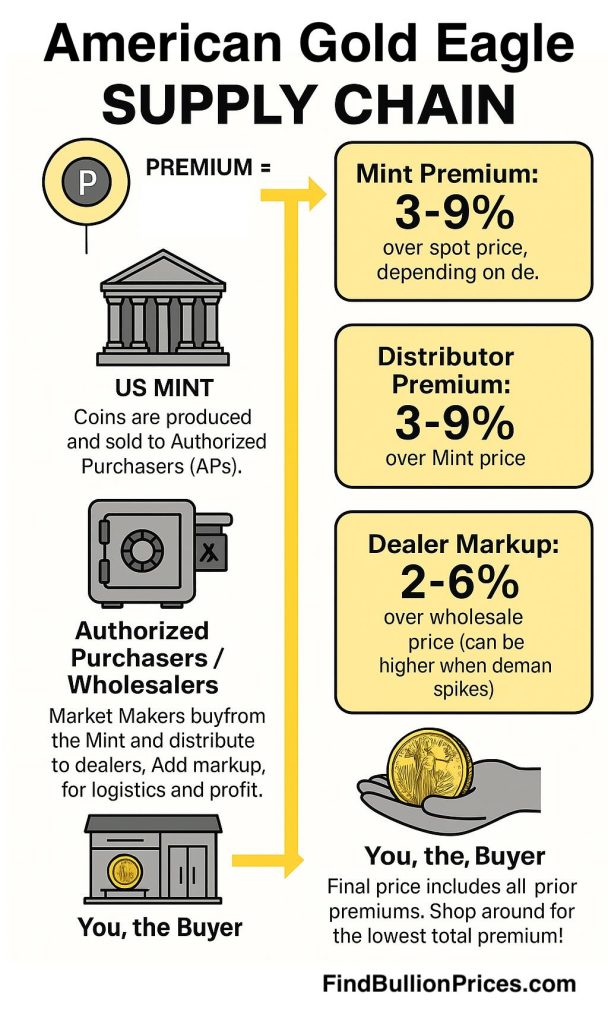

The American Gold Eagle is among the most popular gold bullion coins worldwide, prized for its quality, global recognition, and government backing. But if you’ve shopped for these coins, you’ve noticed that they always cost more than the spot price of gold. Why? The answer comes down to a combination of real-world production costs, mint premiums, distribution structure, and simple market forces.

This infographic breaks down each component, allowing you to make informed, financially responsible decisions.

The Spot Price vs. The Price You Pay

Spot price is the current market price for one troy ounce of raw gold, traded on futures contracts in international markets of 100 ounces or more. However, when you buy an American Gold Eagle, the final price per ounce is always higher than the spot price. The difference is called the premium.

Premiums on Gold Eagles reflect:

- U.S. Mint manufacturing costs and profit (seigniorage)

- Authorized Purchaser distribution markup

- Bullion dealer markup

- Supply and demand in the retail market

Let’s break down each part.

1. What Premiums does the U.S. Mint Charge?

The U.S. Mint does not sell Gold Eagle bullion coins directly. Instead, the newly minted coins are sold to a select network of wholesalers known as Authorized Purchasers (APs). Current year coins are sold at spot price of gold plus a mint premium that covers the costs of minting, packaging, and overhead.

Mint Premiums for American Gold Eagles (as of 2025):

- 1 oz Gold Eagle: spot + 3% per coin

- 1/2 oz Gold Eagle: spot + 5% per coin

- 1/4 oz Gold Eagle: spot + 7% per coin

- 1/10 oz Gold Eagle: spot + 9% per coin

(Source: U.S. Mint official pricing disclosures. These numbers are updated periodically—check the U.S. Mint website for current rates.)

This premium helps the Mint cover the raw cost of producing, handling, and distributing coins. It is non-negotiable and applies to every Gold Eagle distributed.

