Silver is an asset. Silver has been used as a form of currency for thousands of years. Silver represents wealth, so you should buy silver as part of your savings plan.

Buy Silver as an Investment

There are many better investment options besides silver. Silver does not provide the rate of return that traditional investments in stocks, bonds, and other securities can. When looking at the overall rate of return, silver makes for a horrible investment.

Silver and other precious metals have always been a way to hedge against inflation. Historically, silver’s value and purchasing power have remained roughly the same for decades.

Silver’s Purchasing Power

Silver has maintained its purchasing power over time at pace with inflation. The amount of goods or services you can buy with one troy ounce of silver has stayed relatively the same. This has even held over the last 100 years or so.

For example, in 1964, one troy ounce of silver was worth around $1.29. Since the price of one gallon of regular gas was around 30 cents per gallon, that one troy ounce of silver could purchase roughly 4.3 gallons of gas.

In 2018, silver has been hovering around $16.50 per troy ounce, while a gallon of regular gas has been around $3.00 per gallon. Using the same methodology, one troy ounce of silver today can purchase roughly 5.5 gallons of gas.

Buy Silver, a good way to save for rainy day

Most financial experts agree that everyone should have an emergency fund containing about six months of expenses. Unsurprisingly, most people can’t do this for one reason or another.

Some people don’t have the income to set aside in a savings account in this way. Others need to gain the self-discipline to avoid dipping into their savings when everyday expenses arise.

Buying silver is one way to set money aside in a rainy day fund like a savings account. However, it’s not a savings account you store in the bank. Nor is it a savings account from which you can pull cash easily. It’s a savings account that you can hold onto. While liquid and easily convertible into money, it takes some effort. This makes it easier to spend if you need to.

Silver is money, but it’s more challenging to spend than fiat currency. When you buy American Silver Eagles by the tube, each coin has a face value of $1. However, the real value is in the intrinsic nature of the silver. A tube of Silver Eagles contains 20 troy ounces of silver. Since Silver Eagles are the most popular and widely recognized government bullion coins in North America and one of the most recognized worldwide, it is effortless to trade Silver Eagles for fiat currency.

It’s essential to think about and understand your plan and strategy for dipping into your silver savings account. It helps you know how liquid it will be for you and how you can get the most value when it comes time to sell or trade for fiat currency. Do you have a local coin shop that will buy at a reasonable price when you need it? Will you be able to sell to an online dealer? What are your options to sell in a pinch?

When dealers buy Silver Eagles from the mint, they are charged a premium of $2.00 per coin. The US Mint charges this premium to cover the cost of manufacturing and distributing the coins.

Most local coin shops will pay $1.00 or so over the spot price for American Silver Eagle coins. They do this because they know they can easily sell them very quickly. When they buy silver eagles from individuals, they can purchase them for a lower price than they can get them from the US Mint.

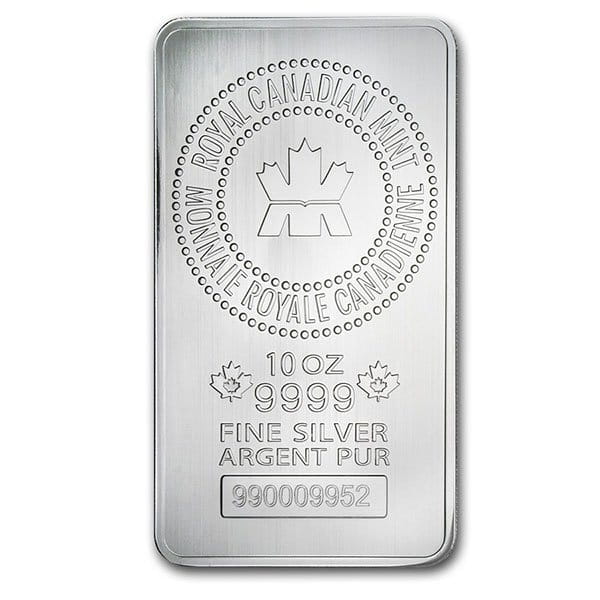

With generic silver bullion, most local coin shops will pay 50 cents to a dollar per ounce below the spot price. Reselling generic bullion has lower margins than selling Silver Eagles. Often, local coin shops buy generic bullion with the intent to ship it to a refinery to be melted back into something else. This is a common practice.

Buy Silver Eagles for your savings.

It’s no secret that Silver Eagles hold their premium better than generic bullion. There are ways that you can buy silver eagles at a lower premium for your rainy day fund. Buying Silver Eagles allows you to recapture much of that premium when it comes time to dip into your rainy-day fund and convert some back into fiat currency. You will find the best value when you buy silver eagles, not in the current year’s mintage.

There are many different ways that online silver dealers will market Silver Eagle coins from previous mintages. They could be sold simply as “Random Year” American Silver Eagles. Random Year Silver Eagles are sold and marketed as non-specified years because it may depend on what the dealer has in stock when you place your order. View Random Year Silver Eagles Pricing

Random Year Silver Eagles will be in Uncirculated condition (BU). If you buy tubes of 20 Eagles at a time, they will most likely be shipped in the original mint tube. These eagles will likely be new old stock, 1, 2, or 3 years old. There’s nothing wrong with them except that they have likely been sitting in the dealer’s vault for a while. These will often be sold for as low as $1.50 or so over the silver spot price. Sometimes, deals can be found for even less.

An even better value when buying Silver Eagle coins is to look for those in cull condition. Cull condition American Silver Eagles will likely have been handled at some point. The coins may contain scratches and show signs of tarnish and wear and tear. Some may even have been painted. You can buy cull condition American Silver Eagle coins for less than Random Year Silver Eagles. View Cull Silver Eagles Pricing

Ultimately, the intrinsic value of silver is the most important. Being American Silver Eagles, even in cull condition, still bring a premium over the spot price when it comes time to sell them.