Why did RBI Repatriate 100 tons of Gold?

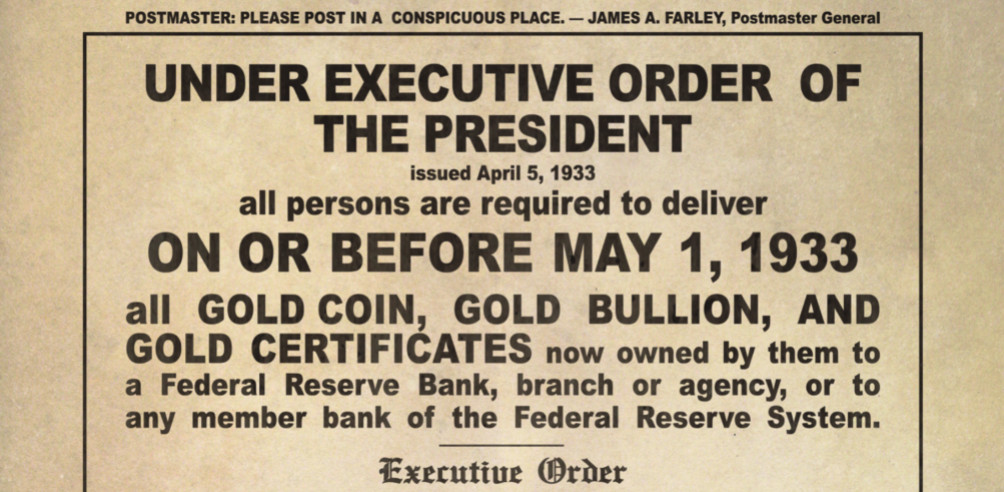

Economist and a member of the Economic Advisory Council to the Prime Minister of India, Sanjeev Sanyal, said on Friday that India will now hold most of its gold in its vaults. Citing the decline in confidence in dollar assets among central banks as one of the prime reasons