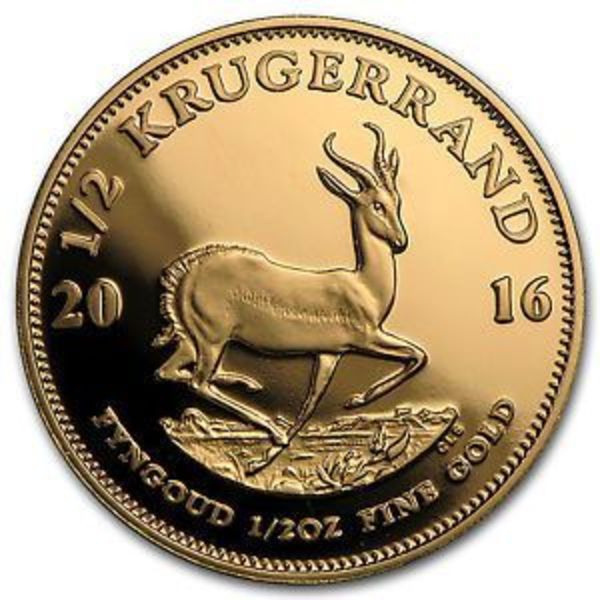

In a press release last week, A-Mark and JM Bullion announced the acquisition of the website domain Gold.com. No terms were disclosed. Following this acquisition, JM Bullion now owns both silver.com and gold.com.

“The acquisition of the gold.com domain represents a significant investment in our direct-to-consumer growth strategy,” said JMB CEO Robert Pacelli. “The gold.com domain carries broad global appeal and is an extremely versatile asset that will be incorporated into our long term strategy. Prominent, single word domains are in high demand due to their scarcity, and benefits of such domains include instant brand recognition and enhanced marketability.”

Pacelli continued, “It’s rare to have an opportunity to acquire a category defining asset such as this, and we are excited to add the domain to our expanding portfolio. All gold.com traffic is currently being redirected to the JMB website, providing visitors with seamless access to the company’s extensive range of products and services.”

JM Bullion was founded in 2011 and has grown to become one of the largest online precious metals dealers in the United States.

At the time of its founding, the spot price of silver was around $37 an ounce, while the spot price of gold was trading near $1,755 an ounce.

As JM Bullion’s sales and customer base began to skyrocket, they began acquiring other bullion dealers. The first notable acquisition came in 2019 when the company bought Provident Metals.

By 2020, JM Bullion marked a significant milestone, selling more than $1 billion dollars worth of precious metals to investors that year.

The following year, in March of 2021, JM Bullion was acquired by the industry wholesale powerhouse, A-Mark.

Following the sale to A-Mark, JM Bullion continued their acquisition spree, buying up other notable dealers including BGASC, BullionMax, Pinehurst Coin Exchanges and others, as well as buying significant portions of other vertical businesses such as Silvertowne, Sunshine Minting, Pinehurst Coins and others.

Since 2018, A-Mark has grown through the acquisition of other companies to establish itself as a leader across the entire precious metals vertical, from sourcing and refining capabilities, to direct-to-consumer retail operations, as well as wholesale investment platforms.

A partial list of acquisitions by A-Mark/JM Bullion includes:

- Silvertowne Mint – Silvertowne was established as a local coin shop in Winchester, Indiana in 1973. In the 1980s, Silvertown expanded into minting and selling their own brand of silver bars and rounds. A-Mark acquired a majority stake in Silvertowne in 2016.

- Goldline, LLC – Goldline was a full-service precious metals trading company and an official distributor for all the major sovereign mints. The acquisition in 2017 bolstered A-Marks ability to reach investors directly by adding an expansive direct-to-client distribution model.

- Collateral Finance Corporation (CFC) – Collateral Finance Corporation provided a secured lending facility to consumers and institutions wishing the leverage their gold holdings as a tangible asset.

- Sunshine Minting – Sunshine Minting was established in 1979. The company is a leading domestic and global supplier of precious metal mint products with manufacturing facilities in Nevada, Idaho, as well as a joint venture in Shanghai, China. Sunshine Minting’s primary customers include sovereign governments and major financial institutions. SMI is a notable supplier of blank planchets to the US Mint, which are utilized in the manufacturing of American Eagle Silver Coins.

