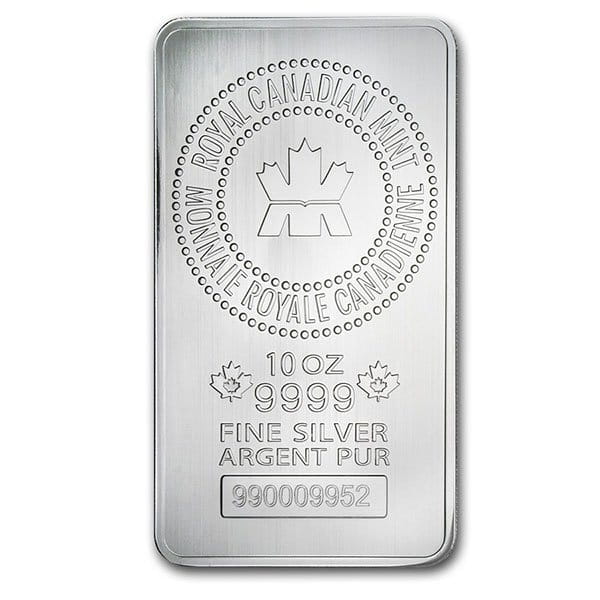

The Federal Reserve is developing its digital currency token or CBDC. Bitcoin investors are worried that the government intends to track all digital transactions and are using their profits to buy 10-oz silver bars with Bitcoin.

There are growing concerns that blockchain and new digital currency technology are not mature enough to handle issues around privacy, tracking, and reliability. The technology is advancing at such a rapid pace as the world shifts to a multipolar gold-backed trading system.

Many experts, critics, and supporters quickly point out that many huge risks will come as widespread integration of the blockchain and related technologies continues this year in the economy.

Many are starting to believe that the current government intends to support the Fed in its push to usher in the FedNow platform. Implementing a digital token to complement the dollar carries many risks.

In addition to being a globally accepted reserve currency, eleven countries have adopted the US dollar as legal currency either solely or in conjunction with local currency.

Blockchain implementations also place heavy demands on an electricity grid that has been shown in recent years to be vulnerable to weather, cyberattacks, and other external threats.

According to a report from the Bank of International Settlements (BIS), the digital currency being developed in secret by the Fed will change the way Americans use money. Even big banks are concerned that the government’s blockchain implementation will strip away the rights of millions of Americans.

Americans continue to be anxious, frustrated, and angry because of the complacency placed on the failing economy.

While it is difficult for the government to associate specific Bitcoin transactions with individuals, the IRS and other federal agencies have been seizing cryptocurrencies and digital tokens at alarming rates.

Although it’s been suggested that crypto offers anonymity, there are growing reports that the IRS and other federal agencies have been employing notable forensic researchers and hackers to find new ways to track each purchase you make.

During the 12 months from October 2020 to September 2021, IRS agents seized more than $3.5 billion worth of bitcoin from Americans in cases unrelated to taxes!

The pending blockchain implementations by the Federal Reserve are likely to result in significant new regulations that will have a major impact on the economy this year.

While the IRS claims that all of these funds were from criminal enterprises, many legal experts have raised concerns that civil forfeiture laws could be used as a regulatory enforcement tool to continue the unlawful seizure of crypto in similar ways to how gold was seized by the government in 1933.

Criminal charges are pending for some who have been accused of money laundering; the IRS is reportedly hiring at its fastest pace in history to allow politicians to continue to fleece the American people.

Pending regulations in Congress continue to put many normal people at risk of being investigated by the IRS and other federal agencies.

New data shows that in January 2022, inflation may have been as high as 7.3%, well above the previously reported number.

Wall Street analyst are mixed on their predictions for the upcoming interest rate hikes.

Based on what we’ve seen in recent months, including the highest inflation rates in recent history, rising interest rates, and uncertainty in the mid-term elections, our economic future is fraught with risks that investors must act on before it’s too late.

Stock and crypto investors are transferring profits at alarming rates into other assets, like precious metals. Precious metals are one of the most effective ways to balance portfolio risk.

Crypto tokens are not proven as stable and reliable investments or a proven store of wealth.

Major Wall Street Banks share many concerns that giving the Federal Reserve real-time access to your purchase data is just part of a slippery slope that will strip away the right to privacy and the individual security of all Americans.

A growing amount of evidence suggests that much of the hype pushed by the mainstream media over the last few years has mainly been propaganda.

A growing number of Americans believe that the intention behind many of the misinformation campaigns in recent years has been to line the pockets of the political elite. This is an ongoing concern for millions as we approach the mid-term elections.

Many investors are taking their profits as crypto prices continue to drop.

Any pending digital currency implementation is likely to significantly impact our money and invade privacy at the same time.

One of the most effective and simple ways to store crypto profits is to buy silver bars as a store of value.

Silver, historically, has been one of the most trusted and reliable stores of value for thousands of years.

Even today’s central and private banks use precious metals to store wealth.

Many trusted and reputable online bullion dealers have made it easy to buy 10 oz bars with Bitcoin as a payment method. Several dealers integrate Bitpay wallets and other wallets with payment gateways and exchanges to provide some assurance that transactions will occur with discretion and privacy.

FindBullionPrices.com compares the prices of silver bars to make it easy for crypto and digital token investors to buy ten-ounce silver bars with bitcoin.