In a world of ever-changing economic landscapes, investors often seek ways to protect and grow their wealth. One such asset class that has been a cornerstone of wealth preservation for centuries is precious metals, with investment-grade silver coins being a popular choice due to their affordability and potential for appreciation.

Investment-grade silver coins are high-quality, government-minted coins that contain a specified amount of pure silver. They are recognized for their silver content, purity, and legal tender status, making them a reliable store of value. Some famous examples of investment-grade silver coins include the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic.

As the purchasing power of fiat currencies erodes, the value of silver can help maintain purchasing power due to its historical role as a hedge against inflation.

For example, the American Silver Eagle was first issued in 1986 when the average silver price was $5.87 per ounce, and the average gas price was around 90 cents a gallon. One ounce of silver was roughly the equivalent of 6.5 gallons of gasoline.

By comparison, in 2023, the average price of silver was $23.40 per ounce, while the average price of gas was $3.52 per gallon. Thus, one ounce of silver is roughly the equivalent of 6.65 gallons of gas.

Unlike stocks, bonds, or cryptocurrencies, investment-grade silver coins are physical assets you can hold and store securely at home. This tangibility provides a sense of security and control over one’s investments.

While each government mint has its own specifications, bullion investment coins are typically minted with 1 troy ounce of.999 or .9999 fine silver. Some mints offer coins in both larger and smaller denominations to accommodate the needs of different types of investors.

US Mint American Silver Eagles

The American Silver Eagle is the only investment-grade bullion coin issued by the US Mint. Introduced in 1986, the 1 oz Silver Eagle is a trusted store of value and wealth.

Silver Eagles are made of .999 fine silver and carry a legal tender face value of $1. The US government provides backing as legal tender, and they are recognized and traded worldwide.

During the 2008 financial crisis and Great Recession, the demand for American Silver Eagle coins surged significantly. In 2008, the US Mint sold 20,583,000 bullion coins, a massive increase from the previous year and nearly doubling the prior record.

This spike in demand was a direct response to the economic uncertainty and the sharp increase in the price of silver at that time. During this period, these coins were evidently popular among investors as a store of value and a hedge against inflation.

US Mint Silver Eagles are minted based on investor demand and confirmed orders from Authorized Purchasers. During the first four months of the year, the US Mint sold more than 10 million American Silver Eagle coins. The increased popularity of American Silver Eagle Tubes at major retailers like Costco has helped raise awareness and demand amongst a larger pool of investors.

Secondary market silver coins can often be a way for investors to find lower premiums. These silver Eagles were bought in previous years and liquidated by selling to a bullion dealer or broker. Dealers then resell them at a reduced premium compared to current-year coins.

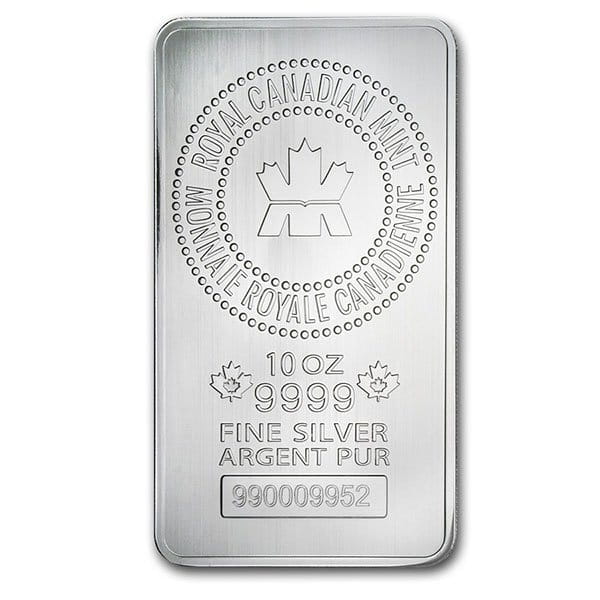

Royal Canadian Mint Silver Coins

The Canadian Silver Maple Leaf is one of the purest silver coins on the market, with a purity of .9999 fine silver.

The coin’s reverse features the Sugar Maple Leaf design, a national symbol of Canada. The obverse of the current coins shows a portrait of King Charles. Secondary market Maple Leaf 1 oz Silver Coins will most often be from previous years.

The Royal Canadian Mint incorporates several advanced anti-counterfeiting measures in the coin’s design, making it one of the most secure bullion coins in the world. These measures include:

- Radial Lines: The coin features a unique background of light-refracting radial lines that create a distinctive sparkle, making it difficult to replicate and appealing from an aesthetic standpoint.

- Micro-Engraved Maple Leaf: A micro-engraved textured maple leaf, visible under magnification, is added to the coin. This feature identifies the coin’s year of issue.

