Investing in silver bars can be a valuable addition to a diversified portfolio. They offer a tangible asset that can act as a hedge against inflation and economic uncertainties.

With so many options on the market, choosing the best silver bars for your investment needs can be challenging. Key factors such as brand reputation, country of origin, government backing, and IRA eligibility can influence decisions. In this article, we cover the leading brands, U.S.-made options, government-backed bars, and IRA-approved choices to guide you through the process.

Leading Silver Bar Brands

Several brands have become reputable names in the silver bar market, recognized for their quality, purity, and value. Here are some of the top brands that are popular among investors worldwide:

PAMP Suisse Silver Bars

PAMP Suisse, based in Switzerland, is one of the most renowned names in precious metals.

Known for its .9999 fine silver bars and iconic Lady Fortuna design, PAMP offers high quality and artistry. PAMP’s bars are LBMA-approved, and are available in industry standard sizes from 1 oz up to 100 oz.

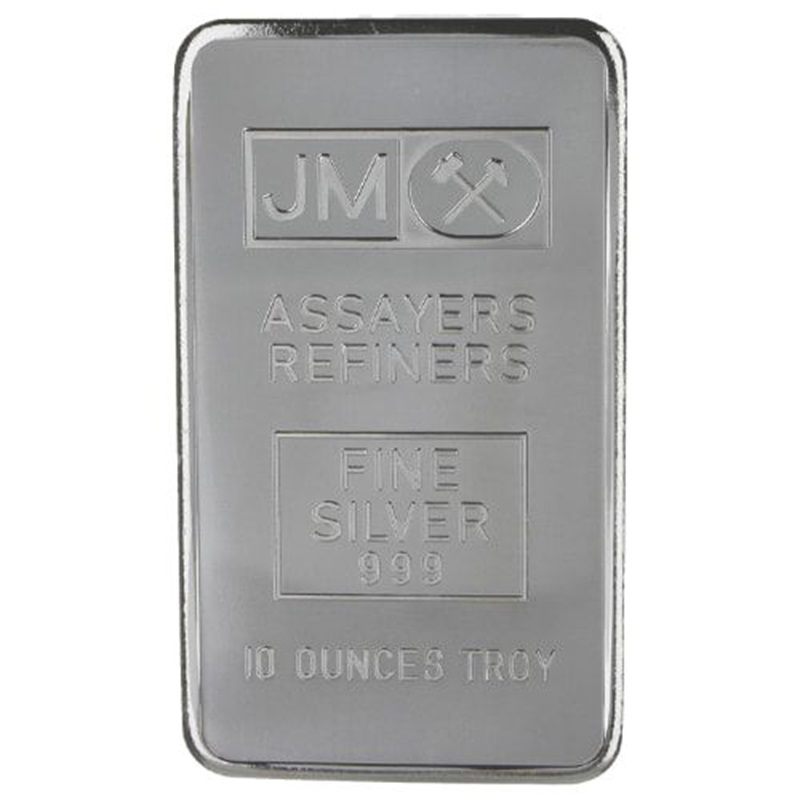

Johnson Matthey

Johnson Matthey produced bullion bars with a reputation for quality and purity. Although no longer actively producing, Johnson Matthey bars remain in circulation and are respected for their brand heritage and reliability.

Secondary market Johnson Matthey bars are available in a range of sizes from 5 oz to 100 oz.

Engelhard Silver Bars

Engelhard bars are highly sought after in the secondary market due to the brand’s long-standing history and reputation.

Engelhard ingots come in .999 fine silver and are widely recognized and trusted by investors.

Royal Canadian Mint (RCM)

The Royal Canadian Mint (RCM) produces some of the most trusted investment bullion, known for their .9999 fine purity.

RCM silver bars are also widely recognized for their quality and security features, making them a preferred choice among investors.

Sunshine Minting Silver Bars

Sunshine Minting (SMI), based in the United States, is one of the largest private mints and supplies silver blanks to various other mints, including the U.S. Mint.

Sunshine silver bars are .999 fine and include anti-counterfeit security features such as the MintMark SI, enhancing their appeal. In addition to their role in the commercial markets, silver bars are available from dealers in sizes that range from 1 oz silver to 100 oz and all of the industry standard sizes in between.

Perth Mint

The Perth Mint, established in 1899 and owned by the Government of Western Australia, is renowned for producing high-quality precious metal products, including silver bars.

Investors and collectors highly regarded these bars for their exceptional purity, craftsmanship, and the mint’s longstanding reputation.

The Perth Mint produces various bullion bar product lines, most featuring the iconic kangaroo motif, along with the Swan Logo, symbolizing Australia’s rich wildlife heritage.

For bulk purchases, Perth Mint 1 oz silver bars are available in protective acrylic tubes of 20 bars, each with The Perth Mint’s tamper-evident security seal.

For investors who prefer a natural finish, the Perth Mint offers a line of poured bars that are government-backed. The design contains only the Swan logo, weight, and purity.

This range provides flexibility for investors, whether they are making small acquisitions or more significant investments.

Asahi Refining

Asahi Refining is a global entity with refineries in Salt Lake City, Utah, and Brampton, Canada. Products bear the Asahi Refining brand and are recognized for their adherence to international standards.

Available in various sizes, including 1 oz, 10 oz, 1 kilo, and 100 oz, with a variety of designs beyond bullion bars such as the Diwali and Lunar series.

In 2016, Asahi acquired Johnson Matthey’s precious metals business and now produces bullion bars under its brand. Asahi’s bars are LBMA-certified and known for their purity and reliable quality.

In 2015, Asahi Holdings completed the acquisition of Johnson Matthey’s gold and silver refining businesses, including refineries in Salt Lake City, Utah, and Brampton, Ontario.

