to weighing the bullion, you can use a scale to help measure its density.

Water Displacement

Water displacement is a technique that measures the volume of an object submerged in water and the amount of water it displaces. This method can be used to verify the weight and density of silver bullion.

A container filled with water is needed to use water displacement in verifying silver. The container should be large enough to submerge the silver bullion completely. First, the weight of the silver bullion is measured using a scale. Next, the silver bullion is immersed in the water container, and the volume of water displaced is measured. The weight of the silver bullion is then divided by the volume of water displaced to determine the density of the silver bullion.

The density value can be compared to the known density of silver to verify its authenticity. This method is relatively inexpensive as it does not require any special equipment.

Silver has a density of 10.49 grams per cubic centimeter, meaning a piece of silver bullion should have a specific weight based on its size. By measuring the weight and volume of the bullion, you can calculate its density and compare it to the expected density for silver to ensure that it is authentic.

Measuring Coins with Calipers

Calipers can be an effective method for measuring coins to help verify the authenticity. A set of calipers, sometimes referred to as a micrometer, is precision measuring instrument that can accurately measure the dimensions of an object, allowing you to compare the measurements of your coin against known specifications.

When using calipers, the first thing to do is to measure all dimensions of the piece, including its length, width, and thickness.

By comparing the measurements to those published by the original manufacturing mint. Most online bullion dealer listings information related to the dimensions of each piece as provided from the manufacturer. It is easy to compare the measurements of your piece with those provided online.

These measurements can also be used to calculate the volume of the coin, which can be compared to the expected volume based on the weight and density of silver.

Additionally, when measuring the dimensions of the bullion, calipers can help identify signs of tampering or alteration. For instance, when the thickness of a bullion bar fluctuates along its length, this could indicate that some metal has been shaved off.

Unlike chemical testing or X-ray fluorescence (XRF) analysis, caliper measurements can be taken immediately without requiring specialized equipment or extensive preparation.

Silver Ping Test

Pure silver makes a distinctive sound when it impacts another object such as a solid countertop. The Ping Test analyzes the ringing sound that is produced when it is bounced off surface.

Various Apps are now for both IOS and Android mobile devices that analyze the frequencies that resonate against a known database of other coins.

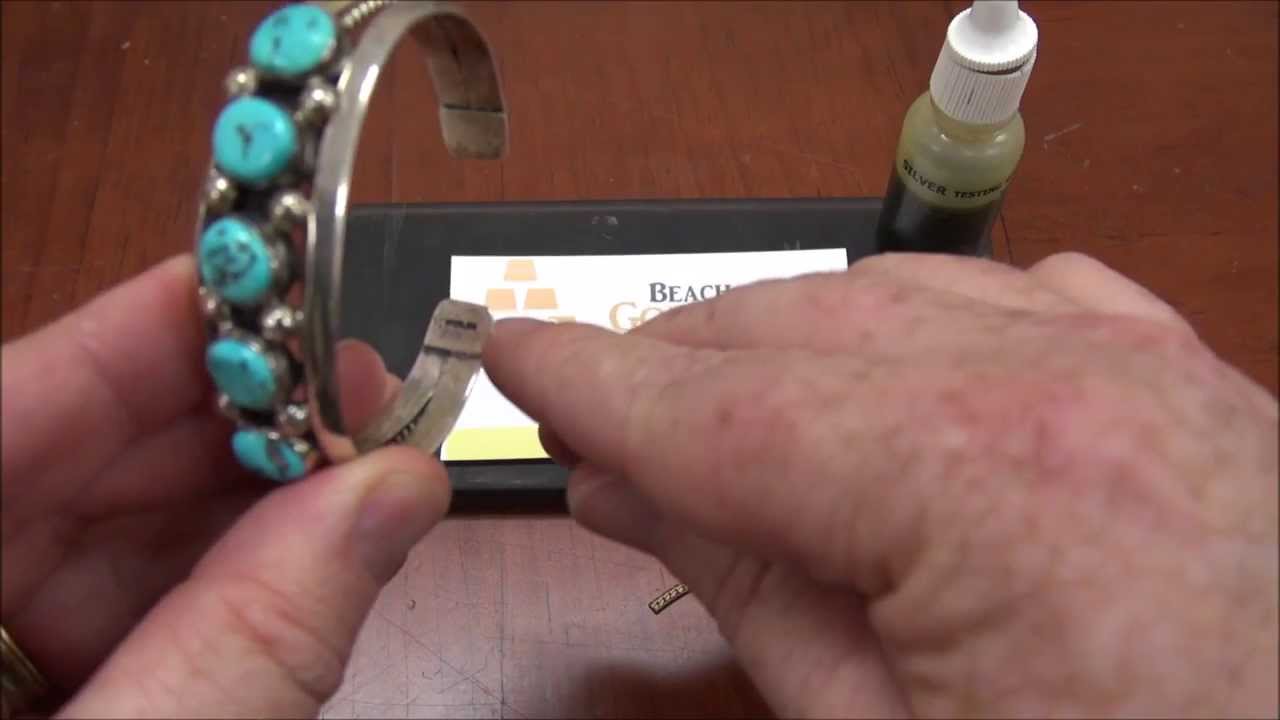

Acid Testing method

Acid testing is a common method used for testing silver purity. Acid testing involves using a simple solution to test the silver’s purity. The process is straightforward. A small sample of the silver is taken using a special jeweler’s stone. When the acid is applied to the sample it will react by changing color.

Additionally, 18k gold testing solution can also be used when testing silver with a different color reaction as described in the video below:

Simple and easy to use acid test kits are readily available from Amazon and other online marketplaces and are inexpensive and the most reliable way method of testing silver and gold bullion at home.

Acid testing is the most trusted way to verify the purity of silver bullion. It’s important to note that care should be taken with the testing process, particularly with items that may have potential value as numismatics, collectibles or antiques. Additionally, acid testing should only be complementary to other verification forms, such as weight and size measurements and confirmation of stamps and markings when available.

Final Thought

While several ways are used to test silver purity, many investors may need more than just third-party grading or testing services. Fortunately, the above are a variety of methods that you can use to verify the authenticity of your silver bullion at home.

If you still have concerns about a particularly piece, it may be best to visit a local coin shop or other precious metals dealer. You can ask them to test the piece in question on a Sigma Precious Metals Verifier.