For over 40 years, from 1933 until 1974, the US government made it illegal for citizens to own gold.

Thanks to President Gerald Ford, it has been legal for everyone to own gold, silver, and other precious metals since 1974.

20th Century Gold and Silver Coins

In the early 20th century, paper currency was far less common than it is today. Paper bills were often only available in large denominations and commercial and interbank transactions. Much of the currency in circulation was coinage minted of silver and gold alloys.

Economies were still based on the gold standard. The coins in circulation were minted 21k gold, a mixture of 90% gold and 10% copper for strength and wear resistance during everyday circulation.

Gold coins during this era included denominations like the $2.50 (quarter eagle), $5.00 (half eagle), $10 (eagle) and $20 (double eagle).

The roaring 20s led to the Great Depression. Wall Street Banks, along with regional banks under the purview of the young Federal Reserve system, were happy to give out margin loans and unsecured credit in fiat currency.

During the economic hardship, many people lost faith in the banking system. Instead of depositing cash into banks, many people turned to hoarding gold and silver coins at home.

Prohibition of Precious Metals Ownership

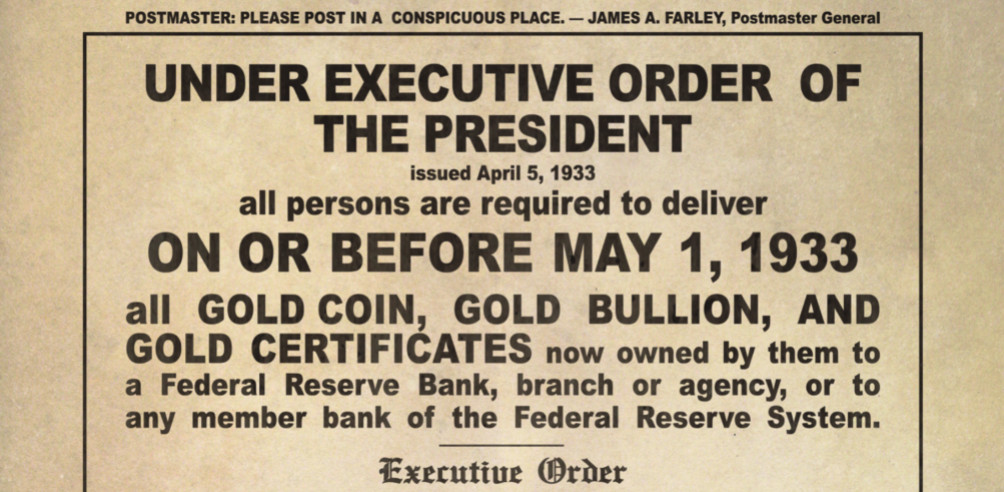

On April 5, 1933, after enduring several years of the Great Depression, President Franklin Roosevelt signed Executive Order 6102.

With the swipe of his pen, Roosevelt made it a crime for any US citizen to own gold coins, bullion, or even gold certificates. In exchange, the government offered citizens $20.67 in fiat for each ounce of surrendered gold.

All gold was ordered to be surrendered to the government. Within the first thirty days, the Treasury collected roughly one-third of the $1,400,000,000 in circulation gold.

Any person who failed to comply with the presidential order faced imprisonment and fines of up to $10,000. Many private citizens and investors were put on a list, targeted, arrested, prosecuted, fined, imprisoned, and had their gold seized.

The order did exempt some items, such as jewelry, numismatic collectibles, items used by industry, some professions, and artists.

Prosecutions For Owning Gold

Any person who failed to comply with the presidential order faced imprisonment and fines of up to $10,000. Many private citizens and investors were put on a list, targeted, arrested, prosecuted, fined, imprisoned, and had their gold seized.

In defiance of the order, people drilled holes or attached hasps to the coins to convert coins into pendants to hang on a chain to meet the minimum standard of jewelry.

