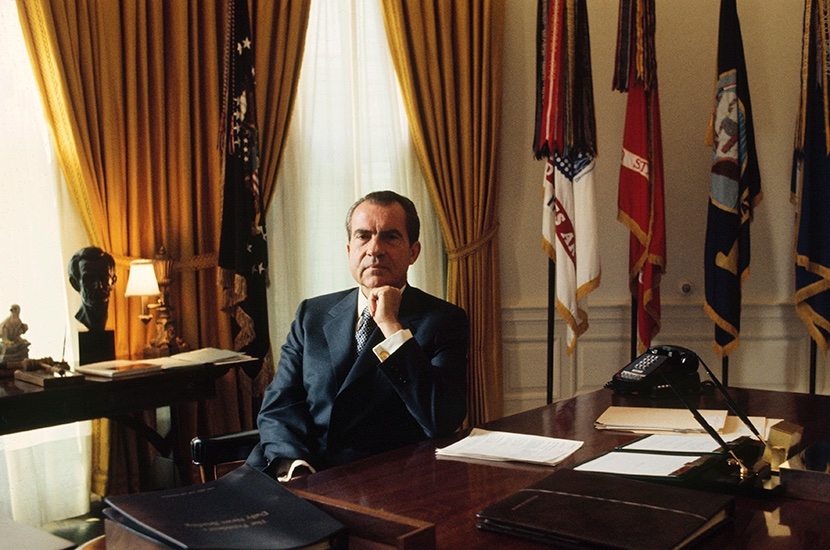

The push toward de-dollarization that began after the 2008 financial crisis has taken hold in recent years.

Many central banks are preparing for the elimination of the dollar from international trade settlements in favor of local currencies and are preparing by stocking up on gold and other commodities.

Development of the BRICS+ basket currency began more than ten years ago, with reforming the global finance system at the top of the plan.

The EuroAsia alliance and the push for the Moscow World Standard, a gold market that is outside of the manipulation from the corrupt Western banking elite is seen as a key driver for adoption of a basket currency.

This week, the Iraqi central bank announced they are dropping the dollar and switching to the Yuan for their trade with China after the US Treasury forced stricter SWIFT transfer rules last year.

While the intent of the tighter rules was to curtail money laundering and to prevent the siphoning of dollars to heavily sanctioned countries. It is yet another political move that appears to have backfired.

Jamie Dimon seems to have lost faith in the Federal Reserve. During a recent interview with CNBC, the JP Morgan Chase CEO said that he believes the Fed has lost control of inflation while suggesting that it is still possible to have a “soft landing” of the economy.

While the stock market appears to be having a fragile recovery since the market bottom at the beginning of the pandemic lockdowns, the housing market has completely collapsed in record time.

As the rest of the world begins to transition to a gold-backed CBDC for international trade, the risk of out-of-control inflation to continue remains high, and the chances of a soft landing for the economy are increasingly low.

The Federal Reserve has been piloting a number of different CBDC projects in recent months while recent legislation in Congress has been introduced to restrict the central bank from issuing any digital currencies to individuals.

In the long term, gold and silver preserve wealth and spending power while central bankers devalue fiat currency.

Even if the Fed is able to reduce inflation without destroying other sectors of the economy, the long-term goal is to devalue the dollar by 2% annually with the inflation targets.

The global economy is shifting back towards some form of a gold standard. Everyone should be buying some physical gold and silver to have at home or in a secure location to be prepared for whatever happens this year.

