Switzerland has long been a mecca for finance, banking and precious metals. Although all of the country’s native metal deposits were mined long ago, some of the most renowned and legendary refiners continue to operate there.

The World Gold Council estimates that to date, approximately 200,000 tons of gold has been extracted from the earth’s crust and miners are extracting roughly 2,600 tons of new gold each year.

Much of the newly mined gold ore is sent for processing at various private mints and refineries in Switzerland.

Valcambi-Suisse, Balerna, Ticino

Valcambi was founded in 1957. The company is headquarters is nestled along the Swiss-Italian border just 35 miles from Milan. The refinery processes more than 2,000 tons of precious metals each year and is owned by Global Gold Refineries Ltd.

Valcambi bars, ingots and rounds are produced from gold, silver, platinum and palladium. That are also a certified Good Delivery provider for the London Bullion Market (LMBA).

Valcambi manufacturers some of the most unique, practical and popular products for investors and stackers with their CombiBar series.

Valcambi CombiBars come in a variety of industry-standard weights. The thickness of each bar is similar to that of a credit card and they are uniquely minted with scored lines making them easy to break apart into smaller fractional bars if the need to sell, barter or trade arises.

The most popular weight variation is the 100 gram gold CombiBar, which is minted from 99.99% pure gold and often has the lowest dealer premiums when compared to others in the series.

Argor-Heraeus, Mendrisio, Ticino

Argor was in 1961 in Chiasso. In 1986, Argor merged with Heraeus and become the Argor-Heraeus we known today. Now headquartered in Hanau, Germany, the refinery in Mendrisio produces many different weights of gold, silver and platinum bullion bars for investors.

The Argor-Heraeus Gold KineBar is minted to incorporate a unique holographic image that adds an additional level of anti-counterfeiting protection to give investors further confidence in the authenticity of their gold stack.

