Gold Coins

Learn More About Gold Coins

Gold coins remain one of the most trusted and recognizable forms of wealth preservation. For centuries, governments and mints around the world have issued gold coins to serve as both circulating currency and as reliable stores of value.

Today, gold coins are popular among investors, stackers, and collectors alike. They offer:

- A hedge against inflation and economic instability.

- Liquidity, as they are easily tradable worldwide.

- Tangible value, with intrinsic bullion content and often historical or numismatic premiums.

Because premiums vary between dealers, it is wise to comparison shop before buying. FindBullionPrices.com helps investors find the lowest dealer premiums on both modern bullion issues and secondary market gold coins.

For a deeper look at the pros and cons of secondary market coins, read: Gold Coin Investing: Secondary Market vs Newly Minted.

Why Buy Gold Coins?

- Diversification – Gold coins are an effective way to balance a portfolio of stocks, bonds, and crypto.

- Variety – From modern bullion to pre-1933 U.S. gold, investors can choose coins that fit their budget and collecting interests.

- Potential Numismatic Premiums – Historical coins like Liberty Head Double Eagles or Mexican Centenarios may trade well above melt value.

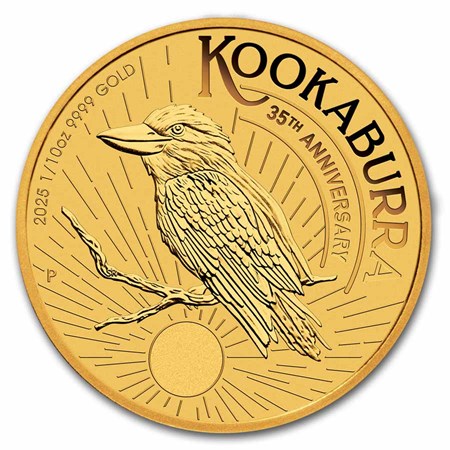

- Fractional Sizes – Lower denomination coins (1/10 oz, 1/4 oz, etc.) make gold ownership accessible.

Popular Gold Coins and Specifications

| Coin / Series | Country | Denominations | Purity | Gold Content (oz) | Common Mint Marks | Notes |

|---|---|---|---|---|---|---|

| American Gold Eagle | USA | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | .9167 Au | 0.1–1.0 | W (West Point) | Iconic Saint-Gaudens obverse, U.S. legal tender. |

| American Gold Buffalo | USA | 1 oz | .9999 Au | 1.0 | W (West Point) | First 24k U.S. Mint bullion coin. |

| Canadian Maple Leaf | Canada | 1 oz, fractional sizes | .9999 Au | Varies | RCM | Advanced security features, globally recognized. |

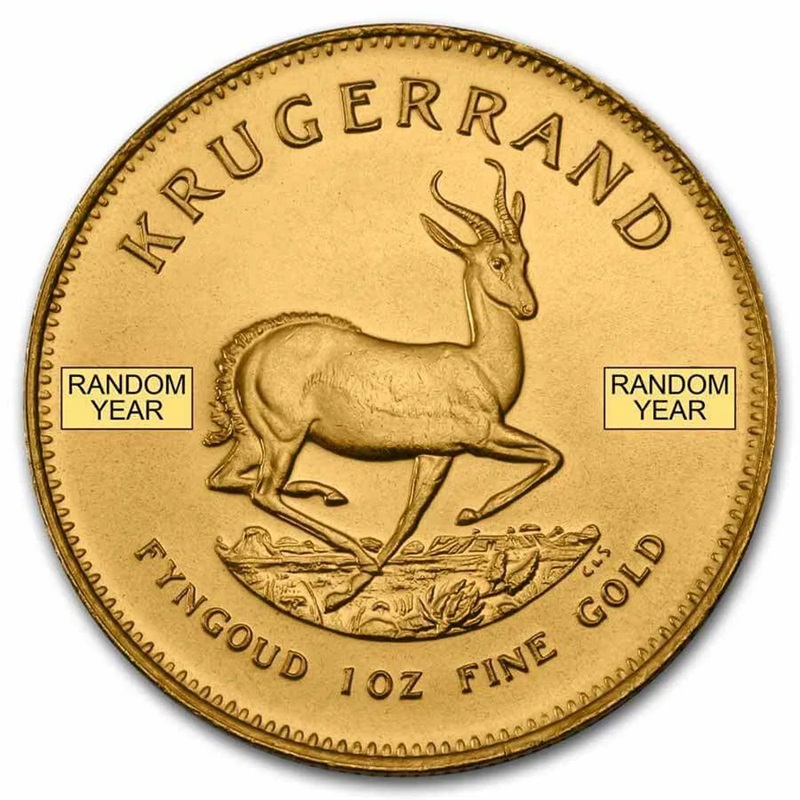

| South African Krugerrand | South Africa | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | .9167 Au | Varies | Rand Refinery | First modern bullion coin, introduced 1967. |

| British Gold Britannia | UK | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | .9999 Au (post-2013) | Varies | Royal Mint | Features Britannia; strong global demand. |

| Austrian Gold Philharmonic | Austria | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/25 oz | .9999 Au | Varies | Austrian Mint | Leading European bullion coin. |

