Investing in precious metals is a big commitment. The notion of using a portion of your cash savings to buy a physical asset goes against the mainstream narrative.

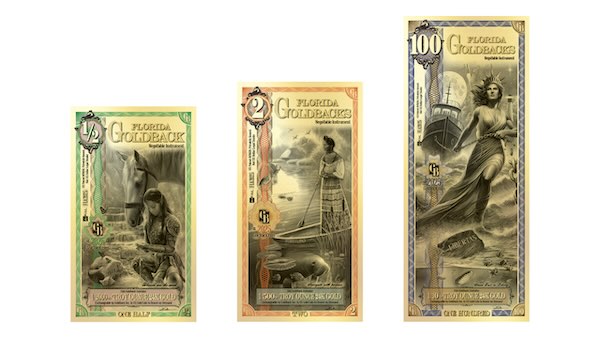

The Federal Reserve has announced that the FedNow service is NOT a CBDC. Most “conspiracy theorists” suggest that the Fed may not be telling the truth. Luckily, a few states, like Florida and Texas, have tried to reject any Fed-issued digital token.

Many people want precious metals as a store of value in lieu of cash, and deciding which metal to buy can be a laborious choice. Ideally, having a balanced portfolio that is diverse, with a portion in both gold and silver, alongside traditional investments, can provide extra assurance to cover many unexpected financial scenarios.

Price Per Ounce of Silver is Lower Than Other Precious Metals

The enormous price gap per ounce is the most obvious reason many investors prefer to buy silver. The average per-ounce premium is often higher on silver as a price percentage.

However, just like the stock markets, the commodities markets also have bull and bear periods during which the returns on silver can shine or tarnish.

For example, at the start of the pandemic in 2020, the price per ounce of silver hit a low of $11.77. In three years, silver has already risen more than 100%.

Gold prices have been trading at record highs in recent weeks. Rumors have been circulating for weeks about an upcoming announcement from the BRICS summit in South Africa related to a new gold-backed reserve currency.

Precious Metals are Easy to Liquidate

Some analysts continue to suggest that gold prices will continue to climb higher as central banks in many emerging economies continue adding gold to their reserves.

A portfolio containing many smaller silver coins, such as Britannia or 1-ounce silver bars, is naturally more convenient to sell than larger bars or a full ounce of gold.

Silver stacking is far more prevalent than most people realize. Many find it a convenient and effective way to set aside a small amount of cash each week or month.

As a physical asset, silver is a little more difficult to spend than cash and easy to keep stashed at home. It is available in a variety of formats, from naturally fractional junk silver to larger kilogram and 100-ounce silver bars.

Many local and online options make selling silver easy when the time comes, whether for an emergency repair or to raise some cash for a new venture.

While selling a portion of silver coins is straightforward, it’s not as easy or practical to cut a gold bar in half.

Growing Industrial Consumption

Various industries consume silver in considerably more significant quantities than other precious metals. Although undeniably an excellent store of value, silver is also one of the best conductors of electricity and is used in everything from iPhones and other consumer devices to solar panels and EV batteries. According to statistics released since it was used in smartphone manufacturing.

The most significant growth in consumption and industrial consumption continues to be driven by globalist climate change and green energy initiatives. Global statistics on solar panel manufacturing show consistent year-over-year growth, which is likely to continue based on the 2030 narratives.

Renewable energies represent an area where many see potential for continued increases in consumption. Compared to other metals, silver is relatively scarce in nature. There are very few naturally occurring silver ore deposits.

Most raw silver is mined as a by-product of other metals such as lead, copper, and gold, making mining these different metals relatively more important.

Medical Applications

Silver plays a massive role in medical technology and has natural antibiotic properties. The invention of X-rays, MRIs, and other medical imaging technologies would not have been possible without silver.

Silver bromide is a chemical compound sensitive to light and plays a key role in X-ray and photographic films.

Silver plays many hidden crucial roles in countless ways throughout our everyday lives. Around half of all silver mined annually is consumed by industry while producing over 3000 technologies, including integrated circuits, medical radiology equipment, water purification, photographic imaging, and even explosives.

Silver is Undervalued

The gold-silver ratio is a great way to track silver’s fluctuations and current value relative to gold. It demonstrates the relationship between their respective values and can help investors spot potential opportunities.

Over the long term, the price of silver has steadily increased relative to the dollar due mainly to inflation.

Recent CPI data indicate that inflation continues to rise at a steady rate, while the data used by the Fed in decision-making lags behind the reality that consumers face each day.

Most countries fill their reserve vaults with gold, but a few countries, such as Peru, Mexico, and China, hold significant silver stockpiles.