2. Authorized Purchasers and the Distribution Chain

The Mint sells only to Authorized Purchasers, a network of large wholesale distributors and refiners, sometimes referred to as Market Makers. U.S. Mint rules allow only companies with significant capital and can meet minimum monthly order commitments are able to purchase directly as Authorized Purchasers. These companies act as the bridge between the Mint and retail dealers. Market Makers (AP) pay the spot price plus the Mint premium, then add a small markup to cover their costs and profit.

Why does this matter?

Because the public cannot buy bullion directly from the Mint, every Gold Eagle passes through at least two hands (the AP and the dealer), with each adding a markup.

Authorized Purchasers’ markup is based on the LBMA spot price, plus an additional premium depending on the denomination.

- 1-ounce Gold Eagle: 3% premium

- 1/2-ounce Gold Eagle: 5% premium

- 1/4-ounce Gold Eagle: 7% premium

- 1/10-ounce Gold Eagle: 9% premium

Some Authorized Purchasers are also bullion dealers, such as APMEX. A-Mark is the parent company of JM Bullion, BGASC and others. In addition to being part of the distribution, some of these companies are also suppliers of raw planchets to the Mint.

3. Retail Bullion Dealer Markup

Your final price includes the dealer’s markup and covers:

- Overhead (labor, insurance, security, website costs)

- Shipping and handling

- Payment processing fees

- Their own profit margin

Bullion dealers compete not only on price but also on service, buyback guarantees, and reputation. Dealer markups can be as low as 2% above the AP price during stable markets, and increase when supply is tight or demand surges.

4. Market Forces: Why Do Premiums Rise and Fall?

Premiums are not fixed. They move with:

- Demand: In times of economic uncertainty, demand for Gold Eagles surges, often driving premiums much higher than average.

- Supply: If the Mint limits production or wholesalers run low on inventory, premiums can skyrocket.

- Secondary Market: Dealer buybacks, retail selling, and coin condition also affect prices.

In periods of normal market conditions, the total retail premium for a 1 oz American Gold Eagle can be as low as 3–6% over spot. During high-demand periods, premiums can exceed 10%—or even more.

Example: How Gold Eagle Premiums Adds Up

Suppose gold’s spot price is $3,400/oz:

| Source | Cost Component | Price (Example) |

|---|---|---|

| Spot Price | Raw gold | $3,400 |

| U.S. Mint Premium | Minting | +$102 |

| Authorized Purchaser | Distribution | +$30 |

| Dealer Markup | Retail/service | +$30 |

| TOTAL | $3,562 |

Premium over spot: $162, or about 4.5%. In a high-demand market, dealer markups could double or triple, especially if Gold Eagles become scarce.

Why Pay the Premium?

- Government guarantee: Gold Eagles are legal tender and backed by the U.S. Mint for weight, purity, and content.

- Liquidity: They are instantly recognized and easily resold anywhere in the world.

- IRA eligibility: Gold Eagles are approved for inclusion in most precious metals IRAs.

Can You Avoid Premiums?

You can reduce premiums by:

- Comparing dealers using FindBullionPrices.com to track real-time prices and shop for the lowest markup

- Considering secondary-market or “random year” coins

- Buying in bulk for volume discounts

But you can’t avoid the Mint and AP premiums. These costs are built into the market for every newly minted Gold Eagle.

Random Year coins come from the secondary market. These are coins that dealers have purchased from investors through buybacks and are thoroughly tested and inspected to ensure authenticity. These coins are then offered back to the market at a lower premium.

Final Thoughts

American Gold Eagle premiums are not just dealer greed, but the result of real production, distribution, and retail costs. Understanding these premiums helps you shop smarter and avoid overpaying, especially during volatile markets.

Always compare dealer prices, check current spot premiums, and be aware of market trends before making a purchase. With the correct information, you can maximize your investment and protect your wealth for the long term.

For more gold coin price comparisons and dealer insights, visit FindBullionPrices.com.