World gold coins are one of the easiest and most affordable ways to buy gold coins. While modern fractional gold coin premiums can seem extremely high relative to their full troy-ounce counterparts, vintage gold coins offer a way for investors to save significant premiums in the long run.

It is important to consider the premiums you will pay over the gold spot price when considering an investment in gold coins. For many investors, it is more reasonable to purchase fractional gold coins more frequently rather than saving up to purchase larger gold coins.

Due to its popularity, the 1/10th oz American Gold Eagle coin is often the first choice. However, dealer premiums usually exceed 10-15%, sometimes even higher. Compare premiums with the 1 oz Gold Eagle, which you can often find with a much lower premium of 1% to 2% over the gold spot price.

Many world gold coins have been circulated as currency for hundreds of years since the days of the gold standard. Since gold doesn’t degrade and lasts thousands of years, a large assortment of vintage gold coins, which carry a lower premium than their modern counterparts, are available in the bullion market.

Fractional World Gold Coins

The Latin Monetary Union (LMU) was an early attempt at unifying Europe under a single currency standard in the mid 19th century. The most common gold coin of the time was the 20 Franc Gold Coin.

20 Francs Gold Coins

The 20 Francs Gold Coin is one of the most popular vintage gold coins you can buy at a low premium. Each is struck on a 21mm planchet and contains 6.45161 grams of .900 fine gold, which is .1867 troy ounces. The coin’s diameter is slightly smaller than a US Quarter dollar coin.

The 20 francs gold coin was designed to be a stable and reliable unit of currency that could facilitate trade and store value. Most of the 20 Francs Gold coins traded as bullion today were minted in France during the 19th century. They feature various designs that include portraits of multiple rulers of France during the era, including Napoleon I, Louis XVIII, Napoleon III, and French Third Republic gold coins like the “Lucky Angel” and the Gallic Rooster.

Its circulation was not limited to France, eventually becoming the standard coin across Latin Europe, playing a crucial role in international trade. After the Latin Monetary Union (LMU) was established in 1865, 20 Francs gold coins were minted and circulated in several countries throughout Europe and other parts of the world. Other common variations include the Helvetia or Vreneli 20 Francs from Switzerland, 20 Lire Gold Coins from Italy, Belgian 20 Francs, and many others.

It is difficult to measure the number of gold coins minted by LMU member countries due to the extensive period of production and the number of countries that adopted the standard. However, millions of these coins were produced over the decades to meet the needs of trade, investment, and currency stability in Europe.

As the value of paper fiat currencies continues to drop, gold coins can help protect wealth against inflation. The relatively small size of the 20 Francs gold coin makes it easy to store, transport, and trade. They are generally highly liquid assets, meaning they can be easily converted into cash when needed.

10 Francs Coins

The 10 Francs Gold Coin contains half the amount of gold as the 20 Franc, 3.2258 grams of .900 fine gold. The 10 Francs Gold Coin contains .0933 troy ounces of gold, slightly less than 1/10th troy ounce.

When looking for vintage counterparts to modern American gold bullion, the 10 Francs Gold coin is comparable to the 1/10th oz American Gold Eagle. The 10 Francs Gold Coins premiums are typically around 12% over the melt value, while modern fractional gold bullion coins can be significantly higher.

Austrian Fractional Gold Coins

The Gold Ducat originated in the Republic of Venice in the 13th Century. From the medieval period onward, ducats were widely used across Europe as trade coins.

1 Ducat Coins

The Gold Ducat was used as a trade coin in various parts of Europe from the late Middle Ages into the early 20th Century. It was minted using .986 fine gold, which is exceptionally high for a circulating gold coin.

Popular versions of the Gold Ducat were produced in Austria, Hungary, and the Netherlands. Each 1 Ducat Gold Coin contains .1106 troy ounce of gold, slightly more than 1/10th oz.

Premiums on 1 Ducat Gold Coin can be as low as around 5% over their melt value. Their high gold purity and low premium make them one of the most affordable fractional gold coins for investors.

