Why Vintage European Gold Coins Deserve a Spot in Your Vault

When it comes to investing in gold, most folks default to modern bullion—Maple Leafs, Eagles, Krugerrands, and the like. But there’s a smarter, often overlooked niche: vintage gold coins minted during the era of the gold standard. These aren’t rare museum pieces; they’re tangible links to a time when currencies were literally backed by gold, and governments took coinage seriously.

From the mid-19th and early 20th centuries, European mints were pumping out gold coins that weren’t just beautiful—they were actual circulating money. Coins like the British Sovereign, French 20 Franc, and Austrian Ducats served dual purposes: currency and wealth storage. These coins carry low premiums, tight spreads, and have decades of historical liquidity.

In the U.S., Pre-1933 gold coins (like the $20 Saint-Gaudens or $10 Indian Head) are well known and frequently traded—but they often command numismatic premiums, especially in better grades. European vintage coins, by contrast, are less hyped, more accessible, and just as solid when it comes to preserving and growing wealth.

Let’s dig into the Top 10 Vintage Gold Coins that hit the sweet spot between history, investment-grade metal content, and market liquidity.

1. Mexican 50 Pesos (Centenario)

- Years Minted: 1921–1947 (restrikes ongoing)

- Gold Content: 1.2057 troy oz of .900 fine gold

- Design:

- Obverse: Winged Victory (El Ángel) with volcanoes in the background

- Reverse: Mexican coat of arms with the eagle and serpent

- Market Availability Rating: Generally Available

- Why It Matters: Big, beautiful, and usually priced with a very low premium over spot. It’s a chunk of gold with serious collector flair.

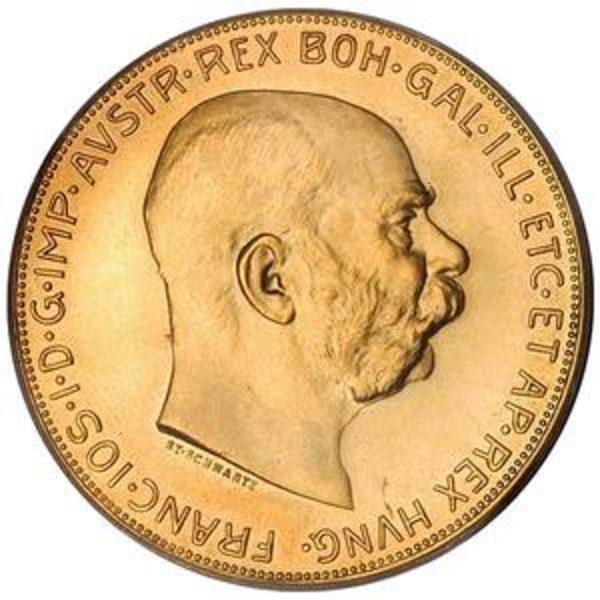

2. Austria 100 Coronas Gold Coin

- Years Minted: 1908–1914 (restrikes dated 1915)

- Gold Content: 0.9802 troy oz of .900 fine gold

- Design:

- Obverse: Emperor Franz Joseph I

- Reverse: Imperial Austrian double-headed eagle

- Market Availability Rating: Common

- Why It Matters: One of the most affordable ways to buy nearly an ounce of gold. Large format makes it ideal for storage efficiency.

3. British Gold Sovereign

- Years Minted: 1817–present

- Gold Content: 0.2354 troy oz of .9167 fine gold

- Design:

- Obverse: Portrait of reigning monarch

- Reverse: St. George slaying the dragon (by Benedetto Pistrucci)

- Market Availability Rating: Widely Available

- Why It Matters: Arguably the most recognized vintage gold coin on the planet. Traded globally, trusted by bullion dealers everywhere.

4. French 20 Franc Rooster (Also includes Swiss, Belgian, Italian 20 Francs)

- Years Minted: 1800s to early 1900s (varies by country)

- Gold Content: 0.1867 troy oz of .900 fine gold

- Design:

- Obverse: Marianne, the national symbol for Liberty and Freedom.

- Reverse: The Gallic rooster

- Market Availability Rating: Widely Available

- Why It Matters: A workhorse coin in the vintage gold world. Perfect for small fractional exposure and easy to stack.

