The SD Bullion Silver at Spot Price Offer is for a single 10 oz silver bar at spot price.

10 oz Proclaim Liberty Silver Bar Features

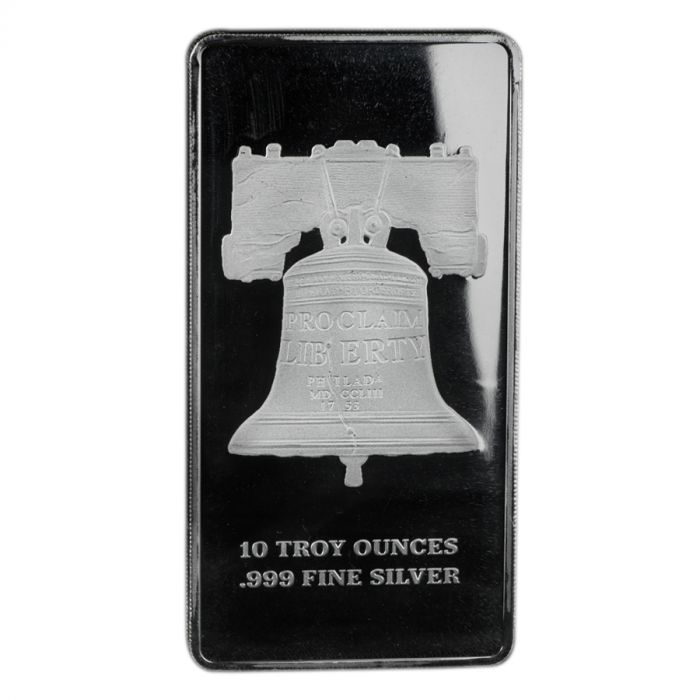

- Contains 10 troy ounces of .999 fine silver

- Features the iconic Liberty Bell on side one

- Boasts the Constitution of the United States on side two

- Minted by the world-renowned Republic Metals Corporation

- Ships in a protective, plastic sleeve

- Approved for Precious Metals IRA’s

Use the code SILVER23 after you add the Proclaim Liberty silver bar to your cart to update the pricing to silver at spot price.

Take advantage of this limited time opportunity to buy silver at spot price with no premium. Add to your silver stack at the best price possible, place your order today!

This is a limited time offer, and limited to one bar per household/shipping address/customer account.

See our Silver at Spot Price Deals page to see a comprehensive list of all of the available spot price offers from trusted and reputable online bullion dealers.