Gold is money. Period. The fiat paper currency that we use for daily transactions is little more than an IOU from the government. Except with inflation, the value of fiat keep getting lower and lower.

The start of the latest banking crisis began with the failure of SVB that was quickly followed by Signature Bank. Regulators attempting to prevent bank runs put up ‘backstop’ to ensure depositors that their funds will be safe and accessible.

The current Orwellian doublespeak flaunted by the mainstream press is driven by regulators trying to convince customers that this time is different. It’s essentially a bank bailout.

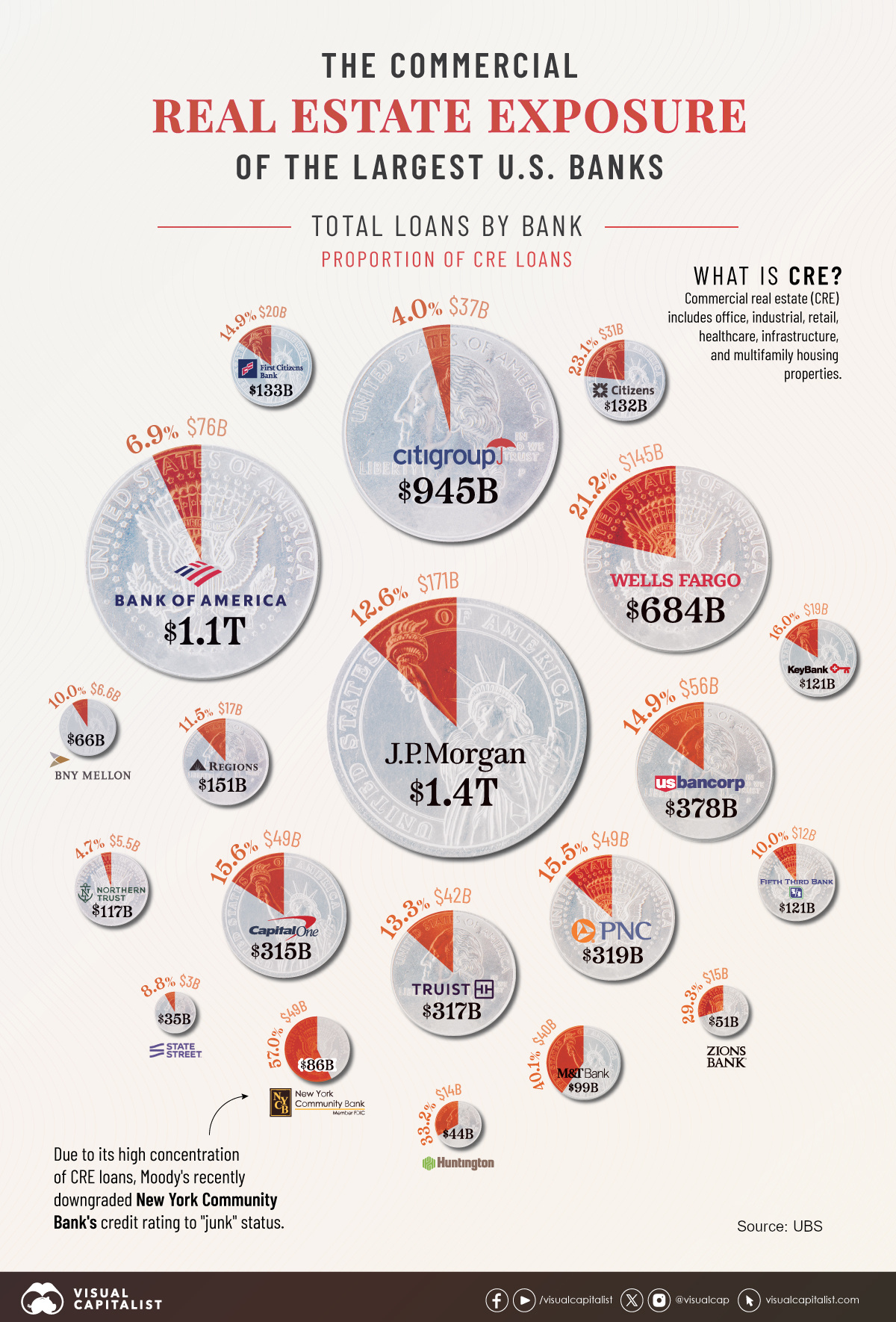

The big global banks like JP Morgan and Bank of America have seen an influx in deposits as smaller regional banks continue to request emergency funds from the Fed.

Hot on the heals of this banking crisis, the Federal Reserve has announced that it will rolling out its FedNow instant payment service in July which many see as a precursor to CBDC rollout.

As the stock market continues to tumble, the latest news about Credit Suisse and from the Bank of Japan may be sending the Western world into a recession as some analyst are predicting that Russia, China and Iran are on the cusp of launching of a BRICS gold-backed currency that will unseat the dollar’s hegemony.

Over the past few weeks investor uncertainty has returned to the stock markets as retail investors pile into precious metals in volume unseen since the start of the pandemic.

Estimates of precious metals sales based on inventory data from APMEX shows record sales of both gold and silver.

Gold sales at APMEX topped 27,000 troy ounces in the past seven days. While sales of silver bullion exceeding over 1 million troy ounces in the same seven day period.

FindBullionPrices.com tracks prices from dozens on online bullion dealers, including APMEX. APMEX is one of the largest and most popular bullion dealers in the country.

As precious metals prices remain relatively low many other online dealers are reporting delays in shipping as order volume continues to rise.

Retail investors looking for deals to add to their stack can often find the best prices when buying random year or secondary market coins.

The secondary market is where previous year gold bullion coins are traded between investors and dealers. These coins may have been stored since the year they were minted or may have traded hands dozens of times. Regardless, these gold coins maintain their intrinsic value and will continue to be a store of wealth for future generations.

Stacking physical gold and silver bullion a one way to help protect the financial security of your family in ways far beyond that of trading crypto or ETFs.

First time precious metals buyers are invited to checkout the current Spot Deals page for offers from online dealers to buy silver for spot price. Gold buyers also have the opportunity to buy 1 oz gold bar at spot price.