- Bullion DNA Technology: The Royal Canadian Mint employs its proprietary Bullion DNA anti-counterfeiting technology, which involves laser micro-engraving a small maple leaf on the coin’s surface. Each mark contains an encrypted code unique to each coin, which you can authenticate through a secure database.

- MINTSHIELD™ Surface Protection: This technology reduces the occurrence of white spot discoloration on the coin’s surface, ensuring the coin retains its visual appeal over time.

- Serrated Edges: The coin features serrated edges, which enhance its aesthetic appeal and make it harder to counterfeit.

Silver Maple Leaf coins are available only in a 1 troy ounce denomination. These coins are highly liquid and widely traded in the secondary market like other bullion investment coins. Secondary market Maple Leafs can have coins from previous years, including those that may have been issued prior to the RCM solving the milk spot issues. However, these coins are often available at a even deeper discount from those looking for the lowest dollar-cost average.

Austrian Mint Philharmonic Silver Coins

Austrian Silver Philharmonic coins are an excellent, lower premium alternative to American Silver Eagles. They are minted with a purity of .999 fine silver, making them a high-quality option.

One significant aspect of the Philharmonic Silver coins is their lower premium over spot price compared to some other bullion coins. This makes them a more cost-effective choice for those looking to invest in physical silver.

Despite this lower premium, the coins are still widely recognized in the global market, especially in European markets, due to their association with the renowned Vienna Philharmonic Orchestra and the Austrian Mint’s reputation for quality.

The coins celebrate the rich cultural heritage of Austria, featuring the Vienna Philharmonic Orchestra on the coin’s obverse and the Great Organ of the Golden Hall in Vienna’s Musikverein on the reverse.

Britannia Silver Coins from The Royal Mint

The Silver Britannia coin is minted with .999 fine silver by the Royal Mint, which is known for its high-quality standards and tightly controlled production protocols.

The Britannia Silver coin has a highly detailed design that showcases Britannia, the female personification of Britain, holding a trident and shield on the reverse.

For the 2024 Britannia Silver Coin, the obverse features a portrait of His Majesty, King Charles III. While many secondary market Britannias will be from previous years featuring a portrait of Queen Elizabeth II.

The Royal Mint incorporates several advanced anti-counterfeiting measures into each coin. These include a latent image on the coin’s surface that changes from a padlock to a trident when viewed from different angles. Additionally, the coin features micro-engraved details and a textured background that is difficult to replicate, ensuring its authenticity and integrity.

The Britannia 1 oz Silver Coin is often available at a lower price than other investment coins, making it a top choice for investors looking for the best priced silver coin.

South African Mint Krugerrands

The Krugerrand Silver Coin features the same iconic design as the gold Krugerrand, but is minted with .999 fine silver. The obverse showcases a portrait of Paul Kruger, the first president of the South African Republic, while the reverse depicts the national animal of South Africa, the springbok, against a backdrop of the country’s landscape. This design has been widely recognized and appreciated since the introduction of the gold Krugerrand in 1967.

Perth Mint Silver Coins

The Kangaroo 1 oz silver coin is a bullion coin produced by the Perth Mint in Australia. Since 2016, it has been produced annually with unlimited mintages as legal tender under the Australian Currency Act of 1965. The coin is struck from .9999 fine silver, making it a highly pure silver investment option.

The design of the coin features a bounding red kangaroo surrounded by rays of sunlight, symbolizing Australia’s vast natural beauty. The reverse of the coin also includes the inscription “AUSTRALIAN KANGAROO”, which also contains a micro-laser engraved letter. This security feature allows for easy authentication of the coin’s genuine nature. Also incorporated into the reverse design are the Perth Mint’s “P” mintmark, the year of issue, and the weight and purity of the coin.

Apart from the Kangaroo 1 oz silver coin, the Perth Mint offers several other investment-grade silver coins. These include:

- Australian Lunar Series: The Perth Mint’s Lunar Series is one of its most popular offerings. Each year features a different animal from the Chinese zodiac, with 2024 showcasing the Year of the Dragon. The coins are available in various sizes, including 1 kg, 10 oz, 5 oz, 2 oz, 1 oz, and even smaller fractional sizes.

- Koala Silver Coins: Introduced in 2007, the Australian Koala silver coins are another popular series from the Perth Mint. Like the Lunar Series, Koala coins are available in multiple sizes, with the 1 oz version being the most common. The mintage is limited with each year featuring a new design, adding to their collectibility.

- Kookaburra Silver Coins: The Kookaburra series started in 1990 and features the iconic Australian bird. Similar to the other series, the Kookaburra coins are available in various sizes, with the 1 oz version being the most popular. Each year showcases a new design, making the series appealing to collectors.