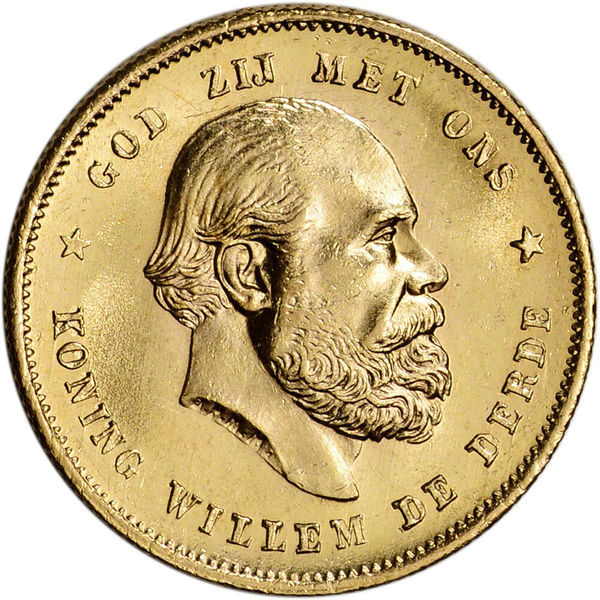

5. Netherlands 10 Gulden

- Years Minted: 1875–1933

- Gold Content: 0.1947 troy oz of .900 fine gold

- Design:

- Obverse: Monarch’s bust (usually Queen Wilhelmina or King Willem)

- Reverse: Dutch coat of arms with lion and shield

- Market Availability Rating: Generally Available

- Why It Matters: Often overlooked, but widely traded in Europe. Clean design and compact format.

6. Austria 4 Ducat

- Years Minted: Primarily restrikes dated 1915

- Gold Content: 0.4430 troy oz of .986 fine gold

- Design:

- Obverse: Emperor Franz Joseph I facing right

- Reverse: Ornate double-headed imperial eagle

- Market Availability Rating: Common

- Why It Matters: Ultra-thin and flashy with near-pure gold content. Historically used for ceremonial and trade purposes.

7. Russian 10 Roubles (Nicholas II)

- Years Minted: 1897–1911

- Gold Content: 0.2489 troy oz of .900 fine gold

- Design:

- Obverse: Tsar Nicholas II facing left

- Reverse: Imperial double-headed eagle with shield

- Market Availability Rating: Common

- Why It Matters: Pre-revolutionary Russia gold with solid historic appeal and good liquidity in Eastern Europe.

8. Italian 20 Lire Gold Coin

- Years Minted: Mid-1800s to early 1900s

- Gold Content: 0.1867 troy oz of .900 fine gold

- Design:

- Obverse: King Victor Emmanuel II or Umberto I

- Reverse: Italian coat of arms or Savoy shield

- Market Availability Rating: Generally Available

- Why It Matters: Fractional, elegant, and often slightly cheaper than 20 Franc equivalents.

9. Spanish 25 Pesetas Alfonso XIII

- Years Minted: 1876–1885, 1886–1890 (as part of gold standard)

- Gold Content: 0.2333 troy oz of .900 fine gold

- Design:

- Obverse: Alfonso XII or XIII bust

- Reverse: Crowned Spanish coat of arms

- Market Availability Rating: Scarce

- Why It Matters: Less commonly seen, but prized by collectors seeking under-the-radar European gold.

10. German 20 Mark (Wilhelm II)

- Years Minted: 1871–1915

- Gold Content: 0.1152 troy oz of .900 fine gold

- Design:

- Obverse: Emperor Wilhelm I or II

- Reverse: German imperial eagle

- Market Availability Rating: Generally Available

- Why It Matters: Rugged, historic, and representative of the Second Reich’s push for economic power.

Why Gold Coins from the Gold Standard Era Make a Solid Investment

Gold coins minted under the gold standard weren’t collectibles when they were struck—they were money. Period. They had intrinsic value and global trust, and they moved across borders long before crypto or fiat swaps existed. The era of the classical gold standard (roughly 1870–1914) was one of unprecedented monetary stability. These coins are a leftover from that system—when governments couldn’t just hit Ctrl+P on a printing press.

Gold doesn’t pay interest, but it doesn’t go to zero either. Vintage gold coins combine the metal’s long-term stability with the added bonus of historical recognition and, sometimes, collector premiums that rise over time.

Final Thoughts

In a world drowning in debt and fiat debasement, physical gold is your no-B.S. insurance. These vintage gold coins? They’re your ticket to holding history in your hand—while keeping your wealth outside the system. Unlike modern bullion, these coins have real circulation history, tight dealer spreads, and are damn near impossible to fake if you know what to look for.

Get some. Stack smart.