Having a diverse investment portfolio helps spread risk while take advantage of the growth potential across different asset classes. A balanced portfolio is typically comprised of a mix of stocks, bond, cash, real estate, commodities and tangible assets.

While stocks like Nvidia are doing well, most have been down in recent months. Companies have been laying off left and right. If that wasn’t enough, we are still dealing with record high inflation and the highest interest rates in decades.

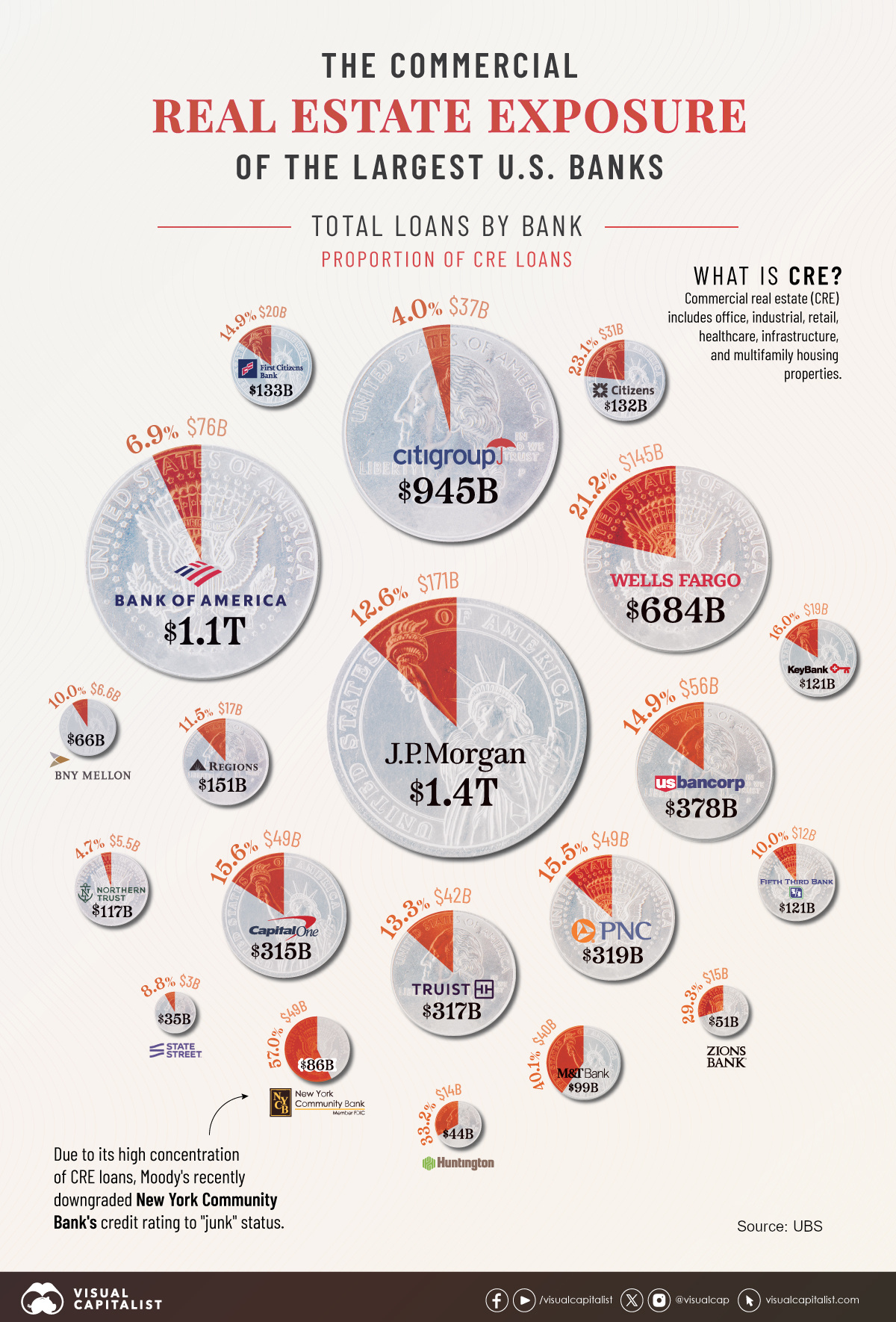

In his testimony before Congress, Fed Chairman Powell said that he believes there will be bank failures caused by the looming commercial real estate crisis.