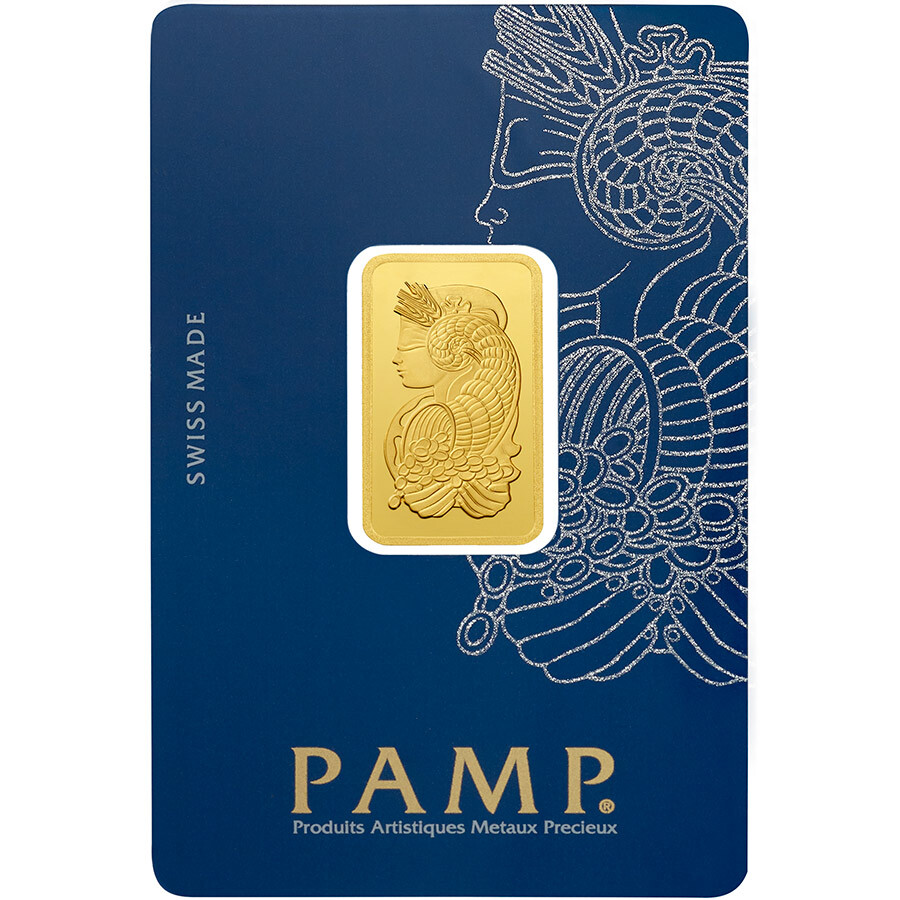

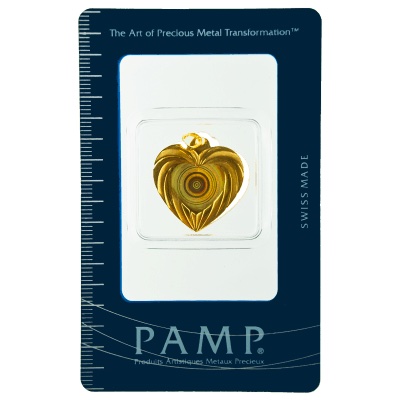

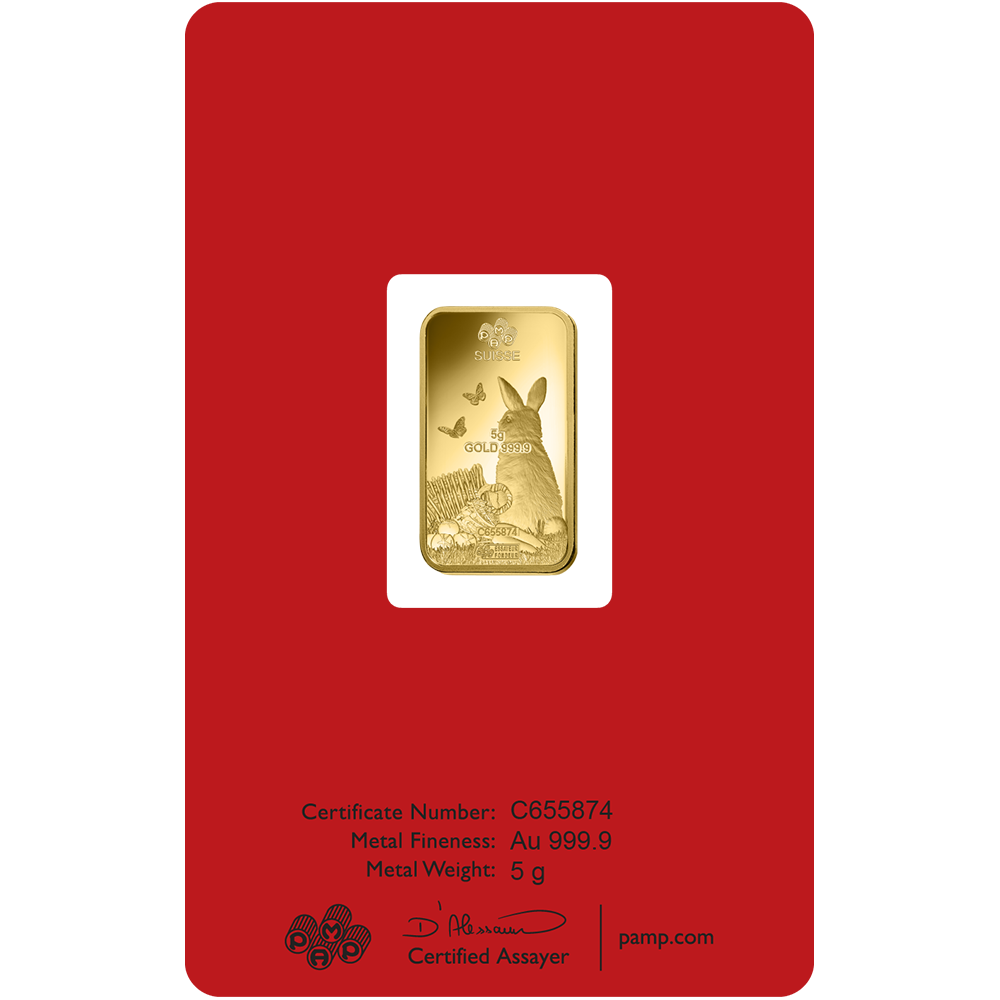

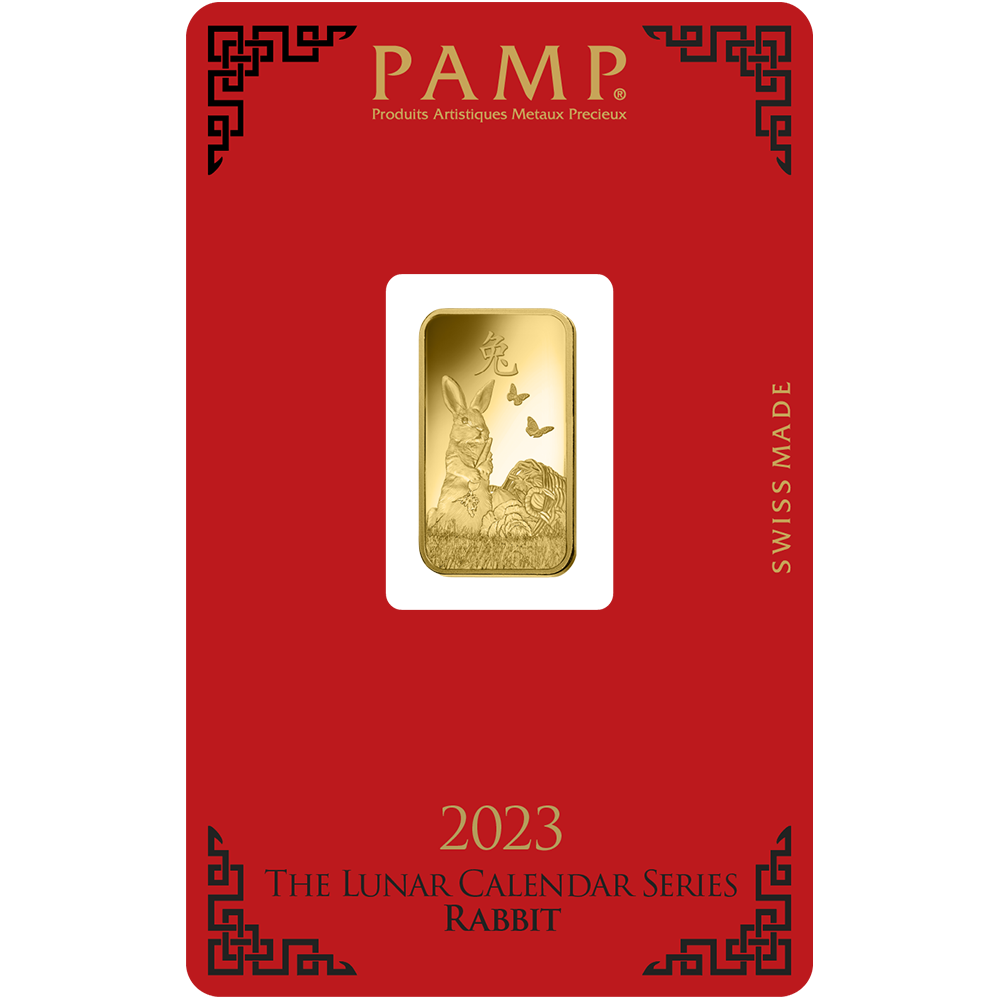

Produits Artistiques Métaux Précieux (PAMP), Castel San Pietro, Ticino

PAMP-Suisse is one of the most well-known Swiss-based refineries to many investors. The Lady Fortuna series features the ancient Roman and Greek goddess of luck and fortune in the obverse design which is instantly recognizable.

PAMP processes more than 450 tons of gold annually. In addition to supplying jewelry manufacturers with industry standard 400 troy ounce ingots, the company is a leading provider of investment bullion bars ranging in size from 1 kilogram to as small as 1 gram.

Metalor Technologies, Neuchâtel

Founded in 1852, Metalor is one of the oldest continuously operating refineries in the country. The company began supplying refined fine gold to watchmakers for the creation of Swiss watches.

The company was acquired by the Japanese based Tanaka Kikinzoku Group in 2016 and continues to refine silver and gold into a variety of bullion bars for investors.

Metalor kilogram silver bars and poured from .999 fine silver and can often be found with low premiums from various online bullion dealers.