In 2015, Asahi Holdings completed the acquisition of Johnson Matthey’s gold and silver refining businesses, including refineries in Salt Lake City, Utah, and Brampton, Ontario. Following this acquisition, Asahi Refining began producing bullion bars under its own brand. These bars are certified by the London Bullion Market Association (LBMA), ensuring they meet stringent standards for purity and quality.

Silver Bars Made in the USA

For investors looking to support U.S.-based mints, several reputable brands produce silver bars domestically:

| Brand | Description |

|---|---|

| Sunshine Minting (SMI) | Based in Idaho, Sunshine Minting is a leading producer of silver bullion in the United States. Known for its quality and innovation, SMI supplies silver for the U.S. Mint’s American Eagle program and offers .999 fine silver bars with anti-counterfeiting features. |

| Scottsdale Mint | Scottsdale Mint, located in Arizona, is a well-regarded producer of bullion known for its quality and unique designs. Scottsdale’s .999 fine stacker bars are available in various sizes and are popular with investors and collectors. |

| SilverTowne | Founded in Indiana, SilverTowne has been producing 1 oz bullion bars since 1949. Their .999-fine silver bars are known for their quality and affordability. SilverTowne bars often feature unique designs that appeal to collectors as well. |

| Asahi Refining | Asahi Refining, located in Utah and Canada, is a significant player in the U.S. silver market. Known for acquiring Johnson Matthey’s precious metals division, the company continues to produce high-quality silver bars with .999 fineness. |

These American-made bullion bars offer a blend of quality, craftsmanship, and competitive premiums, making them attractive options for investors supporting U.S. manufacturing.

Government Issued Bars

While private mints produce most bullion bars, a few government-backed options exist. Government-backed bars carry the credibility of being minted by a sovereign mint, often enhancing their trust and liquidity in the market.

Royal Canadian Mint (RCM)

The Royal Canadian Mint, a government entity in Canada, produces .9999 fine silver bars that carry the backing of the Canadian government. These bars come with high security and anti-counterfeit measures, including a unique serial number and assay certificate, which add to their appeal to investors.

Perth Mint Silver Bars

The Perth Mint, backed by the government of Western Australia, offers .9999 fine silver bars that are trusted worldwide. The Perth Mint’s bars come in various sizes and feature a government-backed guarantee of purity and quality, making them a popular choice for international investors.

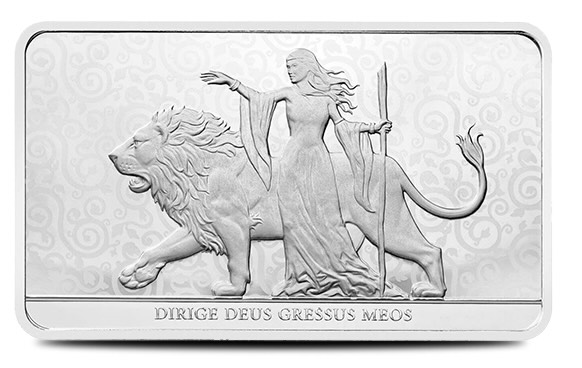

The Royal Mint

The Royal Mint produces a range of bars in various weights, including 1 oz, 10 oz, 100 oz, and 1 kg.

Each bar is struck from .999 fine silver and features designs such as the iconic 10 oz Britannia Bar or commemorative themes like Una and the Lion. The Royal Mint ensures the authenticity and purity of its silver bars, making them a trusted choice for those looking to invest in precious metals.

IRA Approved Silver Bars

Investors seeking to add silver to their Individual Retirement Accounts (IRAs) must select bars that meet IRS guidelines. These guidelines require silver products to have a minimum fineness of .999 and be produced by an accredited manufacturer.

| Brand | Description |

|---|---|

| PAMP Suisse | PAMP Suisse silver bars are LBMA-approved and meet IRS requirements for IRA investments. Known for their .9999 fine purity and high-quality design, they are a popular choice for IRA investors. |

| Royal Canadian Mint (RCM) | The Royal Canadian Mint’s .9999 fine bars meet IRS requirements and are eligible for IRA inclusion. Backed by the Canadian government, these bars offer high purity and anti-counterfeit features. |

| Sunshine Minting (SMI) | Sunshine Minting’s .999 fine bars are IRA-eligible and have a strong reputation as a major precious metals supplier. Their MintMark SI anti-counterfeit technology adds value for IRA investors. |

| Perth Mint | Perth Mint bars, with their .9999 fine silver and government backing, meet IRS standards for IRA inclusion. These LBMA-certified bars are a trusted choice for retirement accounts. |

| Asahi Refining | Asahi’s .999 fine bars are IRA-approved and meet IRS fineness requirements. Known for their reputation, LBMA certification, and quality assurance, they are reliable for retirement accounts. |

Best Silver Bars for Investing

When choosing physical bars for investment, multiple factors must be considered: brand reputation, country of origin, government backing, and IRA eligibility.

Reputable brands like PAMP Suisse, Johnson Matthey, and Sunshine Minting offer reliable options for investors.

At the same time, those looking for U.S.-made products can find quality bars from Sunshine Minting, Scottsdale Mint, and SilverTowne.

The Royal Canadian Mint and Perth Mint provide excellent choices for investors seeking government-backed options. For those looking to invest in silver within an IRA, selecting bars from LBMA-approved mints ensures compliance with IRS requirements.

By understanding the variety of silver bars available, investors can make more informed decisions based on their unique goals and preferences. With so many high-quality silver bars on the market, there’s an option for every investor looking to secure wealth with physical silver.