The US Mint is one of the most significant coin producers and one of the world’s oldest continually operating minting operations. In recent years, a variety of production problems related to the production of bullion coins have struck the Mint, leading to tremendous volatility with Silver Eagle premiums.

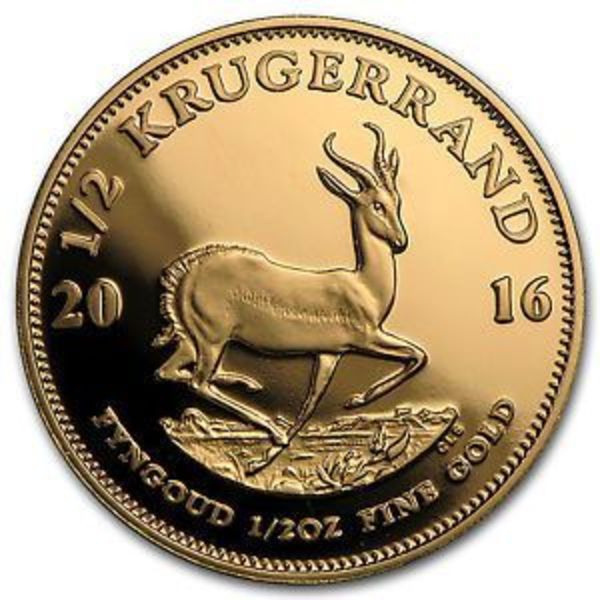

Some investors continue buying Silver Eagles despite the higher premiums, hoping that their dollar-cost average and rising commodity prices will offset the cost increases. Other investors are buying alternative bullion coins from other government mints.

Silver Eagle Premiums and Production Costs

The US Mint purchases raw materials for coins either in large rolls of metal strips or as ready-to-strike planchets from a select few approved suppliers, such as Sunshine Minting, Coins’N’Things, and other precious metals producers.

Before minting, the blanks are sent through a furnace to soften the material, referred to as annealing. The blanks are then rinsed and cleaned before the upsetting step raises the edges or rim of the blank to turn it into a planchet, which is then ready to be struck into a coin.

Each step in the production process costs the Mint resources, such as wages, electricity, water, tools, dies, and other materials. The law requires the Mint to charge Silver Eagle premiums which covers the cost of each coin’s production to prevent the program from operating at a loss.

The premium that the Mint charges at a wholesale level to the Authorized Purchasers includes the production costs, which also reflects the packaging, and distribution of each coin.

The West Point Mint is the only facility that produces Silver Eagle coins, which now feature the W mint mark.

Results from a recent third-party audit have shown that the Mint’s production techniques remain some of the most efficient because of regular and ongoing continuous improvements for the last 75 years.

Although newer processes exist for manufacturing large volumes of small parts (such as injection molding), the Mint’s ability to produce the quantity and quality of metal stampings is far more economically cost-effective.

Authorized Purchasers

Just ten companies in the US that meet the very stringent criteria can buy wholesale Silver Eagle coins directly from the Mint. The criteria and process of becoming a U.S. Mint Authorized Purchaser are arduous and require significant financial capital.

Some of the Authorized Purchasers are companies familiar to precious metals investors, including wholesalers and one primary online bullion dealer. Others include financial and banking institutions that provide an array of investment solutions.

| Company | Headquarters | Authorized Metals |

|---|---|---|

| A-Mark Precious Metals Inc (AMRK) | El Segundo, CA | Silver, Gold, Platinum & Palladium |

| American Precious Metals Exchange (APMEX) | Oklahoma City, Oklahoma | Silver, Gold Platinum & Palladium |

| Coins & Things, Inc. (CNT) | Bridgewater, Mass. | Silver, Gold Platinum & Palladium |

| Dillon Gage Inc. of Dallas | Addison, Texas | Silver, Gold Platinum & Palladium |

| Fidelitrade, Inc. | Wilmington, Delaware | Silver, Gold Platinum & Palladium |

| Jack Hunt Coin Broker, Inc. | Kenmore, New York | Silver, Gold Platinum & Palladium |

| Manfra, Tordella, & Brookes, Inc. (MTB) | New York, New York | Silver, Gold Platinum & Palladium |

| ScotiaMocatta (Scotia Bank) | New York, New York | Silver, Gold Platinum & Palladium |

| StoneX Bullion | Santa Monica, California | Silver, Gold Platinum & Palladium |

| The Gold Center | Springfield, Illinois | Silver only |

Monthly Silver Eagle Sales Volume

The US Mint provides monthly reports showing the sales of bullion coins. These sales reports are effectively mintage reports since the Mint only manufactures coins based on orders from Authorized Purchasers.

The most significant mintage year for 1 oz Silver Eagle coins was 2015. In that year, the Mint produced more than 47 million coins at the West Point Mint, indicating a production capacity of nearly 4 million coins monthly.

Mintage reports from the first few months of 2023 indicate that the Mint was producing only 900,000 coins per month, the equivalent to just 1,800 monster boxes. This is drastically lower than regular demand and limits the supply of coins and drives up premiums.

During the 2020 mintage year, the West Point Mint shut down operations due to pandemic lockdowns. During this time production was temporarily moved to the Philadelphia Mint. Following the reopening of the West Point Mint, the mint released reports indicating difficulty sourcing suitable blank planchets from suppliers leading to the cancellation of the 2022 Morgan Silver Dollar and Peace Silver Dollar commemorative issues.

Some of the planchets suppliers are owned by Authorized Purchasers, creating a closed-looped for the production and distribution of silver bullion coins, with the US Mint providing manufacturing services at a fixed cost.

Less than a dozen companies control the wholesale market; several are also primary raw materials and blank planchets suppliers.

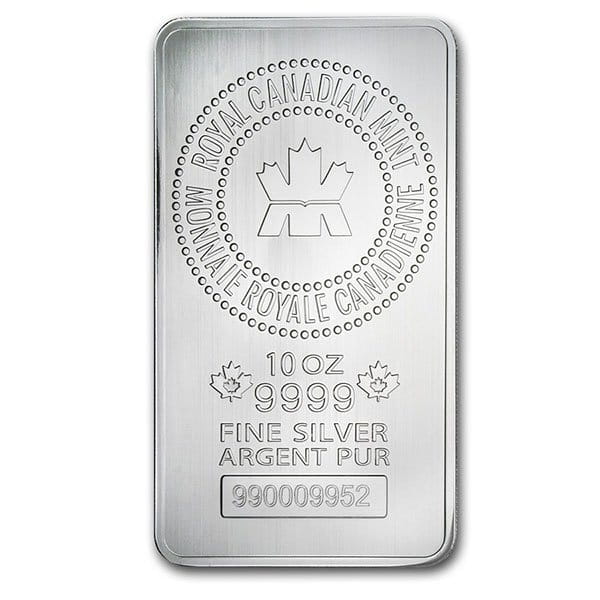

Across the market, it is apparent that premiums on 1 oz silver coins from other sovereign mints have remained lower than Eagles.