Secondary Market Gold Coins

Secondary Market Gold Coins Quick Facts

Secondary market gold coins offer a cost-effective and diverse way to invest in gold or build a collection.

Coins from the secondary market are those that have been previously owned and are being resold by a dealer, rather than being sold as newly minted or current year.

These coins may have been part of a collection, stored as an investment, or held for various other reasons before being reintroduced into the market.

Their availability, often at lower premiums, makes them an appealing choice for both new and experienced gold investors.

Secondary Market Gold Coins Prices

For investors looking to accumulate gold without paying high premiums, secondary market coins can be an attractive option.

These coins generally have different pricing dynamics compared to newly minted coins. The primary factors that influence these differences include premiums, condition, rarity, and the current market demand.

Secondary market gold coins generally come with lower premiums because they have already been through the initial retail process.

Since they are not newly minted, the costs associated with production and distribution are not factored into the resale price, often making them more affordable per ounce of gold.

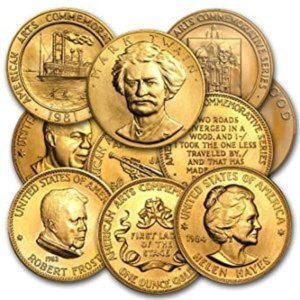

Variety of Previous Year Gold Coins

Some secondary market gold coins, particularly those that are no longer minted, can become collectibles and may command higher prices due to their rarity and historical value.

Investors will often find well-known gold coins from various countries, such as the American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, Austrian Gold Philharmonic, and British Gold Sovereign. These coins are recognized worldwide and are valued for both their gold content and national significance.

Secondary markets offer fractional gold coins, such as 1/2 oz, 1/4 oz, 1/10 oz, or even smaller denominations. Investors can also find full-1 oz coins and sometimes even larger denominations, such as 2 oz, 5 oz, or kilo coins, depending on their investment goals and budget.

Some listings may include proof coins or special commemorative editions issued by mints for significant national events, anniversaries, or other special occasions.

Condition

Secondary market gold coins can vary in condition, ranging from uncirculated or near-mint condition to coins that show signs of wear or handling. The condition of the coin often influences its resale value.

Random Year Gold Coins

When buying secondary market gold coins, the buyer may receive coins from random years and in varying conditions, depending on the dealer's inventory. This unpredictability can be appealing to some collectors who are looking to diversify their holdings or complete a collection.

Authenticity

Reputable dealers will verify the authenticity of secondary market gold coins before reselling them, providing assurance to the buyer that the coins are genuine and contain the stated amount of gold.

Where to find the cheapest Secondary Market Gold Coins

FindBullionPrices.com compares prices from trusted and reputable online precious metals dealers to help you find the lowest premiums when shopping for Secondary Market Gold Coins. The prices on our site are updated hourly and adjusted for gold spot price, providing a tool that helps investors compare gold prices.

We help find the cheapest Secondary Market Gold Coins when you're ready to buy.

You can find a large assortment of gold coins at FindBullionPrices.com. If we don't list prices for something you're looking for Contact Us and let us know so we can add it.

Compare Secondary Market Gold Coins prices

FindBullionPrices.com compares Secondary Market Gold Coins prices from top-rated and trusted bullion dealers. Our product listings compare the online prices to help you buy the cheapest Secondary Market Gold Coins.

.jpg)