Pre 1933 US Gold

Pre-1933 Gold Coins: Compare Prices & Premiums (Liberty, Indian & Saint-Gaudens)

Why this page matters: Pre-1933 U.S. gold coins—Liberty/Coronet Head, Indian Head, and Saint-Gaudens—combine bullion value with historic significance. Our aggregator monitors live offers from vetted U.S. dealers so you can quickly identify lowest premiums by denomination, grade (VF/XF/AU/BU/MS), or certification (PCGS/NGC). This page helps investors and collectors avoid overpaying while selecting the right coin for their goals.

How Pricing Works & Common Pitfalls

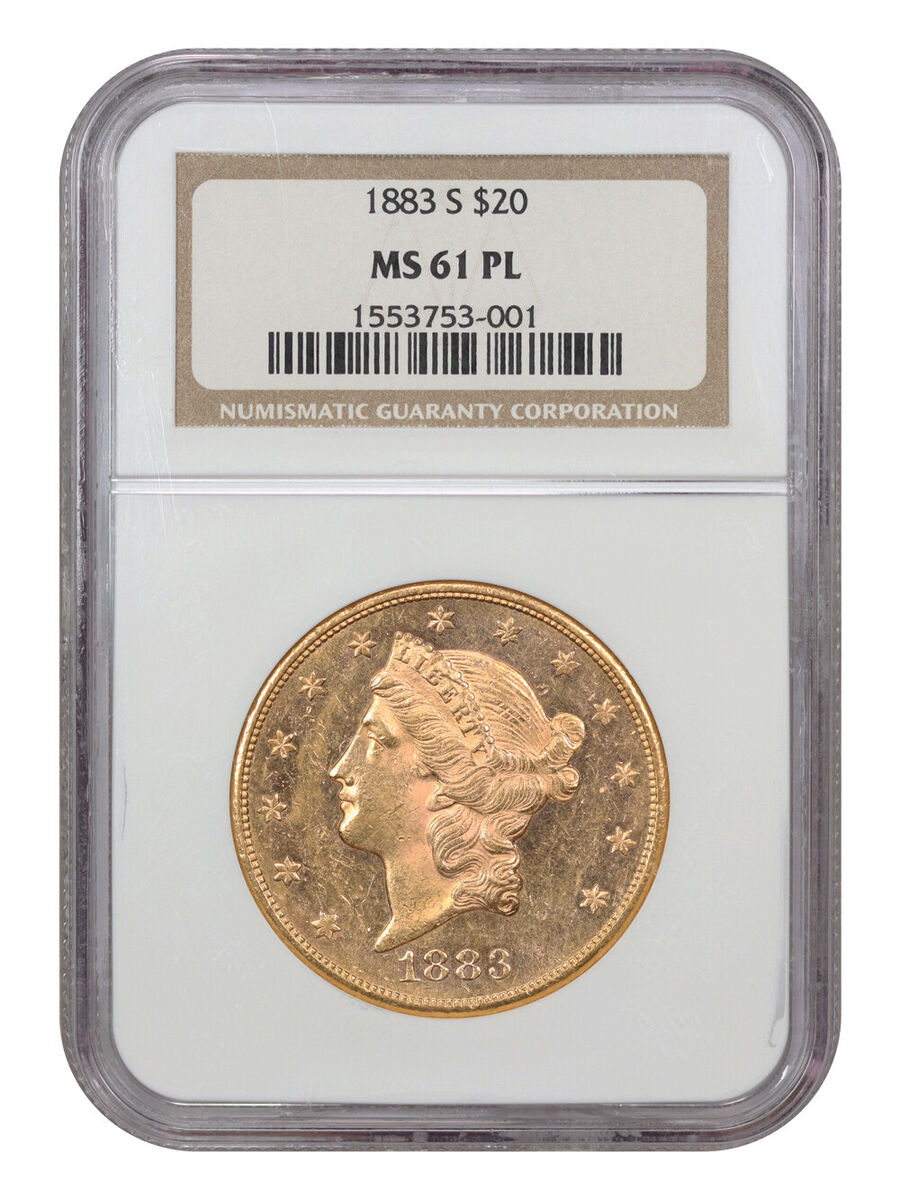

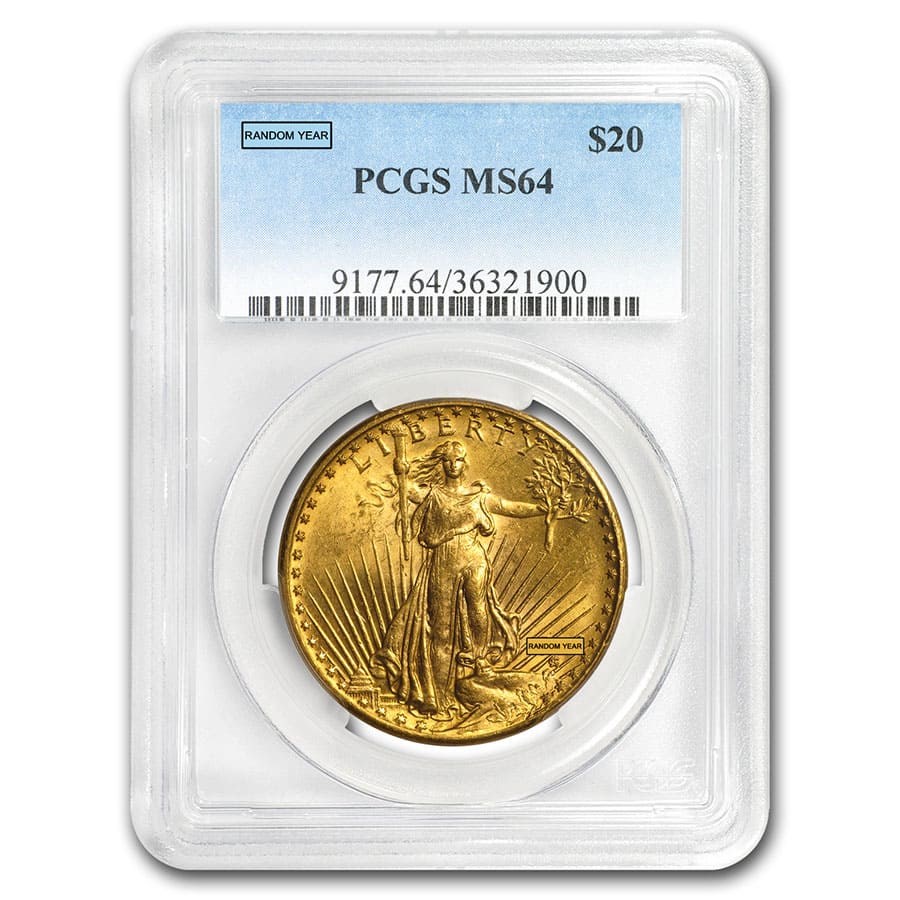

Pricing = Melt Value + Premium. Melt tracks the gold spot price × fine gold content (e.g., a $20 Double Eagle contains 0.9675 ozt of fine gold). Premiums reflect supply/demand, date/mint rarity, eye appeal, grade (raw vs PCGS/NGC), and market liquidity. Circulated common-date coins (VF/XF/AU) generally have the lowest premiums; certified MS coins (MS-60 to MS-65) carry higher premiums that can expand in strong collector markets.

- Avoid surprises: “Cleaned,” “ex-jewelry,” mount marks, or hairlines reduce resale value, even with identical gold content.