With recent news that BRICS is creating a blockchain-based payment system along with digital currencies, a growing number of affiliated countries, including China and Russia, have been boosting their Central Bank gold reserves.

Many investors may have some exposure to silver and gold, possibly through investments in mining stocks, ETFs or via direct investment in physical coins such as the American Eagle, Maple Leaf, and Britannia.

Given that the global economy is dedollarizing and speeding like a freight train in the direction of a commodity backed currencies for trade, it may be a good time to consider diversifying into other precious metals.

Why Platinum?

Platinum is a dense, malleable, ductile, highly unreactive, precious, silverish-white transition metal. It is one of the rarest elements in the Earth’s crust and is known for its remarkable resistance to corrosion, even at high temperatures. It is a vital industrial metal as well as a highly valued precious metal for investment and jewelry.

The largest platinum deposits in the world are located in South Africa and Russia. These two resource rich countries combined are responsible for producing over 80% of the world’s platinum.

A diverse precious metals portfolio is constructed to mitigate risk while aiming for growth by investing across various types of metals and investment vehicles within the precious metals category.

During the 2008 Financial Crisis, the price of platinum reached its current all time of $2176.30 per troy ounce. Since 2018, the price has been rising at a stable rate, with some short lived peaks and troughs along the way. In recent months, the price of platinum has been hovering below $1000 per ounce, less than half of the current price per ounce of gold.

Some investors have been looking at this as unique opportunity to diversify further by invest some money in 1 oz platinum coins. Investment-grade platinum coins are issued by a variety of trusted and reputable governments mints, including the US Mint, the Royal Canadian Mint, the Royal Mint and the South African Mint.

Great Britain Platinum Britannia

The Platinum Britannia is a trusted investment option from the Royal Mint that offer a low premium, low risk way to diversify your physical holdings.

The current year 2024 1 oz Platinum Britannia Coin reverse carries the infamous Philip Nathan illustration of Britannia that is shared amongst the other coins in the series.

The design captures a powerful image of the mythical female warrior protecting the southern coast, carrying a trident in her right hand to control the seas. Her left hand rests on a shield bearing the Union Jack, signifying her role in defending the British Isles.

The obverse of 2024 Platinum Britannia Coins feature a new effigy portrait of His Majesty King Charles III. Also available in a fractional 1/10 oz platinum coin.

Additionally, The Royal Mint also issues platinum coins for collecting and investment, including those in the Tudor Beasts series such as the 1 oz Seymour Unicorn Platinum Coin.

American Platinum Eagle

First introduced in 1997, the American Eagle 1 oz Platinum Coin is the only investment-grade platinum coin from the U.S. Mint. The obverse of the coin displays the “Portrait of Liberty,” designed by John Mercanti, which symbolizes the American ideals of freedom and democracy.

The reverse features an eagle soaring above America’s landscape, designed by Thomas D. Rogers.

Minted from .9995 pure platinum, the coin is notable for the high-quality minting and legal tender status with a face value of $100 USD.

Maple Leaf Platinum

The Platinum Maple Leaf was first introduced by the Royal Canadian Mint in 1988, following the success of the gold and silver versions. These coins are known for their purity, quality, and the iconic Canadian maple leaf design.