4 Ducat Gold Coin

Based on the Ducat Gold Standard, the 4 Ducat Gold Coins contain four times the amount of gold as the 1 Ducat. Like the 1 Ducat, the 4 Ducat Gold coin is also minted from .985 fine gold and contains 0.4430 troy ounces.

Austria 100 Corona

The Gold 100 Corona was first minted in Austria-Hungary in the 19th century. The Austria Corona was primarily used as a trade and circulation coin. It was intended to facilitate large transactions and store value in a stable and internationally recognized form. The coin played a significant role in Austria-Hungary’s economic system, serving both domestic and international trade needs.

Various denominations of Corona Gold Coins were issued throughout the long period of production until the dissolution of Austria-Hungary in 1918 following the outbreak of World War I. These coins were produced in large quantities to support the empire’s economic and financial needs.

Great Britain Gold Sovereign

Great Britain has a history of minting many beautiful gold coins. One of England’s most popular British Gold Coins is the Gold Sovereign. The Royal Mint began minting the Gold Sovereign in 1817. Each gold sovereign coin contains .2354 troy ounces of gold. The Gold Sovereign is one of the most popular vintage gold bullion coins for investors and stackers.

Since the series’s inception, millions of Gold Sovereign coins have been minted, including from various overseas mints during the Colonial period. You can often buy Gold Sovereigns for as low as 3% to 4% over the melt value.

With dozens of unique variations, mint marks, and other details, sovereign gold coins have a well-established numismatic history and a variety of interesting design variations, making them widely recognized worldwide. The British sovereign gold coin has a rich history as a medium of international trade, a store of wealth, and a symbol of stability and reliability.

British Half Sovereign

Other variations of the Sovereign standard include the half-sovereign. The half-sovereign gold coin contains half the amount of gold (.1177 ozt) as the full sovereign, representing half the value.

The British began the Great Recoinage in 1816, which aimed to restore confidence in the country’s currency and standardize coinage. The minting of the half-sovereign started in 1817.

Some years, only a minimal half sovereign coins produced. In others, these coins were mass produced.

Its extensive minting history and wide availability have cemented the British Gold Sovereign’s status as a key piece in the world of numismatics and precious metals.

As an investment, Sovereign gold coins are naturally fractional and are a popular choice among gold buyers looking for one of the lowest premium investment coins in the market.

Today, the British sovereign gold coin is primarily considered a bullion coin for investors and collectors, valued for its historical significance, artistic design, and gold content. While it is no longer in general circulation, the sovereign symbolizes Britain’s rich numismatic heritage.

World Gold Coins from Mexico

Due to their gold content and familiarity, Mexican gold pesos appeal to investors and stackers. Collectors adore both the designs and their connection to Mexico’s rich numismatic history.

Mexican Gold Pesos coins are some of the world’s most beautiful vintage gold coins.

All Gold Pesos were minted at the Mexican Mint, la Casa de Moneda in Mexico City, in a standard .900 gold alloy with 10% copper, which makes coins hard enough to withstand the wear of circulation.

Six different denominations of the Gold Pesos were minted to commemorate the centennial of Mexico’s hard-won independence from Spanish colonial rule.

2 Peso Gold Coin

The 2 Pesos Gold coin (dos Pesos) is the smallest denomination of the gold peso. Each Dos Pesos contain .0482 troy ounces or roughly 1.50 grams of gold and are worth $249.14 in melt value.

The 2 Peso Gold Coin features the Mexican Coat of Arms on the obverse, which shows an eagle facing forward while perched on a cactus in a lake with a snake in its beak. The reverse shows the face value of “Dos Pesos”, the year of minting and a laurel design.

The dos pesos coin is a popular choice with collectors and investors as an introduction to gold coins because of the affordable price point.

2.5 Pesos Gold Coin

The Mexican 2.5 Pesos Gold Coins were produced from 1918 to 1948. Most of the coins on the market that are sold as 1945 2.5 Pesos Gold Coins are restrikes that were produced between 1951 and 1972 and again in 1996.

The obverse features a portrait of Miguel Hidalgo y Costilla, a key figure in Mexico’s fight for independence from Spain. The reverse showcases the Coat of Arms.