- Verify authenticity: Shop known dealers; prefer certified coins (PCGS/NGC) for higher grades or bigger spends.

- Know taxes/spreads: U.S. coins are “collectibles”; federal long-term gains rate can be up to 28%. Bid-ask spreads vary by grade/market.

- IRA note: Most Pre-1933 coins are not IRA-eligible (0.900 fineness); check with your custodian.

Pre-1933 U.S. Gold Coin Specifications

Key specs investors search for—denomination, fineness, fine gold content, and dimensions—across the most sought-after series.

$20 Double Eagle

| Series (Design) | Years | Fineness | Gross Wt (g) | Fine Gold (ozt) | Diameter | Notes |

|---|---|---|---|---|---|---|

| Liberty/Coronet Head | 1850–1907 | .900 (21.6k) | 33.436 | 0.9675 | ~34.0 mm | James B. Longacre design |

| Saint-Gaudens | 1907–1933 | .900 (21.6k) | 33.436 | 0.9675 | ~34.0 mm | Augustus Saint-Gaudens; high-relief debut in 1907 |

$10 Eagle

| Series (Design) | Years | Fineness | Gross Wt (g) | Fine Gold (ozt) | Diameter | Notes |

|---|---|---|---|---|---|---|

| Liberty/Coronet Head | 1838–1907 | .900 | 16.718 | 0.4838 | ~27.0 mm | Christian Gobrecht design |

| Indian Head | 1907–1933 | .900 | 16.718 | 0.4838 | ~27.0 mm | Liberty in a feathered headdress |