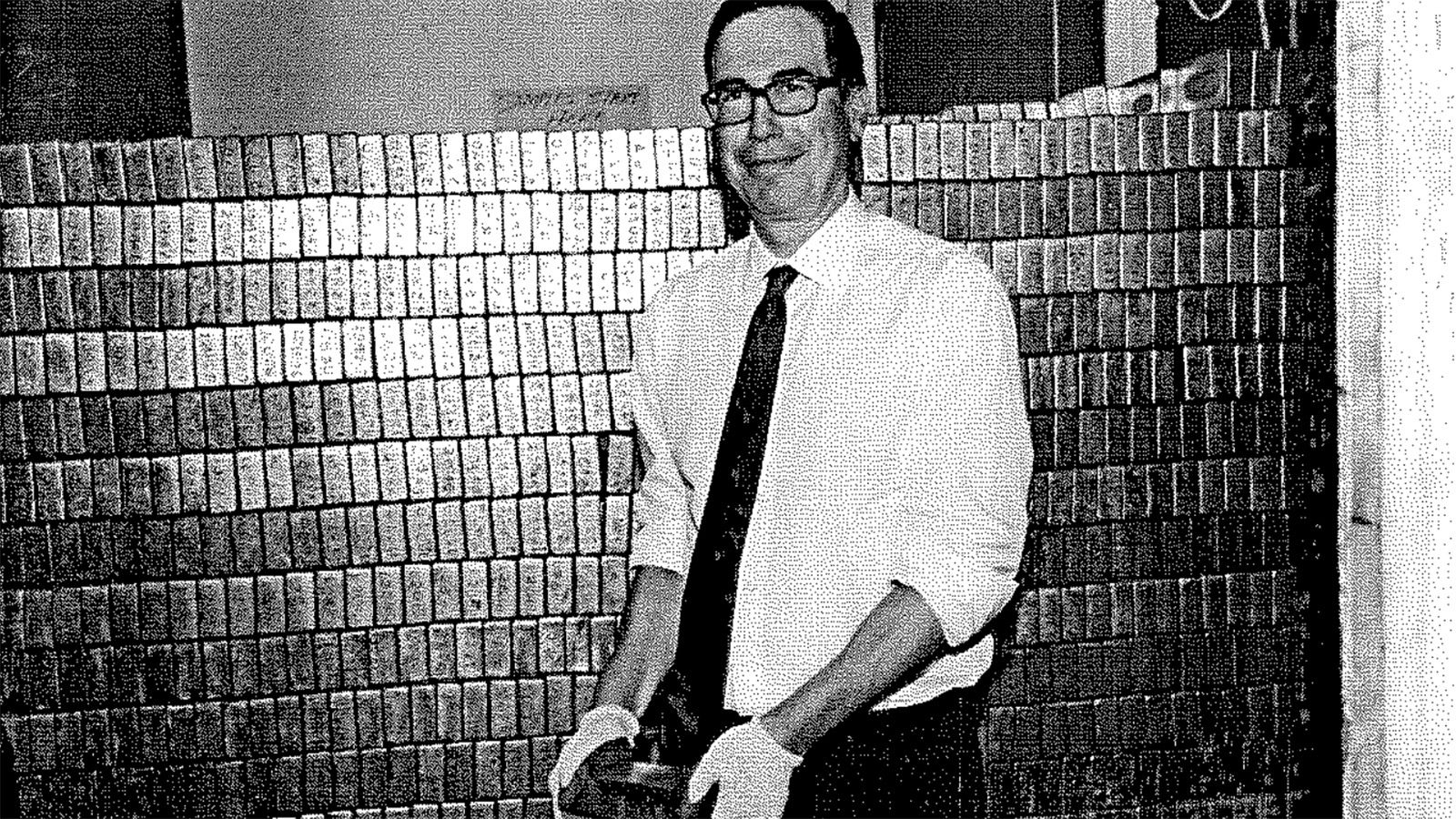

The US Treasury continues to hold the largest gold bullion reserves. The January 31 report shows 258,641,878.085 troy ounces or roughly 8082.56 tons. According to some reports, FDR seized 2,665 tons from citizens during the depression.

Storing physical gold and silver at home alongside firearms and other valuables is more common than you might think. If you don’t hold it, you don’t own it. Physical metals avoid counter-party risk.

Last year, the US Mint sold 980,000 troy ounces of gold eagle coins, a substantial drop from the 1,252,500 ounces that were sold in 2021.

However, 2022 saw an increase in sales of US Mint Gold Buffalo coins by nearly 60,000 troy ounces, which shows that some gold bugs have been turning to .9999 fine gold.

Premiums on current year 1 oz Gold Eagle coins have fallen with online dealer premiums as low as 4.6% of gold spot price, and premiums on random year 1 oz Gold Buffalos are slightly higher from 5.14%.

Gold Eagles are minted from 90% pure gold that is alloyed with small amounts of copper and silver. The addition of silver helps to give these coins their unique color and luster.

Gold Buffalos are minted from .9999 pure 24k gold. The coins are beautifully sculpted and minted from gold that is refined from US mines.

Both coins each contain one troy ounce of pure gold.