The seizures, arrests, and prosecutions of those who did not surrender their gold continued for most of 1933. Roosevelt signed additional Executive Orders throughout the year, including one that authorized the Justice Department spy on citizens suspected to be ‘gold hoarders,’ effectively acting as a government-backed Gestapo.

During the summer of 1933, agents from the Justice Department visited the homes of “known hoarders of gold” to confiscate more than $38,901,009 worth of gold.

The Emergency Banking Act of 1933 was supposed to help restore faith in the banking system and the economy after the Federal Reserve led the country into the Great Depression.

The prohibition on private ownership of gold continued for 41 years.

Nixon Shock

In the early 1970s, Nixon faced rising unemployment, high inflation, the looming oil crisis, and political foes. In August 1971, the President called together top economic advisors for a secret meeting at Camp David.

The meeting included Federal Reserve Chairman Arthur Burns and Treasury Secretary John Connally. Also present was the then Undersecretary for International Monetary Affairs and future Federal Reserve Chairman Paul Volcker.

Following this meeting, Richard Nixon authorized then-Treasury Secretary John Connally to break the Bretton Woods Agreement, which had defined the rules of international trade among many countries following World War II.

Without consulting any international leaders, the actions included immediately suspending the “gold standard.”

Nixon directed the Treasury Secretary to abolish the convertibility of dollars into gold through the London Gold Pool. This also removed the fixed price of gold from $35 an ounce to a market-based system.

By 1973, the US gold standard established by Bretton Woods had been replaced by a new system based on the free-floating exchange of fiat currencies.

Following Nixon’s resignation, President Ford signed one of the first laws, a bill that reversed Roosevelt’s Executive Orders.

The bill authorized the expansion of the World Bank and included provisions that legalized citizens’ full authority to purchase, hold, sell, or otherwise deal with gold in the United States or abroad. It has been legal for anyone to own, hoard, buy, and sell gold in the United States since December 1, 1974.

The gold bull run that followed culminated in a price peak of $850 per ounce in January 1980.

Government Gold Bullion Coin Market

The Gold Krugerrand was the first gold bullion coin sold to investors when it debuted in 1967.

At the time, apartheid sanctions against South Africa made it difficult to invest in Gold Krugerrands. The top gold coins of the day included the Gold 100 Corona from Austria and the Mexican 50 Pesos Gold Coin. These vintage gold coins have maintained their popularity with investors.

In 1979, the Royal Canadian Mint introduced the first mintage of the Maple Leaf 1 oz Gold Coin.

The Canadian Maple Leaf 1 oz Gold Coin’s basic design has remained unchanged since its creation.

U.S. Mint Gold Medallions

The US Mint made several failed attempts during the early 1980s to woo precious metals investors. One notable attempt is the American Arts Commemorative Series Medallions.

Ten medallions are part of the American Arts Commemorative Series minted from 1980 through 1984.

The larger medallions are minted with one troy ounce of pure gold, while the smaller medallions contain 1/2 troy ounce of pure gold. At the time of release, the medallions were poorly received by collectors, the public, and investors.

These medallions were struck from an alloy containing .900 fine gold. Today, these medallions are popular with gold stackers and investors and are often on sale in the secondary market, very close to the spot price.

U.S. Mint Gold Coins

While the gold medallions were a commercial failure, it paved the way for Congress to create and establish the guidelines for the American Eagle series of coins from the US Mint.

The American Eagle series premiered in 1986. It continues to be one of the world’s most popular precious metal investment vehicles.

Gold Demand

It has been more than 52 years since the Nixon Shock removed the United States from the gold standard.

Private ownership of gold, silver, and other precious metals remains legal throughout the United States today.

Demand from investors continues to grow as more people continue to lose faith in the banking system, traditional investments like stocks and bonds, and the federal government’s ability to manage and regulate effectively, given the massive amount of corruption plaguing Washington.

As of 2023, more than 47 million ounces of gold had been used to mint four denominations of American Gold Eagle coins. Investor demand for American Gold Eagle coins remains strong after 37 years.