Confidence in the stock market continues to wane amid concerns over escalating issues involving Ukraine and inflation taking hold in the US economy. Oil and other commodity prices have risen sharply this week.

Many people struggle to save money under normal circumstances. The pandemic has brought a tremendous amount of economic uncertainty for many people. According to a recent report from Bloomberg, more than 30% of American’s earning $50,000 or less have lost almost their entire life savings due to the As the economy continues to recover, more and more people are looking for alternative ways to save money and store value. Precious metals is one of the best ways to save money.

Financial experts recommend that everyone have enough money set aside in liquid savings to cover six to twelve months of expenses in the event of a sudden job loss. The most popular selling products among silver stackers in recent months has been 10 oz silver bars. Precious metals markets are closed for the weekend.

Gold jumped more than 1% this week on news that the US is sending up to 3,000 infantry soldiers from the 82nd Airborne to Poland in anticipation that a Russian invasion of the Ukraine could happen during the next few weeks.

Multiple countries are evacuating embassy staff from Kiev. The US State Department has ordered staff and their families return home and issued a Level 4 Travel Advisory recommending Americans leave Ukraine immediately and avoid future travel to the region.

Crude oil prices recently hit an 8-year high. The average price per gallon is now reportedly $3.47 per gallon.

In addition to the political tensions, some analyst are warning that unregulated robo-trading of derivatives may contribute to higher prices.

Precious metals prices have been rising slowly over the past month and some industry analysts are revising their predictions on precious metals prices.

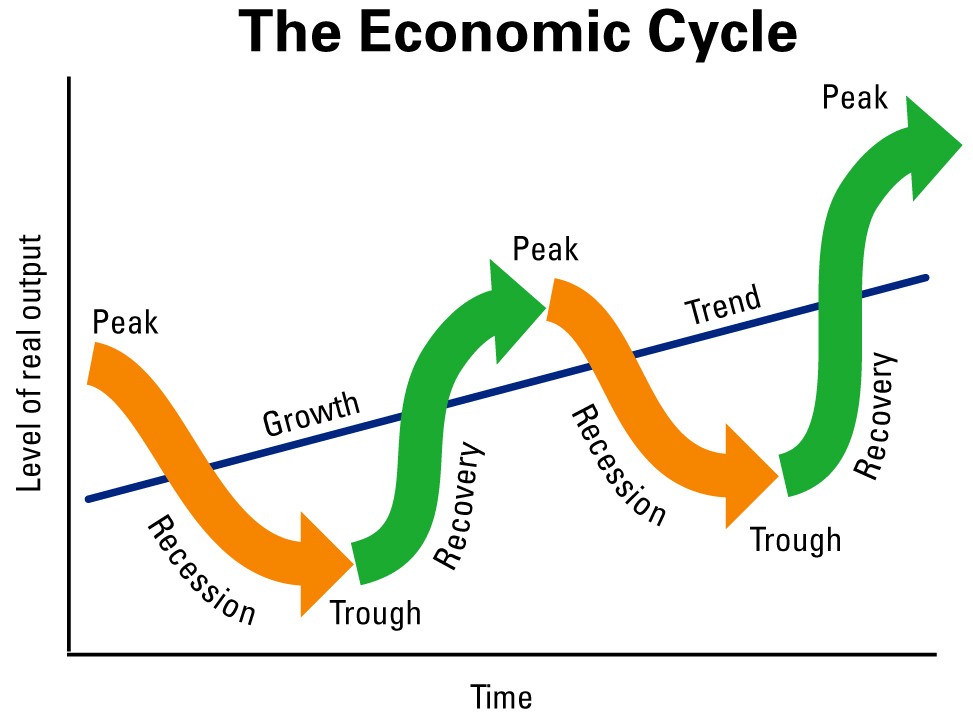

As investor confidence in the stock market and cryptocurrencies continues to drop, analysts from mainstream, left-wing and right-wing media are making predictions about whether these are symptoms of a recession starting later in 2022. (Learn more are political Bias in the Media)

Trends in Statista data suggest that there is rising probability of a recession starting this year.

Most Americans are already feeling the pain of inflation and there is rising concerns that issues at home and overseas will continue to disrupt a recovering economy.

- Job growth has been stagnant and unemployment continues to tick up despite claims by the Biden Administration that “America is Back to Work”

- Supply chain issues are getting worse with trucker protests causing shutdowns along the Canadian border many consumers routinely fine grocery store shelves are still bare.

- In the meantime, large companies have been paying advertising and marketing agencies in droves update product packaging and to misappropriate minority culture and continue to exploit consumers by bending reality. The latest trends are merely a way for companies to charge more for groceries while shrinking the sizes of products in all aisles of the supermarket.

Having trust in any bank today is challenging. The fees charged by all banks continue to rise. Whether it is ATM fees, monthly service charges or other hidden fees we should expect banks will follow the trends from fintech and newer payment providers.

Most people have already gotten used to paying fees on sending money with apps CashApp, PayPal and others. Consumers already expect to pay fees when shopping online or sending money to friends with Venmo.

Coinbase, Binance, Bisq and other crypto exchanges charge a transaction fee whenever you buy or sell bitcoin and other tokens. All of the crypto exchanges have a complicated and confusing fee structure that remains largely unregulated.

Every corner of the economy has found a way to hide fees into every transaction and that trend is likely to continue as banks and merchant providers race to implement blockchain technologies into normal everyday life.

All payment methods aside from cash have some sort of transaction fees associated with it that go straight into the profits of the banks. Alternate payment methods like PayPal, bitcoin and cryptos charge varying fees on both sides of each transaction.

Using credit cards, debit cards and PayPal to shop online has gotten more expensive. Merchant providers automatically charge at least 4% in fees on top each transaction that most online stores hide by raising their prices or charging other fees.

Many online bullion dealers hate the fees too. Some have found creative ways avoid the fees charged by merchant providers and banks. Most online bullion dealers will offer a “cash discount” when paying with alternatives to credit and debit cards. Similar to how some gas stations still have different prices for cash and credit cards. This is a perfectly legitimate to save additional money on premiums by avoiding excess fees charged by banks.

You can also buy silver online from many dealers using digital tokens such as bitcoin as payment. Some of the out of pocket fees associated with buying precious metals online can’t be avoided. Using crypto to buy silver can reduce the fees charged by banks and leave you with the lowest premiums on silver.

The lowest premium are secondary market silver bars which had once been bought when they were newly minted. These are often sold to pawn shops, “We But Gold” stores, jewelers, local coins shops and other local bullion retailers. Most online bullion dealers will also buy silver and gold from you.

Even though there are reports of counterfeits found in the wild, ordering from trusted and reputable dealer helps to assure you are getting genuine precious metals. millions of people are stuck working low wage jobs, collecting unemployment and other government benefits according to a press release on February 4, 2022 from the Bureau of Labor Statistics.

|

|

|

|

|

|

|

|

|

|

|

|

|