Many vintage gold coins have a rich history that provides a tangible connection to a bygone era, something that modern bullion doesn’t offer in the same way. These coins represent ancient empires, defunct monarchies, and bygone eras when many economies were on a gold standard, which can be intriguing to investors and collectors alike.

For investors who value gold as a store of wealth, vintage gold coins are reliable in terms of their gold content. Given that these government-issued coins were used under a standardized system, there’s a level of trust regarding their purity and weight. Because of their connection to history, they also serve as collectible items and tangible assets with intrinsic value.

Government Mints issued these coins when the world economy was using the gold standard. Intended for circulation, most of these coins were minted with an alloy of .900 fine gold, with the remainder a more durable metal, most typically copper.

While all gold coins carry intrinsic value due to their metal content, vintage coins can also have numismatic value. The numismatic value depends on collector demand, rarity, historical significance, condition, and other attributes and can fluctuate based on market conditions.

US Mint Pre-1933 Gold Coins

Gold coins minted by the United States prior to 1933 are an investment choice that is part of history. These coins often carry a numismatic premium and most trade at a premium over spot, unless in very poor or damaged condition.

Only some people complied with the order when the government ordered the seizure of gold in 1933. Some people kept their gold and hoped they wouldn’t get caught. The enforcement of the executive order targeted prosecutions against vocal political opponents of the seizure. This is a historical use of the courts to create examples of political foes and propagandize the media to instill fear in the people.

The executive order made exceptions for gold coins recognized for their particular value to collectors of rare and unusual coins, which meant numismatic (collectible) coins were exempt. Many claimed their gold coins held collectible or numismatic value, even if they were relatively common.

With the passage of Public Law 93–373, signed by President Gerald Ford on August 14, 1974, Americans regained the right to own gold, which had profound implications for the gold market, the economy, and individual financial freedom. The law repealed the restrictions on private ownership of gold that had been in place since President Franklin D. Roosevelt’s Executive Order 6102 in 1933, reflecting a changing view toward gold ownership and the role of gold in the U.S. financial system.

Pre-1933 U.S. gold coins represent an era in American numismatics before the significant gold recall and meltdown. Owning these coins is akin to holding a tangible piece of American history.

In addition to their bullion value, many pre-1933 gold coins have numismatic or collector value. Rarity, condition, mint marks, and historical significance can make certain coins particularly sought after by collectors. Pre-1933 U.S. gold coins like the Saint-Gaudens $20 Double Eagle and the Liberty Head design are traded among coin dealers and collectors worldwide. Their gold content and purity are consistent and widely accepted.

Mexican Peso Gold Coins

Mexico City is home to the oldest mint in North America, established in 1535 under a decree of the Spanish Crown. Vintage Mexican Gold Peso coins are some of the world’s most beautifully designed gold coins.

The Mexican gold peso, especially the “Centenario” 50 pesos coin, is notable in gold coinage. The smaller denominations of Mexican gold peso coins, namely the 2, 2.5, and 5 gold peso coins, were introduced in various periods of the 20th century as both commemorative and circulating coins.

Introduced in 1921 to commemorate the 100th anniversary of Mexico’s independence from Spain, the Centenario became a mainstay in the international gold market. Its purity and the reputation of the Mexican Mint made it a trusted coin for global trade, especially in regions with close economic ties to Mexico.

The smaller denominations of Mexican gold peso coins were introduced in various periods of the 20th century as reliable stores of value. Because of their high gold content, most of these coins have seen limited circulation.

European Gold Coins

Most European countries minted gold coins during the 17th, 18th, 19th, and even the early 20th century. Most were used in merchant trade and circulated globally. Although they are mainly considered bullion coins today, many are in surprisingly good condition for their age and can have additional numismatic value.

20 Francs

The Latin Monetary Union (LMU) was established in the 19th century to unify several European currencies into a gold standard based on the French Franc, facilitating trade and commerce among member nations. The LMU established standardized weights, denominations, and purity specifications for coins with gold or silver content.

These coins were minted to a standard specification used in all member states, similar to how the Euro is used today across the Eurozone.

Many gold coins from LMU member states, like the French Gold Rooster or the Swiss Vreneli, have become iconic. These coins feature designs that resonate with the culture and history of their respective nations.