| Mexican Libertad | Mexico | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz | .999 Au | Varies | Casa de Moneda | Limited mintages, high collector appeal. |

| British Gold Sovereign | UK | Sovereign (0.2354 oz) | .9167 Au | 0.2354 | Royal Mint, Colonial Mints | Historic LMU-standard coinage. |

| Pre-1933 U.S. Gold (Double Eagles, Eagles, Half Eagles, Quarter Eagles) | USA | $20, $10, $5, $2.50 | .900 Au | 0.1209–0.9675 | Various | Circulated under gold standard, widely collected. |

| LMU 20 Francs Gold Coins | France, Switzerland, Italy, Belgium, etc. | 20 Francs (0.1867 oz) | .900 Au | 0.1867 | Paris, Bern, Turin, Brussels | Circulated under Latin Monetary Union. |

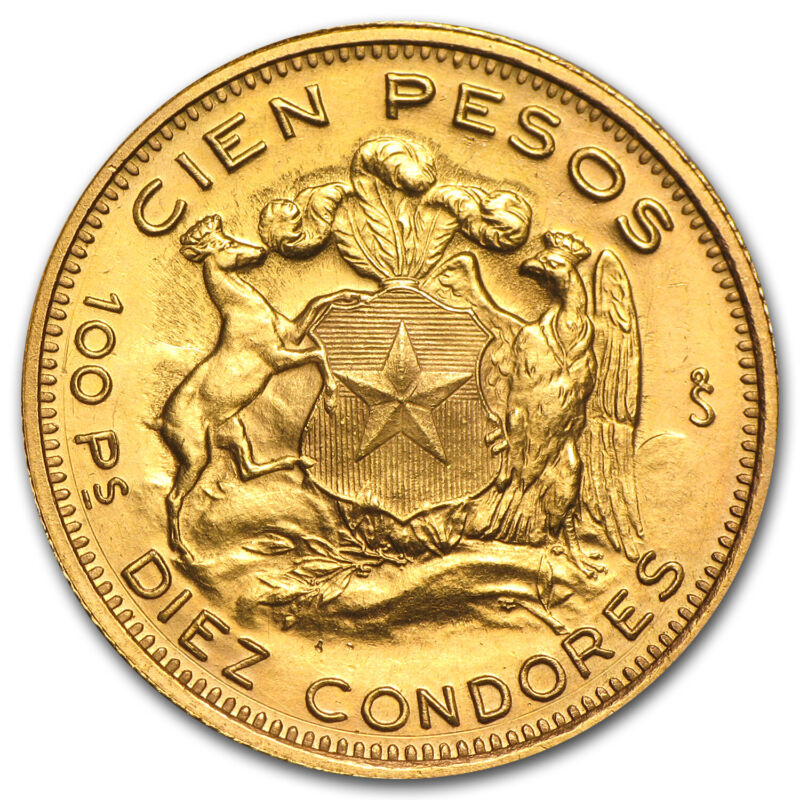

| Mexican 50 Pesos Centenario | Mexico | 50 Pesos (1.2057 oz) | .900 Au | 1.2057 | Mexico City | One of the largest bullion coins, popular with investors. |

Historical and Secondary Market Gold Coins

Beyond modern bullion, investors can access a broad spectrum of secondary market gold coins, which often carry lower premiums than newly minted coins.

- Pre-1933 U.S. Coins: Liberty Head & Saint-Gaudens Double Eagles, $10 Eagles, $5 Half Eagles, $2.50 Quarter Eagles.

- Latin Monetary Union Coins: 20 Francs Napoleon III, Swiss Helvetia, Italian & Belgian Francs.

- British Sovereigns: Minted across the globe, historically the world’s most traded coin.

- Mexican Pesos & Libertads: Attractive for low premiums and striking designs.

- Austrian Ducats, Coronas, and Kroner: Classic European trade coins.

Explore further:

- What Are the Best Gold Coins to Buy?

- Top 10 Vintage Gold Coins for Investors

- The Most Affordable Gold Coins for New Investors

FAQ About Gold Coins

Q: Are gold coins a good investment?

A: Yes. Gold coins combine intrinsic bullion value with global recognition, making them one of the most liquid and trusted assets.

Q: What’s the difference between bullion and numismatic gold coins?

A: Bullion coins (like Gold Eagles or Maples) are valued primarily on gold content. Numismatic coins (like Pre-1933 U.S. gold) can carry additional premiums based on rarity, demand, and condition.

Q: Are gold coins tax-free investments?

A: Tax treatment depends on jurisdiction. In the U.S., gold coins are subject to capital gains tax when sold. Some countries exempt legal tender bullion coins from VAT. Always check local regulations.

Q: How do I find the cheapest gold coins?

A: Use FindBullionPrices.com to compare premiums across multiple dealers. The lowest premium coins, such as secondary market Eagles, Krugerrands, and Maple Leafs, often represent the best value.

Q: How can I verify authenticity?

A: Buy from reputable dealers. Government-minted coins come with strict weight and purity guarantees, and modern issues often include anti-counterfeit features.