$5 Half Eagle

| Series (Design) | Years | Fineness | Gross Wt (g) | Fine Gold (ozt) | Diameter | Notes |

|---|---|---|---|---|---|---|

| Liberty/Coronet Head | 1839–1908 | .900 | 8.359 | 0.2419 | ~21.6 mm | Common “low-premium” pick |

| Indian Head (incuse) | 1908–1929 | .900 | 8.359 | 0.2419 | ~21.6 mm | Sunken/“incuse” devices |

$2.50 Quarter Eagle

| Series (Design) | Years | Fineness | Gross Wt (g) | Fine Gold (ozt) | Diameter | Notes |

|---|---|---|---|---|---|---|

| Liberty/Coronet Head | 1840–1907 | .900 | 4.18 | 0.1209 | ~18.0 mm | Popular fractional option |

| Indian Head (incuse) | 1908–1929 | .900 | 4.18 | 0.1209 | ~18.0 mm | Distinct incuse style |

$1 Gold (Type 1–3)

| Type | Years | Fineness | Gross Wt (g) | Fine Gold (ozt) | Diameter | Notes |

|---|---|---|---|---|---|---|

| Type 1 (Liberty Head) | 1849–1854 | .900 | 1.672 | 0.04837 | ~13.0 mm | Smallest U.S. gold coin |

| Type 2 (Indian Princess, small head) | 1854–1856 | .900 | 1.672 | 0.04837 | ~15.0 mm | Low-mintage subtype |

| Type 3 (Indian Princess, large head) | 1856–1889 | .900 | 1.672 | 0.04837 | ~14.0 mm | Most common subtype |

Specs above are standard references; minor tolerance/strike variance may occur. Coinage framework established by the Coinage Act of 1792; circulation minting ended in 1933.

Buying Tips to Lower Your Premium

- Start with circulated common-dates (VF/XF/AU) in $10 and $20—usually tighter spreads.

- Consider “ex-jewelry/cleaned” only when deeply discounted; know they sell back for less.

- Use our comparisons to watch the spread between raw AU/BU and PCGS/NGC MS-60 to MS-64—when certification premiums compress, graded can be attractive.

- Random-year listings often price best among equivalent grades.

Pre-1933 vs Modern Bullion: Which Fits Your Plan?

- Historic premium potential: Pre-1933 coins can track both gold price and collector demand.

- Liquidity: $20 and $10 coins are widely recognized in the U.S. market; $5 and $2.50 offer fractional flexibility.

- IRA eligibility: Typically not eligible due to .900 fineness (unlike modern bullion at 0.995+ and American Gold Eagles which are specifically approved).

Pre-1933 Gold Coins — FAQs

Are gold coins a good investment?

They can be. Pre-1933 coins offer dual drivers—bullion value and collector demand. Many buyers use common-date circulated coins for low premiums and liquidity, and selectively add certified MS coins for long-term potential. Always align purchases with risk tolerance, time horizon, storage, and taxes.

How can I tell if a coin is gold?

Check weight/diameter specs, look for proper edge/reeding, and use a scale/caliper. Tests include specific gravity and XRF (dealer-level). When condition/value is significant, purchase from reputable dealers and consider PCGS/NGC-certified coins.

Where can I buy gold coins?

Use our comparison pages to view real-time pricing from trusted online bullion dealers. Compare by grade, certification, and seller to find the lowest premium available right now.

How do I include gold coins in my IRA?

Most Pre-1933 U.S. gold (.900 fine) aren’t IRA-eligible. IRAs typically require 0.995+ fineness (with specific exceptions like American Gold Eagles). Consult your IRA custodian for approved products and storage requirements.

What do VF, XF, AU, BU, and MS mean?

They’re condition grades. VF/XF/AU are circulated; BU implies brilliant uncirculated; MS (Mint State) 60–70 is a numeric uncirculated scale (PCGS/NGC). Higher grade usually means higher premium.

Why do some listings say “cleaned” or “ex-jewelry”?

Those coins have been cleaned or used in mounts; they often look bright but lose numismatic value. Buy only with an appropriate discount and clear resale expectations.

How do I get the lowest premium today?

Target common-date circulated $10 and $20 coins, compare multiple dealers, and consider random-year options. Our pages surface the best current offers so you can act quickly.