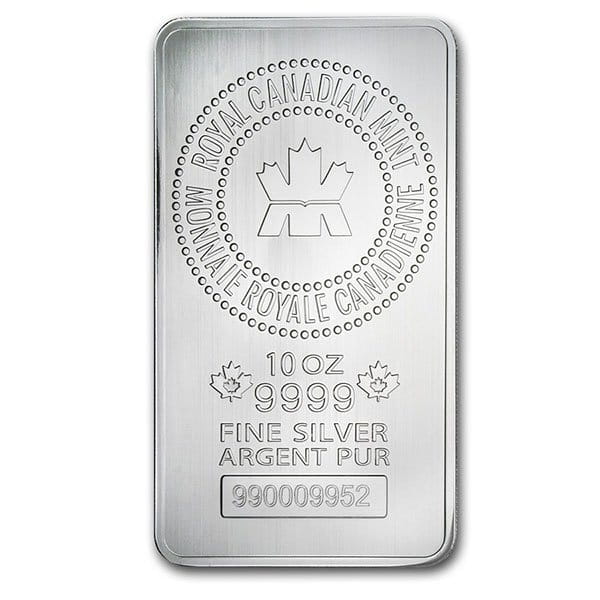

Investing in physical silver is gaining traction as both inflation and economic uncertainty rise. Many reputable bullion dealers offer silver spot price deals to attract new customers, giving investors a unique opportunity to begin stacking without paying high premiums.

Some dealers provide options for pre-made starter portfolios or monthly subscription services to make it simple and affordable to own precious metals and understand the bullion market.

Understanding the Spot Price of Silver

The spot price of silver represents the current market value for one troy ounce of pure silver in real time. This benchmark price is influenced by global economic indicators, industrial demand, monetary policy, and supply constraints. While it’s the baseline cost of silver on commodity markets, physical bullion carries a premium due to refining, minting, logistics, and dealer margins. Understanding dealer premiums and shopping around helps ensure you’re getting a good deal.

Many bullion websites and financial platforms offer live price charts, and it’s a good practice to check these before placing an order.

There are many reasons that investors consider precious metals as an investment. Some are laser-focused on long-term wealth preservation, using silver as a hedge against inflation or developing an interest in numismatics and collecting as a hobby. Pragmatic investors do not expect short-term gains from precious metals. Your reasons for buying silver can influence what types of pieces (bullion, coins, or numismatic pieces) you should buy.

Silver at Spot Price Deals

Several well-known bullion dealers, including SD Bullion, Monument Metals, Bullion Exchanges, and APMEX, frequently run promotions offering silver bars or rounds at the spot price of silver for first-time buyers. These silver-at-spot deals allow customers to buy physical silver with zero premium markup, effectively paying only the raw metal price.

These promotional offers are typically limited to small quantities (e.g., 1–10 oz) to encourage initial purchases. For the investor, it’s an opportunity to learn how buying and selling physical silver works, without overcommitting financially. And for dealers, it’s a way to build trust and loyalty with new customers.

How to Find Silver Close to Spot Price

There are many other low-premium silver deals that are close to spot. Some are reduced premiums, often to promote a particular premium mint product. The promotions often lower the cost of high-premium items by at least a few percentage points, which can help maintain a reasonably low dollar-cost average. These offers continue to appear from time to time.

The availability of silver at spot price deals changes frequently based on market activity. Check out our spot price deals page for the latest offers.

Precious Metals Portfolio Starter Kits

Money Metals Exchange Starter Portfolios

Money Metals Exchange offers curated starter portfolios designed for investors seeking exposure to both silver and gold. These kits simplify the process of building a tangible portfolio, starting with as little as 4 ounces of silver.

Sample Portfolio Options:

- Basic Silver Starter Kit

Includes 2 silver bullion coins and silver rounds of various sizes. A simple way to own 4+ oz of silver. - Gold & Silver Starter Portfolio

Combines (5) 1 oz silver rounds, $5 face value in 90% junk silver dimes, and a 1/10 oz American Gold Eagle. The Gold & Silver Starter Portfolio totals 8.575 oz of silver and 0.10 oz of gold. - Large Gold/Silver Investment Portfolio

Offers 120 oz of silver and 1.1 oz of gold via a mix that includes 1/10 oz and 1 oz American Gold Eagle, and a mix of Silver Eagles and private mint rounds, including fractional pieces.

Each package is built around highly liquid and recognizable bullion products, making resale easy when the time is right. These portfolios are ideal for those wanting physical assets pegged to the silver spot price, with built-in flexibility for bartering or long-term storage.

These starter portfolios include some of the most popular and widely traded bullion products, which means they are liquid. When you are ready, you will be able to instantly sell and command the fairest price.

Subscription-Based Silver Buying: InvestorCrate

For those preferring a hands-off, automated approach to precious metals investing, InvestorCrate delivers monthly allocations of gold, silver, or both directly to your door.

- Subscribers choose their budget and crate type (gold, silver, or mixed).

- Monthly shipments include a curated selection of bullion products.

- This dollar-cost averaging strategy helps reduce volatility and builds your stack over time.

Unlike app-based platforms that sell claims to vaulted metal, InvestorCrate ensures you physically own the metal, with no counterparty risk.

PIMBEX Gram Club: Monthly Subscription

One of PIMBEX’s standout offerings is the Gram Club, a subscription-based service designed for both novice and seasoned investors. Subscribers can choose between $125 and $250 monthly plans, receiving authentic gold and silver gram bars delivered directly to their doorstep.

Each gold bar is serialized and encased in tamper-evident packaging, while silver grams are typically delivered in loose form. The Gram Club operates without any signup, membership, or cancellation fees, providing a hassle-free way to steadily build a precious metals portfolio.

Why Silver Spot Price Awareness Matters for Investors

Being aware of the silver spot price helps investors avoid overpaying for physical bullion and makes it easier to compare dealer offers. While most purchases will include a premium, knowing the baseline market value helps you find the best deals—especially when buying fractional silver, junk silver, or generic rounds.

To get started or monitor the spot price of silver, visit trusted price comparison and market data sites like FindBullionPrices.com.