Junk silver is a common term for U.S. coins minted before 1965 that contain 90% silver. While these circulated coins no longer carry significant numismatic (collector) value, they remain highly sought after by investors and precious metals enthusiasts for their silver content and affordability.

Whether you’re a seasoned bullion investor or just starting out, junk silver offers one of the most accessible ways to accumulate real, tangible assets, without the high premiums often associated with modern bullion coins.

What Is Junk Silver?

“Junk silver” refers to U.S. dimes, quarters, half dollars, and dollars minted prior to 1965 that contain 90% silver and 10% copper. These coins were once standard currency in everyday commerce, but today they are prized for their silver melt value, not their collectible worth.

Despite their name, there is nothing “junk” about these coins. The term simply indicates that they carry no significant numismatic premium, making them an efficient vehicle for silver investment.

Why Invest in Junk Silver?

1. Affordability & Low Premiums

Junk silver coins often trade close to spot price, with very little markup. This makes them an ideal entry point for investors looking to acquire silver without paying high premiums.

2. Fractional Flexibility

Each coin represents a small, fractional amount of silver, which makes them perfect for bartering, liquidity, or incremental sales during uncertain economic conditions.

3. Tangible Asset with Intrinsic Value

As physical silver, junk silver offers protection against inflation and serves as a hedge against currency devaluation. You can hold it, trade it, and store it independently of digital systems.

4. Widely Recognized and Trusted

Because of their historic use in commerce and government-issued status, junk silver coins are easily recognizable and accepted by dealers, investors, and collectors.

Common Types of U.S. Junk Silver Coins

90% Silver Coins

Prior to 1965, 90% silver coinage was in common circulation. The Founding Fathers specifically included silver and gold coinage in the Constitution because they recognized the intrinsic value of precious metals as stable, reliable stores of wealth. This was done intentionally to protect citizens from inflation and instability caused by fiat currency, ensuring economic freedom and stability for future generations.

Because of this, the US Mint issued dimes, quarters, half-dollars, and one-dollar coins in coin silver, a commonly used alloy around the world that contains a mix of 90% silver and 10% copper.

During some 20th century periods, the Mint has adjusted the metal content in coins based on various demands.

Being smaller denominations, junk silver is naturally fractionally by design. This allows for flexibility if you decide to sell or trade in small amounts.

It might be one of the most effective bartering tools for an extreme economic crises because of its widely recognized silver content. It can also be an affordable entry point for those looking to start investing in silver without a significant upfront cost. 90% silver circulated coins often carry a lower premium over the spot price of silver than newly minted bullion coins.

40% Silver Coins

Following the Coinage Act of 1965, most U.S. coins lost their silver content. However, some issues were produced with reduced silver.

From 1965 until 1970, the Kennedy Half dollar coin was minted in a 40% silver alloy. These coins continue the same design as the 1964, but contain significantly less silver. 40% Kennedy Half Dollars typically trade for slightly above their melt value.

From 1971 until 1976, various collector issues of the Eisenhower $1 coin were issued in 40% silver. These coins were issued from the San Francisco Mint with the “S” mint mark so their easy to identify. Including a Bicentennial quarter minted from 40% Silver.

| Coin | Years minted | Silver Content | Total Weight | Silver Weight | Approx. Melt Value |

|---|---|---|---|---|---|

| Kennedy Half Dollar | 1965-1969 | .40 | 12.5 | 5 grams (.148 troy ounces) | $12.56 |

35% Silver Coins

During World War 2, the composition of the five-cent coin due to metal shortages. From 1942 until 1945, nickels were minted with 35% silver alloy. Keep in mind that these coins are very low purity, making the silver nickel value less desirable than those containing 90%. War nickels commonly trade close to their melt value.

| Coin | Years Minted | Silver Content | Total Weight | Silver Weight | Approx. Melt Value |

|---|---|---|---|---|---|

| Silver War Nickel | 1942-1945 | 35% | 5 grams | 1.75 grams (.0563 ozt) | $4.78 |

Buying Junk Silver at or Near the Spot Price

Silver investors flock to junk silver because it is often available at or close to the silver spot price. Deals are easy to find with little to no premium. During some market conditions, it’s possible to buy junk silver at spot price from some online dealers.

Below are described the most common types of junk silver available on the market today. The values are calculated with today’s silver spot price of $84.86 per ounce.

Best Junk Silver Coins for Investing Today

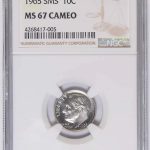

Some junk silver coins have numismatic value to collectors and will carry a higher premium over the spot price. These are typically early-minted coins such as Liberty Head and Mercury Dimes, Liberty Head and Standing Liberty Quarters, and Walking Liberty Half-Dollars. Morgan dollars and Peace dollars will also carry a fairly high premium over the spot price.

The junk silver coins that will be available at or close to spot price will be those with high circulations and were minted during the later years of coinage when it was minted with 90% silver. Those include Roosevelt Dimes, Washington Quarters, and Franklin and Kennedy Half-Dollars.

Collectors and investors began hoarding 90% silver coins for their silver value when the mint began issuing copper-clad in 1965.

Historical Importance and Constitutional Backing

The U.S. Constitution gave Congress the power to coin money using gold and silver for a reason: precious metals were trusted across civilizations for their stability, scarcity, and intrinsic worth.

The widespread issuance of silver coinage in the 20th century reflected this belief. The transition to fiat currency after 1965 further underlines why many investors turn to junk silver as a hedge against monetary inflation and systemic risk.