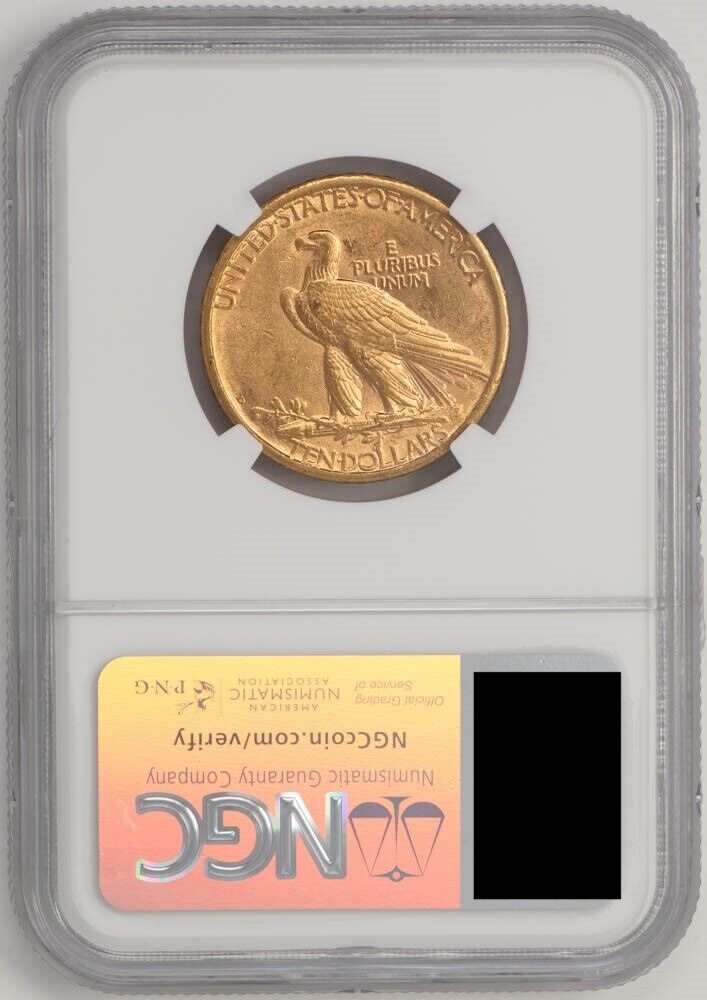

- Pinehurst Coin Exchange – As a leading precious metals broker, Pinehurst established a reputation in the coin industry for best-in-class service and offering a vast array of numismatics and precious metal products. They are a notable seller of gold and silver through the eBay marketplace.

- Atkinsons Bullion & Coin – A-Mark purchased a 25% equity stake in UK based Atkinson’s in May 2023.

- BGASC – Long time California based gold and silver dealer, BGASC was acquired in September 2022.

- Silver.com – Back in their early days, JM Bullion acquired the domain of silver.com for $875,000 back at the end of 2012. It has operated as a standalone website since, with pricing that is often higher than other dealers in the portfolio.

- Texas Precious Metals – At the start of 2023, A-Mark announced an acquisition of a 12% ownership stake in Texas Precious Metals in exchange for $5.04 million in cash.

- Silver Gold Bull – Based in Calgary, Alberta, Canada, Silver Gold Bull has a large international retail presence in dozens of countries around the world. A-Mark upped their ownership stake to 47.4% in 2022 consisting of a considerable amount of cash and common stock. As part of the deal, A-Mark has the option to acquire up to 75% of the equity in the company pending a review based on Canadian Competition Laws.

- CyberMetals – In November 2021, A-Mark and JM Bullion announced the creation of the CyberMetals Platform. The platform allows investors to buy and hold digital gold and silver in non-allocated storage with the option of converting their digital holdings into physical metals and taking fulfillment.

- BullionMax – Fully acquired in 2023. The full terms of the deal were not disclosed, but the acquisition included BullionMax’s 20,000 customers and 100,000 newsletter subscribers.

- LPM Precious Metals – LPM is a precious metals retailer and wholesaler based in Hong Kong. The LPM.hk acquisition is part of a strategic expansion by A-Mark into Asian markets.

- ModernCoinMart – Included in the LPM acquisition, subsidiary Pinehurst Coin Exchange will acquire all assets of Modern Coin Mart, including the inventory.

- Stack’s Bower Numismatics LLC – Stack’s Bower Galleries is a well-known auction house that specializes in numismatics and other collectibles.