Each 2.5 Pesos Gold Coin contains .0603 troy ounces, roughly 2.0833 grams of gold bullion and are worth $311.69 in melt value.

5 Pesos Gold Coin

The Mexican 5 Peso Gold Coin contains .1205 troy ounces, roughly 3.75 grams of gold bullion. Each 5 pesos contains slightly more than 1/10 oz of gold and is worth $622.86 in melt value.

The design of the coin is the same as the dos y medio and the diez pesos gold coins, with Miguel Hidalgo y Costilla on the obverse and the Coat of Arms on the reverse.

The premiums on 5 Peso Gold Coins are often much lower than similar weight coins. Having a lower premium makes them an attractive investment for bullion investors.

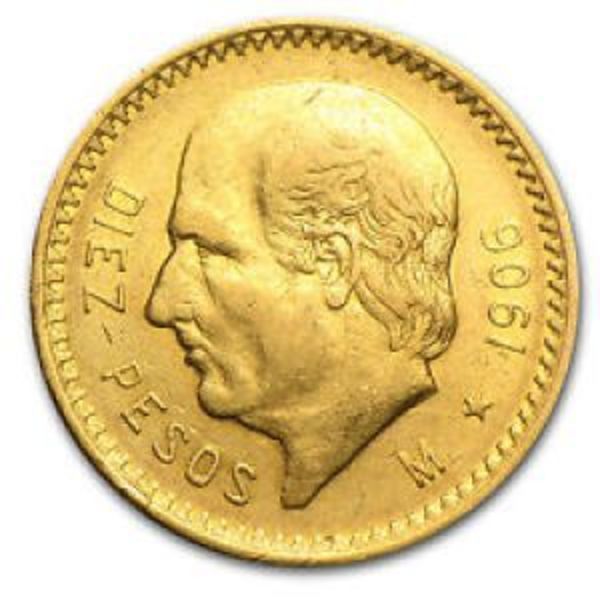

10 Pesos Gold Coin

The Mexican 10 Pesos Gold Coin contains .2411 troy ounces, roughly 7.49 grams of gold.

The premiums on the Gold 10 pesos Coin are lower than similar weight coins, with an approximate gold weight that is slightly lighter than 1/4 oz gold.

For investors that buy 1/4 oz gold coins on a regular basis, the savings on premiums can add up to a significant amount.

20 Pesos Gold Coin

The Mexican 20 Pesos Gold Coin contain .4823 troy ounces, 15 grams of gold. First minted in 1917 and continued until 1959 and was part of the country’s efforts to establish a gold standard for its currency.

Many investors consider the design of the Gold Mexican 20 Pesos, or “Veinte Pesos”, to be one of the most beautiful fractional gold coins available.

The reverse show cases a more modern version of the Coat of Arms, which depicts an eagle perched on a cactus in a lake with a snake in its beak. The obverse features the Aztec Calendar, also known as the Sun Stone, which pays homage to Mexico’s pre-Columbian heritage.

The coin’s aesthetic appeal makes it a favorite among collectors and investors. Annual mintages varied year to year, with some having significantly higher mintages than others.

As a fractional gold coin, 20 Pesos are an affordable way to enter into the gold market. Each coin contains slightly less than 1/2 oz gold, making it good alternative to modern bullion coins.

50 Pesos Centenario Gold Coin

The 50 Pesos Gold Coin was minted by the Banco de Mexico between 1921 and 1947. It is also commonly referred to as the Centenario Gold Peso and contains approximately 1.2 troy ounces of pure gold, making it a substantial piece for both investors and collectors. It was first minted in 1921 to commemorate the 100th anniversary of Mexico’s independence from Spain.

The obverse features the image of Winged Victory, also known as El Angel, a symbol of Mexican Independence. Behind the statue in the background are the countries famous volcanoes, Popocatepetl and Iztaccihuatl. The modern Libertad features a contemporary rendition of Winged Victory. The reverse features the Mexican Coat of Arms.

It was the first gold bullion coin minted in large quantities, predating the South African Krugerrand by almost a half century. During the period of gold ownership prohibition from 1933 until 1974, collecting Centenario gold coins was a popular way to invest in gold, due to the numismatic clause in the restrictions.