For the current year, 2024 Platinum Maple Leaf 1 oz Coin, the obverse features a portrait of His Majesty King Charles III. While previous issues have shown Queen Elizabeth II, with designs varying over the years as the Queen has aged. The reverse displays the signature maple leaf, a national symbol of Canada, along with the coin’s weight and purity. Each coin carries a $50 face value in Canadian dollars, though the market value of the platinum far exceeds this nominal legal tender value.

Issued by the Royal Canadian Mint, known for its high-quality minting processes and innovative security features, the Platinum Maple Leaf benefits from high liquidity and global recognition.

Philharmonic 1 oz Platinum Coin

The Platinum Philharmonic is produced by the Austrian Mint as part of the Vienna Philharmonic coin series. The series celebrates the world-renowned Vienna Philharmonic Orchestra, one of Austria’s most prestigious cultural symbols.

Struck in .9995 fine platinum, the design of the 2024 Platinum Philharmonic 1 oz coin mirrors that of its gold and silver counterparts. The obverse features the great organ found in the Musikverein, the concert hall in Vienna where the orchestra performs. The reverse depicts an array of orchestral instruments, including violins, a viola, a cello, a bassoon, a harp, and a Viennese horn.

South Africa Big 5

The Big 5 platinum coin series from the South African Mint is a testament to the country’s rich wildlife heritage and the mint’s dedication to high-quality numismatic products. The “Big 5” refers to five of Africa’s most famous animals: the elephant, lion, buffalo, rhinoceros, and leopard. These animals are each renowned for their majesty, strength, and the challenge they posed to hunters, making them symbols of Africa’s rich wildlife heritage.

The 2023 1 oz Platinum Elephant coin is available with a bullion finish and the obverse displays a single elephant front profile, while the reverse shows two elephant profiles facing each other.

The South African Mint is known for its exceptional craftsmanship, and each coin in the series is struck from .9995 fine platinum with each featuring detailed and lifelike representations of the Big 5 animals.

Vintage Platinum Coins and Bars

The first significant minting of platinum coins began when platinum was discovered in the Ural Mountains of Russia. The first Russian platinum coin was minted in the region from 1828 until 1845. Due to the similar appearance to the more prevalent silver coins of the era, their use caused confusion and they quickly become unpopular in daily transactions. in Russia.

After World War II, platinum became recognized as a precious metal for trading in the commodities markets. Its rarity, along with its industrial applications have increased its economic importance and investment appeal.

The first platinum investment coin was issued by the Isle of Man, which was introduced in 1983 as The Platinum Noble. The Noble coin is unique since it is not denominated in any traditional currency but rather in “nobles,” a nod to its novelty and the historic nobility associated with platinum.

The Noble was issued and marketed as a bullion coin, appealing to investors for its purity and the intrinsic value of its platinum content.

During the 1980s, the Austrian Mint debuted the Shooting Thaler 1 oz Platinum Coin. Shooting Thaler coins a part of a Swiss tradition of issuing coins to commemorate the Schützenfest (shooting festival) that dates back to the 19th century.

The obverse of these coins features a depiction of William Tell, a folk hero from Switzerland who played a symbolic role in the foundation of modern Swiss identity. He’s known for his marksmanship and defiance against Austrian tyranny rooted in folklore that were written in chronicles in the late 15th and early 16th centuries.

Vintage Platinum Bars

In response to increasingly stringent environmental regulations during the 1970s such as the Clean Air Act amendments, Engelhard developed the first production catalytic converter and helped to commercialize its us in 1973.

Platinum, along with other PGM metals, proved to be extremely effective at accelerating the chemical reactions that convert exhaust pollutants into less harmful substances like carbon dioxide and water vapor.

As a result, platinum bars became popular with investors during the 1980s as its industrial use increased due to the mandating of catalytic converters for internal combustion engines.

Today, catalytic converters are considered standard equipment on gasoline and diesel engines in most parts of the world, significantly reducing the environmental impact of automobile emissions. Vintage Engelhard 1 oz Platinum Bars have retained popularity with investors as a store of value and wealth.