Although the weight and purity of the gold were standardized across LMU members, each country had its design for these coins. For instance:

- France had the “Napoleon” coin depicting Napoleon III.

- Switzerland’s 20 franc coin featured the bust of Vreneli.

- Italy had the 20-lire coins with designs such as King Victor Emmanuel II.

- Belgium, Greece, and other member and affiliated states had distinct designs.

The gold content in 20 franc coins is consistent, set to 0.1867 troy ounces (5.805 grams), making them easy to trade. Even with their fractional size, the premiums on 20 franc coins can be lower than on more popular gold bullion coins, offering a cost-effective way to invest in gold. Their smaller size compared to a one-ounce gold coin makes them more affordable for individual investors, allowing for more incremental investments

Gold Sovereign

By the latter half of the 19th century and early 20th century, the gold sovereign had become the “chief coin of the world,” circulating widely in the British Empire and in international markets and areas outside direct British influence. It was a favored coin for global trade and was often held in central banks as a reserve currency.

The Royal Mint established branches in Sydney (1855), Melbourne (1872), and Perth (1899). Australian sovereigns can be identified by mintmarks S, M, or P, respectively, and were minted until 1931.

The Ottawa branch of the Royal Mint in Canada produced sovereigns from 1908 to 1919. The Pretoria branch minted sovereigns in 1923. The Bombay branch of the Royal Mint produced sovereigns only in 1918.

Dutch Gulden

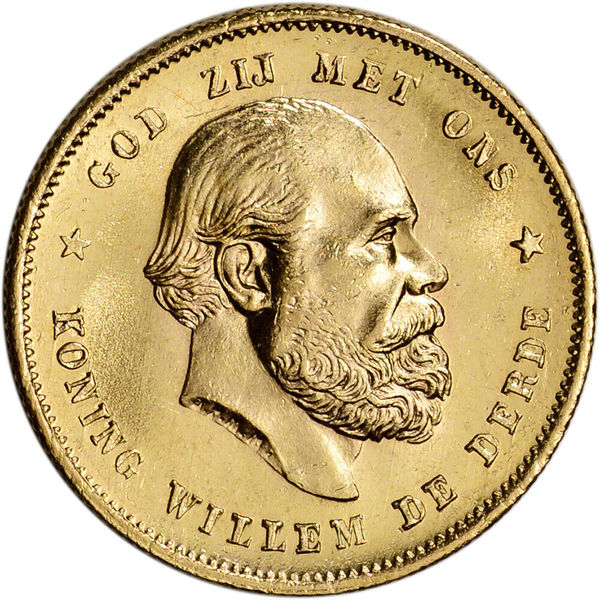

The Dutch 10 Gulden coin is a notable gold coin from the Netherlands that holds historical and numismatic significance and was part of the country’s currency system before the adoption of the Euro.

The 10 Gulden gold coins were minted various times during the late 19th and early 20th centuries. The coins were designed by the reigning monarch of the Netherlands at the time of minting. For instance, coins from the late 19th and early 20th centuries commonly bore the likeness of King Willem III or Queen Wilhelmina. The reverse side typically featured the national coat of arms and the denomination.

Collectors prize these coins for their historical significance, gold content, and artistic design. The value of a 10 Gulden coin can vary based on its condition, rarity, and the specific year of minting, as well as the intrinsic value of the .1947 troy ounces of gold.

The 10 Gulden gold coins reflect the Netherlands’ rich history and economic status during the times they were minted. They were part of a broader gold-based currency system standard in Europe before World War I and the subsequent shift to fiat currencies.

Given their gold content and historical significance, the 10 Dutch Gulden coins are sought after by both gold investors and numismatic collectors. They offer a glimpse into the Dutch monetary history and are considered valuable pieces in European gold coin collections.

In summary, the Dutch 10 Gulden coin is a historic gold coin that represents a significant period in the monetary history of the Netherlands. Its collectability stems from its gold content, artistic designs, and the historical context under which it was minted.

Conclusion

Beyond their intrinsic gold content, vintage coins can have additional numismatic or collector’s value. Rare, high demand, or in excellent condition, coins can command prices significantly above their melt value.

Vintage gold coins provide an alternative avenue for diversifying a precious metals portfolio. While modern bullion may track the spot price of gold more directly, vintage coins can fluctuate in value based on their rarity, demand, and condition, offering a different investment dynamic.