Precious metals have long been trusted by investors as stores of value and wealth. When looking for the most cost-effective way to buy silver, many stackers consider 100 oz bars one of the most cost-effective ways for investors to hold physical silver.

These bars often have the lowest premium per ounce over the spot price and are a great way to bring peace of mind during economic and political restlessness. A variety of both private and sovereign mint 100 oz silver bars are in stock and ready to ship from many online bullion dealers.

Comparing the features, dealer premiums, and shipping costs of the many available options is one way to find the best deal for your needs.

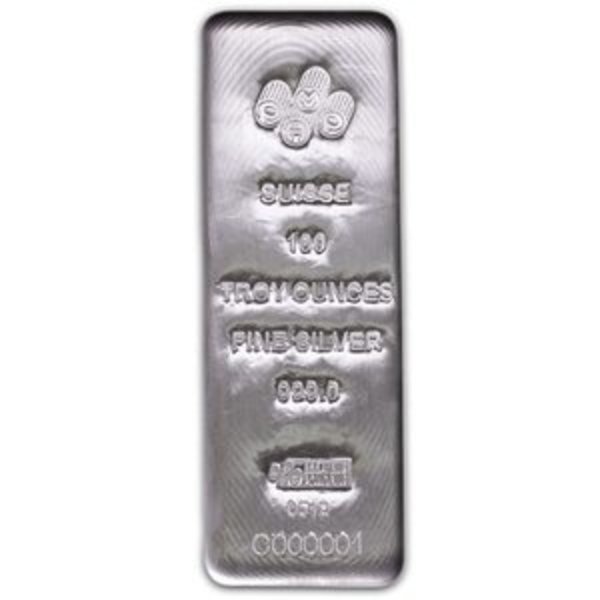

100 oz Silver Bars

Serious precious metals stackers choose 100-oz bars because they often have the lowest dealer premium per ounce. This makes them ideal for adding weight to a silver portfolio.

Some leading private mint one hundred-ounce silver bars include those manufactured by Asahi Refining, Scottsdale Minting, Royal Canadian Mint, Valcambi, Germania, and others. Some designs and manufacturers may offer some collectability, which could impact premiums down the road.

As an investment vehicle, 100 oz silver bars can be used to accumulate wealth at home while taking up only a relatively small amount of storage space.

Each mint works within the conditions of its affiliation organization certifications, such as LBMA, to ensure that these silver bars adhere to the outlined specifications. There is no standard size for a silver bar of this weight class, and the dimensions vary between manufacturers.

However, each 100 oz silver bar contains almost 7 pounds of silver!

Those from the secondary market are often the cheapest 100 oz Silver bars in the market because they were at some point sold back to a bullion dealer, pawn shop, local coin store, or other exchange. Secondary market precious metals, sometimes referred to as “Dealer’s Choice,” typically have lower premiums than when they were newly minted and make an ideal choice as a store of wealth.

All hundred-ounce silver bars are stamped with their weight and purity and include the manufacturer’s hallmark.

Industrial Demand for Silver

Many industries demand precious metals and other commodities. They play a significant role as components in many of our everyday lives.

Silver is one of the most efficient conductors of electricity. Many everyday electronic devices, such as cell phones, computers, solar panels, and electric vehicles, are made with various amounts of silver embedded in the circuitry. There is roughly 1/3 of a gram of silver (0.34g) inside the average iPhone.

While each device only has a small amount, considering that Apple has sold over 1.5 billion devices since 2007, when added up, that’s 510,000,000 grams or 16,396,881 troy ounces of silver.

IPhone manufacturing alone has consumed more than 464,843 kilos of silver.

More than 5.3 billion discarded smartphones have been piling up in landfills as e-waste, with at least another 151 million tossed away each year. Most of that silver will likely never be recovered and will likely be gone forever.

Today, advanced wound dressings and ointments are compounded with elemental silver and silver ions. For more than 6,000 years, these antibacterial properties have been used to treat severe burns and other skin ailments.

Silver also plays a prominent role in medical imaging, x-rays, and other radiographic imaging.

According to Statista, the jewelry industry consumed more than 202 million troy ounces, or more than 6,250 tons, worldwide in 2022 alone.

Generic 100 oz Silver Bars

The spot futures markets drive the price of silver. In these markets, brokers for various industries buy silver with the expectation that it will be mined, refined, and delivered by a specific future date.

Many modern industries are responsible for consuming silver that will never be recovered or recycled. This has a compounding effect and will drive up prices over time.

Value investors look to the secondary market when searching for the lowest premiums on 100 oz silver ba s. These are typically generic, private mint bars that have been bought and sold multiple times after being bought when they were freshly minted. Signs of wear, tear and patina can be indicative of its age and it’s common that most of these bars will have some dings, dents and scratches.

Some investors looking to preserve spending power consider generic 100-oz silver bars to be the perfect investment. They’re often used as a hedge against high inflation because they maintain their intrinsic value.