In his testimony before the Senate Banking Committee, Federal Reserve Chairman Jerome Powell told Senators that there will be bank failures resulting from the commercial real estate crisis.

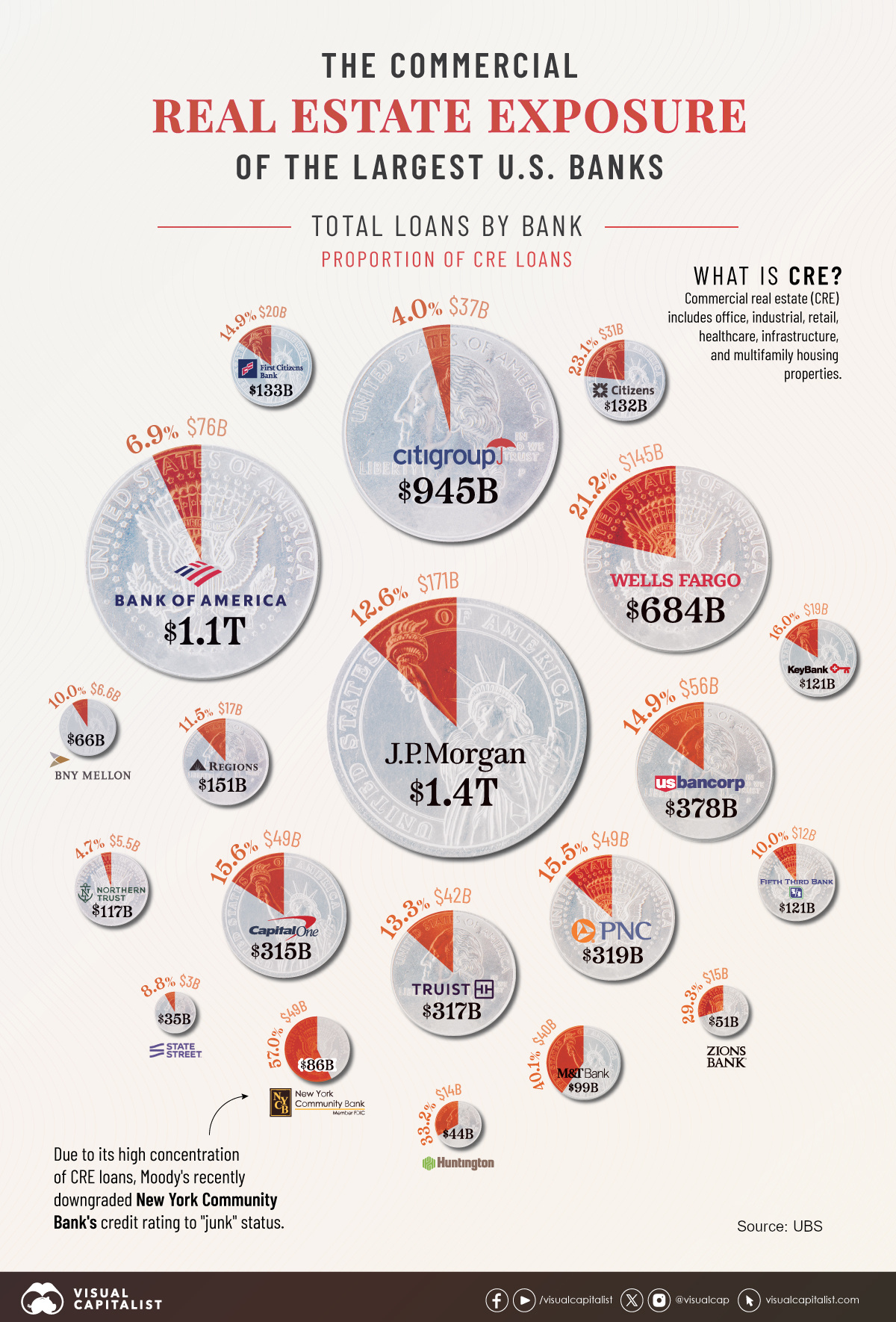

Recently, the folks at Visual Capitalist brought to life a report published by UBS Bank in February 2024 that shows a breakdown that shows which of the country’s banks have the greatest exposure in the commercial real estate sector.

It should be no surprise that the nation’s largest bank, JP Morgan Chase, sits at the top of the list with over $171 billion in commercial real estate loans, roughly 12.6% of their total loans and leases.

New York Community Bank (NYCB), the most recent bank to fail, reportedly held 57% commercial real estate loans.

There are some mid-size banks that are holding a significant share of commercial mortgages, which may be the ones Powell was referring to in his testimony to Congress.

In recent years, Well Fargo has paid more than $3.7 billion in fines in recent years for illegally creating new accounts for customers and other violations. Wells Fargo is holding around 21% of their loan portfolio in CRE.