The Federal Reserve system is comprised of 12 Reserve Banks that were established following the outbreak of World War I in 1914.

Each of the twelve national reserve bank regions were chosen following a Congress sponsored selection committee called the Reserve Bank Organizational Committee.

After the districts were defined, each of the Federal Reserve Bank’s self organized amongst the regional banks, with local banks all contributing to the initial reserves from customer deposits.

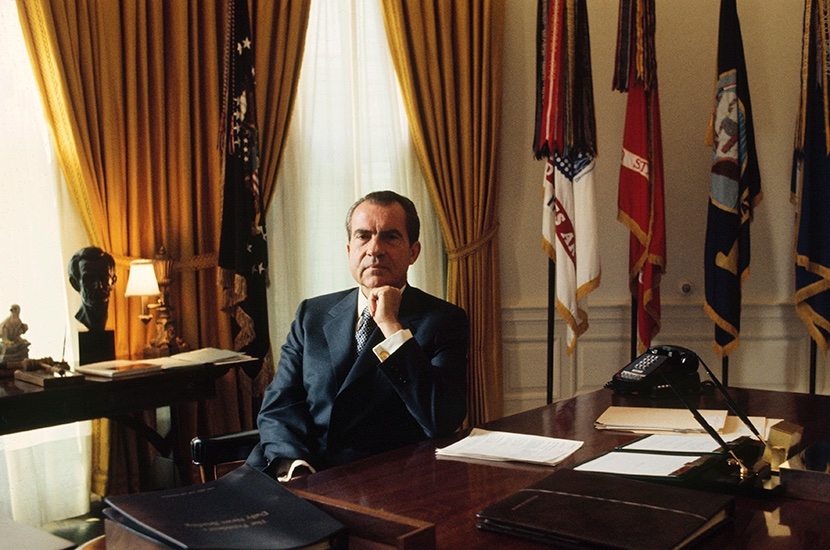

The Board of Governors, appointed by the President of the United States is responsible for supervision of reserve banks and regulating certain financial institutions and activities.

The first President of the New York Fed was Benjamin Strong Jr. who had been persuaded by JP Morgan to take the job.

The Federal Reserve Bank of New York is also the exclusive fiscal agent of the US Treasury and is responsible for managing government debt by raising money through auctions of marketable Treasury securities (bonds) and through authorized government buybacks. It is also the holder of the General Account for the Treasury, where the Federal Government receives all direct revenue and pays nearly all federal expenses.

It also handles exchange rate management, swapping dollars with foreign currencies under the Treasury’s direction.

The Bank of New York owns and operates a bullion depository vault that is built on bedrock some eighty feet below the streets of Manhattan. As of 2019, the bullion depository held roughly 5,100 metric tons of gold, the large majority being held as the custodian of the reserves of thirty-six central banks.

Current Board of Governors

- Jerome H. Powell, Chair – Powell was nominated by Donald Trump to serve as the chair of the Federal Reserve, replacing current Treasury Secretary Janet Yellen at the helm of the central bank.

- Michael S. Barr, Vice Chair for Supervision – Barr was nominated by Joe Biden and confirmed by the Senate in 2022.

- Michelle W. Bowman – In 2018, Bowman was nominated by Trump and approved by the Senate to serve a 14-year term on the Board of Governors, occupying the seat that represents community banks.

- Lisa D. Cook – Cook is a Biden nominee that began serving on the Board in May 2022.

- Philip N. Jefferson – Jefferson is a Biden nominee that began serving on the Board in May 2022.

- Christopher J. Waller – Waller was nominated by Trump and received the approval of Congress in 2019.